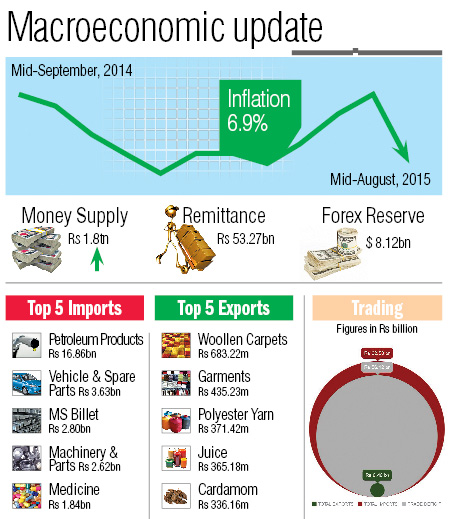

Remittance income grew by 26.3 per cent to Rs 53.27 billion

Kathmandu, October 2

The country’s current account surplus grew by a whopping 553 per cent in the first month of the current fiscal year, as merchandise import growth rate fell and remittance income jumped.

The current account surplus stood at Rs 8.15 billion in the one-month period between mid-July and mid-August as against Rs 1.25 billion in the same period last fiscal year, shows the latest Macroeconomic Report of Nepal Rastra Bank.

Current account shows how much the country has earned from or spent on exports and imports of goods and services, and provides information on inward and outward fund transfers, including remittance. A positive or surplus current account shows that inflow of funds from these activities is greater than outflow.

The country’s current account was in surplus in the first month of the current fiscal year because of sharp rise in money sent by Nepalis working abroad.

Remittance income grew by 26.3 per cent to Rs 53.27 billion in the first month of this fiscal. A huge growth in remittance income was seen this fiscal largely due to contraction in the base of remittance income in the similar period last fiscal.

In the last fiscal, remittance income had grown moderately because of rapid inflow of funds from informal channels.

Also, moderate hike in import growth rate helped the country to book a current account surplus.

In the one-month period, merchandise imports grew by 7.2 per cent to Rs 62.58 billion, as against import growth rate of 12.5 per cent recorded in the same period last fiscal year.

“The growth of imports remained low mainly due to the decrease in the price of petroleum products and also fall in the imports of silver, video television and parts, telecommunication equipment and parts, among others,” says the NRB report.

Despite lower import growth rate, the country’s trade deficit widened by 8.7 per cent to Rs 56.12 billion in the first month, as merchandise exports fell.

Exports dropped by 3.9 per cent to Rs 6.46 billion largely due to fall in demand for zinc sheet, GI pipe, wire and textiles in India, tanned skin and rudraksha in China and pulses, tea and handicrafts in other countries, shows the NRB report.

Also, income from tourism sector fell by 9.9 per cent to Rs 2.42 billion in the one-month period, while expenses of Nepalis who travelled abroad went up by 24 per cent to Rs 5.49 billion in the same period. Expenses of Nepalis studying abroad also rose by 24.4 per cent in the first month of the current fiscal year to Rs 1.84 billion.

Hike in these expenses were, however, offset by a 24.5 per cent rise in foreign pension income to Rs 3.75 billion and 97.5 per cent increment in foreign grants to Rs 4.45 billion.

Also, foreign direct investment surged to Rs 44.3 million in the first month of the current fiscal year, as against Rs two million recorded in the same period last fiscal.

Because of flow of these funds the country’s balance of payments stood at a surplus of Rs 4.95 billion in the one-month period.

BoP surplus indicates that flow of money into the country from all the countries in the world, on average, is greater than outflow.