Secondary market drops slightly

Kathmandu, October 28

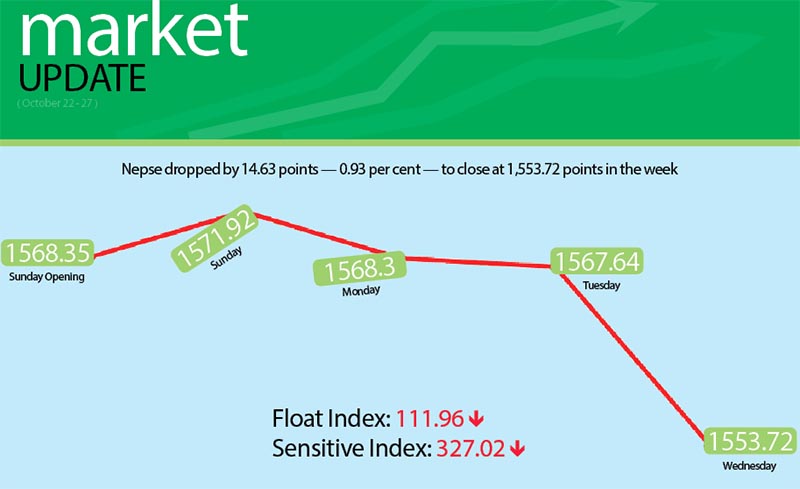

The Nepal Stock Exchange (Nepse) index fell slightly in the week following the festival of Tihar. The country’s sole secondary market fell by 14.63 points or 0.93 per cent to 1,553.72 points during the four-day trading week — October 22 to 25. Stock market remained closed on Thursday because of Chhath Parwa.

In tandem with the Nepse index, the sensitive and float indices also declined during the review period. The sensitive index fell by 3.08 points or 0.93 per cent to 327.02 points and the float index fell to 111.96 points, down 1.44 points or 1.27 per cent.

The benchmark index that had opened at 1,568.35 points on Sunday had gone up to close at 1,571.92 points by the day’s closing. The initial optimism, however, could not sustain as the local bourse reversed course for the remainder of the week — down to 1,568.30 points on Monday, to 1,567.64 points on Tuesday and to 1,553.72 points on Wednesday.

Investors and stock market analysts have said there was no major factor governing the market movement. “The market is moving normally, although I think there is dominance of short-term investors in the secondary market at the moment,” said Chhotelal Rauniyar, vice president of Nepal Investors Forum.

“A few people are trying to dampen investor sentiment, but I think it is the right time to invest in the secondary market.”

Rauniyar further hinted at a possible bull run in the near future as it is expected that banks will cut their rates after the first quarter. “We are hopeful of a rate cut by banks and financial institutions, which will help propel the market,” he stated.

Meanwhile, sub-index of class ‘A’ financial institutions fell by 20.63 points or 1.53 per cent to 1,330.97 points in review period. Share price of commercial banks like Nabil, Everest and Standard Chartered fell. Secondary market price of Nabil Bank slumped by 3.4 per cent to Rs 1,235. Similarly, share price of Everest Bank stood at Rs 1,221 on Wednesday losing 1.61 per cent over the week. Likewise, Standard Chartered Bank fell to Rs 2,125, down 2.48 per cent.

The sub-index of development banks fell by 1.66 per cent to 1,883.03 points during the week. Share price of Jyoti Bikash Bank fell by 5.61 per cent to Rs 185 and that of Muktinath Bikash Bank landed at Rs 605, down 2.26 per cent, among others.

The manufacturing sector slumped by 77.96 points or 3.05 per cent during the review period. Share price of Unilever Nepal rested at Rs 28,812 in the week, declining by two per cent.

The hotels sub-index also declined by 1.76 per cent to 2,379.32 points in the week. Share price of Soaltee Hotel lost 2.96 per cent to settle at Rs 361.

Sub-index of hydropower sector retreated by 2.05 per cent or 38.36 points to 1,833.08 points during the week. Share price of Chilime Hydropower Company plunged by 16.01 per cent to Rs 755 in review period. Similarly, price of Api Power Company fell by 2.52 per cent to Rs 541 in the week.

Likewise, the sub-index of insurance sector dropped by 78.65 points or 0.91 per cent to 8,518.23 points in the week. Secondary market price of Nepal Life Insurance Company declined by 2.23 per cent to Rs 1,972 in the week. Similarly, the finance sector decreased by 5.6 points or 0.71 per cent to 783.41 points in the week.

Meanwhile, the others sector went up to 836.4 points, increasing by 45.11 points or 5.7 per cent during the review period. Share value of Nepal Telecom soared by a whopping 6.58 per cent to Rs 842 per unit.

The sub-index of trading group remained the same at 228.46 points.

In the review period, 4.64 million shares worth Rs 1.71 billion changed hands through 15,538 transactions.