Secondary market breaks losing streak

Kathmandu, February 23

The country’s sole secondary market finally witnessed some gains with a slight increment in the trading week between February 17 and 21. Market watchers have said the stock market index moved into positive territory due to the effect of Nepal Rastra Bank (NRB)’s mid-term monetary policy review.

During the mid-term review of the monetary policy, NRB had mentioned that the new policy document will help ease the problem of high lending rates that has been hitting businesses.

As a result, the Nepal Stock Exchange (Nepse) index slightly went up in the review week by 0.01 per cent or 0.20 point.

However, investors have blamed the government for its insistence on implementing the Personal Account Number provision and also the online trading system which has created hassles for investors for the share market still not being able to rise as expected.

“If the banks and financial institutions decrease the interest on loans for share transactions to a single digit then the market will rise further,” said Radha Pokharel, chairman of Nepal Pujibazar Laganikarta Sangh.

Meanwhile, the sensitive index decreased by 0.13 per cent or 0.31 point to 236.6 points. However, the float index ascended by 0.03 per cent or 0.03 point to 80.89 points.

In the review period, weekly turnover decreased by 67.39 per cent as compared to the previous week to Rs 990.56 million. In the previous week the market witnessed turnover of Rs 3.03 billion. Likewise, the daily average turnover also declined to Rs 198.11 million, which was a fall of 67.39 per cent in comparison to the previous week when it stood at Rs 607.48 million.

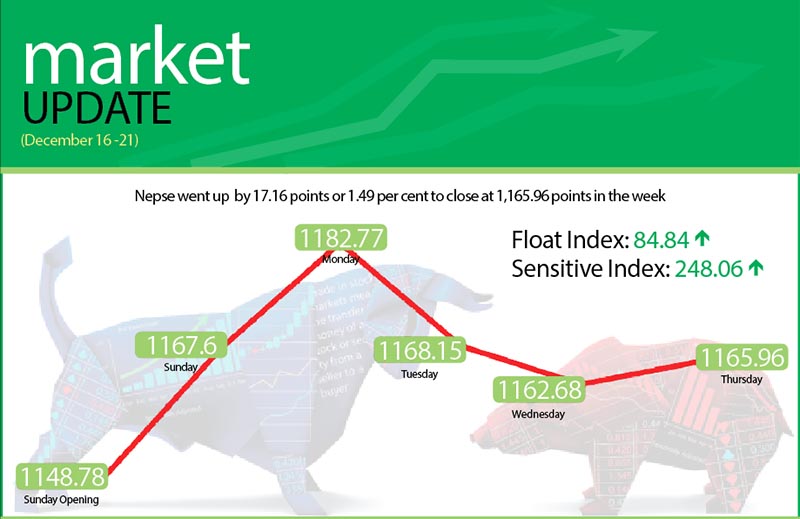

The secondary market had opened at 1,112.87 points on Sunday and went down by 3.15 points by the end of the trading day. On Monday, it decreased further by 7.21 points. The local bourse, however, went up by 22.46 points on Tuesday. On Wednesday though the market went down by 12.74 points. However, it inched up by 0.84 point the next day to close the week at 1,113.87 points.

In the review week, hotels, non-life insurance, manufacturing, life insurance and development bank subgroups landed in the green zone. The hotel subgroup led the pack of gainers, increasing by 1.78 per cent or 30.22 points to land at 1,721.52 points. It was due to the share price of Oriental Hotels rising by Rs 18 to Rs 432.

The non-life insurance also rose by 0.68 per cent or 36.58 points to 5,342.14 points. Likewise, manufacturing sub-index went up by 0.42 per cent or 8.50 points to 1,990.22 points.

Moreover, the life insurance subgroup inched up by 0.23 per cent or 12.84 points to 5,594.78 points and the development bank sub-index rose by 0.01 per cent or 0.21 point to 1,417.24 points.

Meanwhile, the trading sub-index led the pack of losers, dipping by 2.45 per cent or 6.18 points to 245.19 points due to the share price of Bishal Bazar Company decreasing by Rs 24 to Rs 1,637.

Moreover, the hydropower subgroup slumped by 1.31 per cent or 14.88 points to 1,117.83 points and the microfinance sub-index slipped by 1.03

per cent or 14.41 points to 1,374.31 points.

Likewise, others sub-index descended by 0.68 per cent or 4.84 points to 706.2 points and the finance subgroup shrunk by 0.21 per cent or 1.25 points to 591.89 points. Similarly, banking sub-index inched down by 0.20 per cent or 1.92 points to 953.27 points.

In the review week, Nabil Bank was the leader in terms of weekly turnover with Rs 55.76 million. It was followed by Upper Tamakoshi Hydropower with Rs 51.16 million, Nabil Bank (Promoter Share) with Rs 45.43 million, Prabhu Bank with Rs 40.03 million and Citizen Investment Trust with Rs 34.47 million.

In terms of weekly trading volume, Upper Tamakoshi took the lead with 228,000 of its shares changing hands. Prabhu Bank with 184,000 shares,

Siddhartha Equity Oriented Scheme with 124,000 shares, NMB Bank with 111,000 shares and NMB Hybrid Fund L-1 with 111,000 shares were other top firms to record high trading volume.

Meanwhile, Chautari Laghubitta Bittiya Sanstha topped the chart in terms of number of transactions — 3,610. It was followed by Upper Tamakoshi with 3,479, Prabhu Bank with 711, Nabil Bank with 652 and NMB Bank with 517 transactions.

NEW LISTINGS

Company........................................ Type........... Units

Century Commercial Bank.......... Rights......... 1,870,274

Chilime Hydropower.................... Bonus......... 7,930,226.3

Ghalemdi Hydro............................ IPO.............. 5,500,000

Kisan Microfinance Bittiya Sanstha................ Rights 240,250

NIC Asia Bank................................ Bonus......... 8,031,117

Shine Resunga Development Bank Bonus 2,440,498.6