Secondary bourse begins new year on a strong note, up by 48.29 points

The country’s sole secondary market continued with its upward trend in the trading week between April 15 and 18. Commercial banks and microfinance companies have started publishing their nine-month data and most have completed their annual general meetings, where they have announced of distributing rights shares, bonus shares and cash dividend to shareholders.

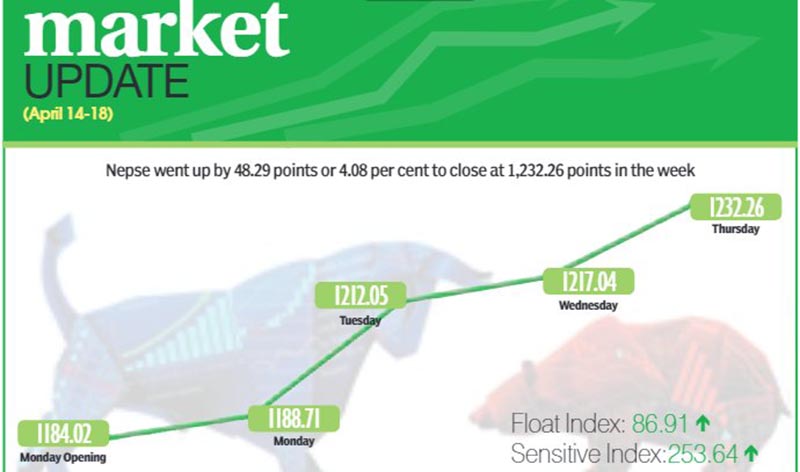

The positive growth trend that the aforementioned financial institutions have revealed has subsequently been reflected in the share market with the Nepal Stock Exchange (Nepse) index rising by 4.08 per cent or 48.29 points in the review period.

“After a long time, the secondary market is showing better signs and investors expect the secondary bourse to continue rising in between April and October,” said Uttam Aryal, chairman of Investors Association of Nepal.

“As the market has remained strong for a month now investor confidence has also risen.”

“However, the secondary market still needs government support if the growth is to be sustained,” he added.

Similar to Nepse, the sensitive index also went up by 4.7 per cent or 11.93 points to 265.57 points and float index increased by 4.69 per cent or 4.08 points to 90.99 points.

In the review period, weekly turnover decreased by 12.45 per cent as compared to previous week to Rs 2.62 billion. In the previous week the market witnessed turnover of Rs 2.99 billion.

However, the daily average turnover went up to Rs 665.05 million, which is an increment of 9.43 per cent in comparison to the previous week when it stood at Rs 598.59 million.

As there was a public holiday on Sunday due to the Nepali New Year, the secondary market had opened only on Monday at 1,184.02 points and increased by 4.69 points by the end of the trading day. It further went up by 23.34 points on Tuesday and by 4.99 points on Wednesday.

The upward trend continued the next day with the index rising by 15.22 points to close the week at 1,232.26 points.

In the review week, banking, microfinance, hotels, development banks, life insurance, finance, manufacturing and nonlife insurance subgroups landed in the green zone. Trading subgroup did not witness any transaction and stood at 244.89 points. In fact, trading sub-index has not seen any transaction since last four weeks.

The banking sub-index led the pack of gainers, soaring by 6.61 per cent or 69.57 points to 1,121.69 points. This was due to the share price of Everest Bank going up by Rs 31 to Rs 631 and that of Standard Chartered Bank rising by Rs 30 to Rs 621.

The microfinance sub-index also rose by 5.46 per cent or 76.22 points to 1,471.38 points with the share price of Chhimek Laghubitta Bikas Bank ascending by Rs 111 to Rs 1,014. Similarly, the hotels subgroup increased by 3.15 per cent or 54.48 points to 1,784 points due to the share price of Soaltee Hotel rising by seven rupees to Rs 213.

Moreover, the development banks subgroup expanded by 1.95 per cent or 28.97 points to land at 1,508.66 points and life insurance sub-index increased by 1.37 per cent or 82.12 points to rest at 6,073.65 points.

Similarly, finance subgroup also went up by 1.04 per cent or 6.45 points to 622.76 points. The manufacturing sub-index rose by 0.75 per cent or 14.95 points to 1,996.7 points and non-life insurance subgroup inched up by 0.61 per cent or 33.17 points to land at 5,468.89 points.

However, hydropower subgroup descended by 0.52 per cent or 6.01 points to 1,132.73 points and the others sub-index fell by 0.20 per cent or 1.44 points to 704.26 points.

In the review week, NMB Bank was the leader in terms of weekly turnover with Rs 194.09 million. It was followed by Kumari Bank with Rs 172.63 million, Prabhu Bank with Rs 150.65 million, NIC Asia Bank with Rs 144.39 million and Nepal Bank with Rs 126.84 million.

In terms of weekly trading volume, Kumari Bank took the lead with 658,000 of its shares changing hands. Prabhu Bank with 568,000 shares, NMB Bank with 513,000 shares, Civil Bank with 490,000 shares and Nepal Bank with 426,000 shares were the other top firms to record high trading volume.

Meanwhile, Kumari Bank topped chart in terms of number of transactions — 1,909. It was followed by NMB Bank with 1,625, Prabhu Bank with 1,416, Upper Tamakoshi Hydropower with 1,369 and NIC Asia Bank with 1,188 transactions.