Restrictive trade policies increasing production cost

Kathmandu, December 21

Restrictive trade policies have been dampening the desire of the country to establish a strong production network for job generation and stimulate economic growth in a sustainable manner.

A case study on Nepal’s trade policies carried out by the World Bank Group has suggested the policymakers to liberalise the trade policy to foster productivity as supply-side constraints are considered to be the major bottleneck to boost exports.

Nepal’s trade deficit is widening every passing year as imports are skyrocketing but the export sector has remained sluggish since the early 2000s.

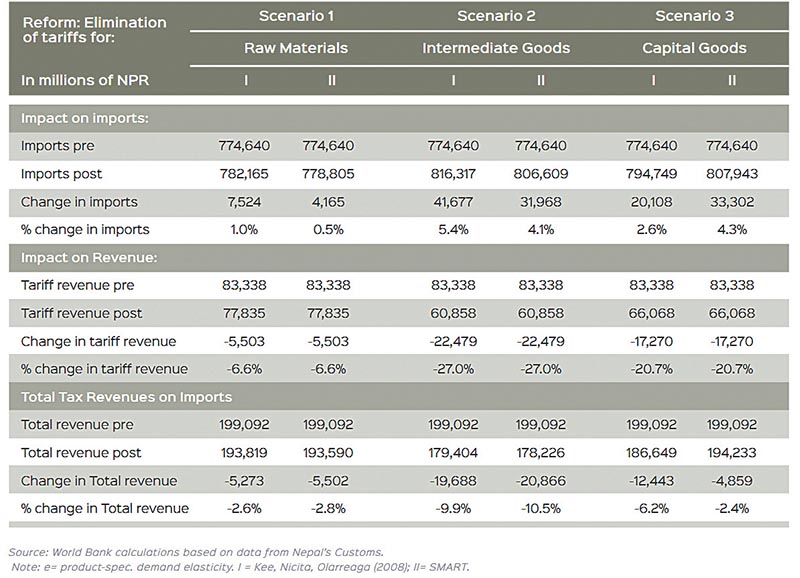

Reduction of tariff on import of raw materials and capital goods requires taking risk of short-term revenue loss, but it will have multiplier benefits in the future. For Nepali firms to be competitive in international markets, they need to be able to access the widest set of intermediates from a supplier that offers the best value for money ratio, as per the World Bank study.

“International evidence suggests that much of the gains from trade liberalisation results from increased productivity of domestic firms that have greater access to a wider variety of inputs,” says the study.

In Nepal, greater use and variety of imported intermediate inputs is correlated with higher exports, diversification of destination markets, and higher quality of exports.

Revenue generated by taxing imports continues to be the dominant source of tax revenue in Nepal. Customs collects around 44 per cent of the total revenue in the country that includes, value added tax (VAT), excise, agricultural reform fee, and road construction fee, besides customs tariff.

This means about half of the government’s tax revenue came from trade-related taxes over the last decade in between 2007 and 2016.

The World Bank study report argues that a simplification of tariff code, implementing tariff reductions, particularly for intermediate inputs, would help firms become more competitive by having access to a wider set of technological choices.

Productivity gains will create a sustainable taxation base in the country, which will be an effective means for redistribution of resources. To improve the import-to-export environment in a fiscally responsive manner, targeted tariff reductions on intermediate inputs for key export sectors are recommended since they can be achieved with negligible revenue losses, says the report.

“A stronger shift to domestic taxation (whether domestic consumption or income taxes) could also help increase export competitiveness through access to better technologies and increased competition.”

Impact of tariff reforms on revenue