Remittance growth retards

Kathmandu, June 10

Growth of remittance has plummeted heavily this fiscal as compared to previous fiscal year.

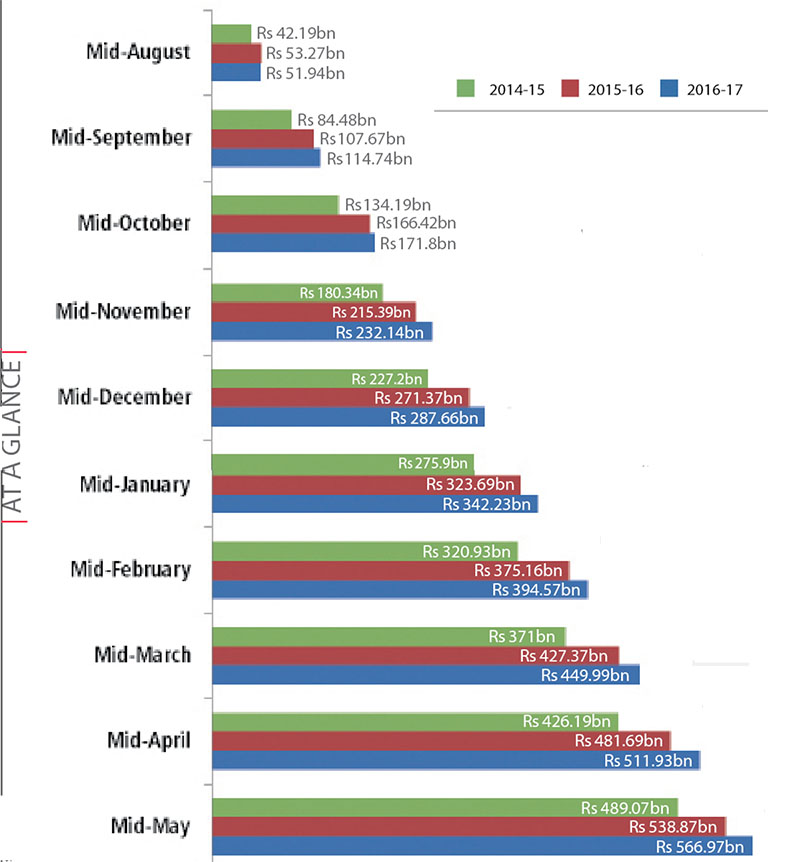

As per the date unveiled by the Nepal Rastra Bank (NRB), growth of remittances in the first 10 months stood at 4.8 per cent on an average, as compared to encouraging growth of 18.9 per cent of the corresponding period of the previous fiscal year.

Remittance growth started to slow down from second half of last fiscal. The negative growth rate of 2.5 per cent in the first month of this fiscal moved towards positive territory from the second month of the fiscal year 2016-17. However, growth rate has remain low when the shrinking base of the second half of last fiscal is taken into consideration.

The NRB data show that remittance growth declined steeply after reaching the monthly highest rate of 7.8 per cent in the fourth month of this fiscal.

The country received a total of Rs 566.97 billion in remittance in the first 10 months of this fiscal, compared to Rs 538.87 billion in the corresponding period of last fiscal.

Remittance growth stated to slow down from the second half of last fiscal basically due to rampant fall in oil prices that hit the Gulf economy. Along with economic slowdown in the Gulf, employment opportunities for foreign job-seekers also declined.

According to the Department of Foreign Employment, number of foreign job-seekers also declined after the devastating earthquake in 2015 as more number of youths chose to stay with their families to help them rebuild their lives in the earthquake-hit districts.

On other hand, Nepali currency has become stronger as compared to US dollar in the recent months. This too affected the remittance growth. Exchange rate of Nepali currency vis-à-vis dollar was Rs 107.11 on June 10 last year. The dollar has weakened by 3.7 per cent over the course of the year to be fixed at Rs 103.16 today.

Senior economist and former vice chairman of National Planning Commission (NPC) Shankar Sharma said that the remittance inflow may be further affected if the diplomatic chaos in Qatar continues. “Though the country is in a comfortable position in terms of foreign exchange reserve at present, the depletion in reserve along with slowdown in remittances inflow will affect the country’s balance of payments,” said Sharma.

The remittance growth slowdown has directly affected the current account as the import has been surging exponentially against sluggish export. Consequently, the country witnessed current account deficit of Rs 7.57 billion in the first 10 months of this fiscal. The country’s current account surplus was at a significant level of Rs 134.30 billion in the same period of the previous year.

The solution, according to Sharma, is to focus on alternatives to diversify the source of foreign currency income, including by promoting tourism sector, bringing in foreign investment and accelerating development of special economic zones (SEZs) to boost exports.