Profit-booking limits gain of benchmark index

KATHMANDU, SEPTEMBER 12

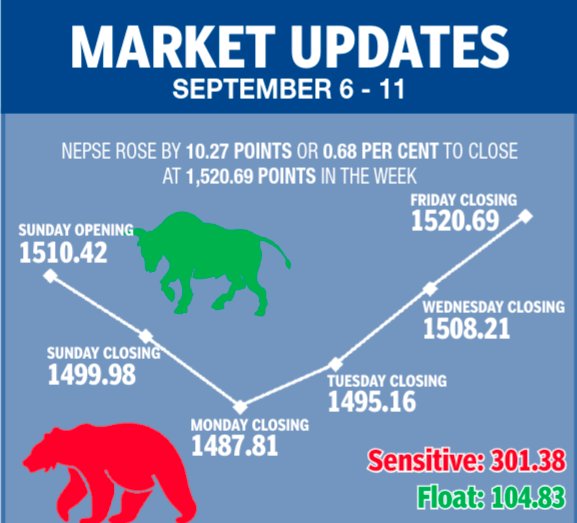

Despite the drop in the initial two days on profit-booking, Nepal Stock Exchange (Nepse) index more than recovered the loss in the subsequent three days, thereby causing the benchmark index to clock a week-on-week gain of 0.68 per cent or 10.27 points in the trading period between September 6 and 10.

The weekly turnover, however, dropped by 3.19 per cent to Rs 11.52 billion compared to the previous week’s total traded amount of Rs 11.90 billion.

Even though the market had opened for only four days in the preceding week against the normal five days in the review period, the daily turnover fell to Rs 2.30 billion this week from Rs 2.97 billion in the previous week — a steep decline of 22.56 per cent.

Similarly, the number of transactions fell to 145,359 from 159,104 in the previous week and trading volume dropped to 26.98 million shares traded against 30.46 million shares changing hands in the preceding week.

Opening at 1,510.42 points on Sunday, the benchmark index had dropped by 10.44 points to retreat below the threshold of 1,500 points. It shed another 12.17 points on Monday. However, Nepse index reversed course thereafter.

After rising by 7.35 points on Tuesday, the local bourse jumped by 13.05 points to close above 1,500 points again on Wednesday. The next day, despite some technical issues, Nepse index jumped by 12.48 points to close the trading week at 1,520.69 points.

Whereas sensitive index, which measures the performance of class ‘A’ stocks, slipped 1.10 per cent or 3.36 points to 301.38 points, the float index that gauges the performance of shares actually traded went up by 0.11 per cent or 0.11 point to 104.83 points.

After advancing 4.92 per cent in the previous week, trading subgroup surged by 14.59 per cent or 131.57 points to 1,033.36 points. The sub-index led the gainers in terms of percentage change, buoyed by Salt Trading Corporation’s share value soaring by 16.21 per cent to Rs 3,370 and that of Bishal Bazar Company Ltd by 5.56 per cent to Rs 1,689.

In terms of points gained, non-life insurance subgroup topped the chart by advancing 567.90 points or 7.60 points to 8,038.19 points.

After gaining 1.44 per cent in the past week, microfinance sub-index ascended by 3.95 per cent or 99.20 points to 2,607.51 points.

Life insurance trailed close behind with an increase of 3.26 per cent or 301.01 points to 9,536.04 points.

Manufacturing went up by 2.73 per cent or 81.80 points to 3,083.46 points. Unilever Nepal’s share price closed at Rs 19,890, up 5.40 per cent; Shivam Cements’ rested at Rs 744, up 2.62 per cent; and Himalayan Distillery’s rose 1.77 per cent to Rs 1,832.

The gain of 2.36 per cent or 23.43 points to 1,017.30 points recorded by the others subgroup was muted compared to the surge of 12.91 per cent in the past week.

While hydropower went up by 1.96 per cent or 21.16 points to 1,103.38 points, finance inched up 0.97 per cent or 6.52 points to 681.54 points.

Four subgroups — banking, development banks, hotels and mutual funds — landed in the red zone.

Banking sub-index, which has the highest weightage on the benchmark index, slumped by 2.14 per cent or 26.41 points to 1,208.39 points.

This was because of commercial banks like Nepal Investment falling by 2.33 per cent to Rs 419 and Standard Chartered down 1.49 per cent to Rs 660, among others.

Development banks dropped by 1.09 per cent or 19.40 points to 1,762.05 points.

Meanwhile, hotels slipped by 0.90 per cent or 13.89 points to 1,530.47 points and mutual funds shed 0.28 per cent or 0.03 point to 10.81 points.

A version of this article appears in e-paper on September 13, 2020, of The Himalayan Times.