Secondary market ends the year in red zone

Kathmandu, December 30

The calendar year 2017 ended with the red signal at the Nepal Stock Exchange (Nepse) — the country’s sole secondary market. The capital market witnessed a bearish trend in the last four weeks of the year. The Nepse index plunged by 122.89 points in the last four trading weeks.

With the banks and financial institutions facing deposit crunch and increment in lending rates, the secondary market index fell for the fourth consecutive week in between

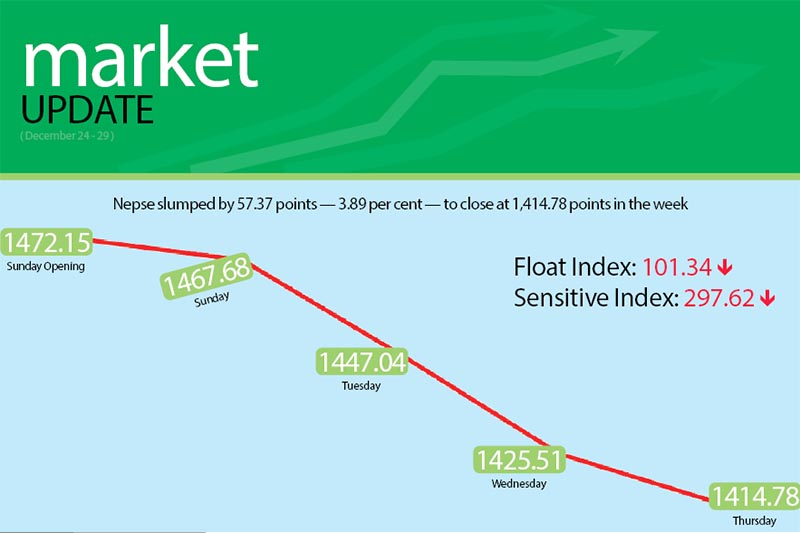

December 24 and 28. The Nepse index descended by 3.89 per cent or 57.37 points to 1,414.78 points in the week. It has been on a continuous slide since the elections and has come to a nine-month low point.

Along with the Nepse index, the sensitive and float indices also dropped. The sensitive index fell by 12.32 points or 3.97 per cent to 297.62 points and float index tumbled by 4.32 points or 4.09 per cent to 101.34 points.

The secondary market was open for four days during the week as against the normal five days as Nepse was closed on Monday due to Christmas holidays.

The benchmark index opened at 1,472.15 points on Sunday and fell to 1,467.68 points by the end of the trading day. On Tuesday, it declined to 1,447.04 points. The Nepse index remained southbound on Wednesday and Thursday to rest at 1,425.51 points and 1,414.78 points, respectively.

Investors and analysts have said that the secondary market is under pressure due to the increasing lending rates and deposit crunch in banks and financial institutions. They also informed that if the interest rates do not drop soon, the secondary market may fall further.

“Investors were expecting the market to grow after the elections. However, though the political environment was favourable, the problem of credit crunch hit the banks and this has put pressure on investors,” said Nawaraj Subedi, chairman of Capital Nepal Stock Market Investors Association. “This situation may drag on for the next few days.”

The sub-indices of financial sector had a negative impact on the secondary market. The sub-index of class ‘A’ financial institutions fell by 4.32 per cent or 54.46 points to 1,205.54 points during the review week. Share price of Nabil plunged by 5.13 per cent to Rs 1,090 per unit, Standard Chartered fell by 8.92 per cent to Rs 1,900 per unit and share price of Prabhu Bank descended by 7.67 per cent to Rs 325.

Similarly, the sub-index of development banks dropped by 87.49 points or 5.19 per cent to 1,596.39 points. Share price of Muktinath Bikas Bank dropped by 23.62 per cent to Rs 417 per unit and that of Mahalaxmi Bikas Bank fell by 3.88 per cent to Rs 198 per unit.

Similarly, microfinance, finance and insurance sectors also slumped in review period. The microfinance sector fell by 3.53 per cent or 62.83 points to 1,719.25 points. Likewise, finance sector fell by 2.77 per cent or 20.76 points to 728.48 points and the insurance sector decreased by four per cent or 304.31 points to 7,296.13 points.

The sub-index of hydropower sector dropped to 1,918.7 points, down 71.36 points or 3.59 per cent. Likewise, manufacturing sector lost 37.77 points or 1.49 points to 2,503.76 points.

The hotels group fell by 29.82 points or 1.41 per cent to 2,086.85 points, the others sector descended by 20.53 points or 2.42 per cent to 829.17 points and the trading group dipped by 2.62 points or 1.32 per cent to 196.37 points.

Altogether, 5.73 million shares of 174 firms worth Rs 2.68 billion were traded through 27,153 transactions in the week. The traded amount was 4.01 per cent more than total weekly turnover of previous week. Standard Chartered Bank secured top position in terms of total turnover with Rs 503.36 million. It was followed by Nepal Telecom with Rs 236.07 million, Everest Bank with Rs 138.33 million, Nepal Life Insurance Company (Promoter) with Rs 110 million and Nepal Life Insurance Company with Rs 75.16 million.

Prabhu Bank (Promoter) topped the list in terms of trading volume, with 348,000 of its shares changing hands and Standard Chartered was forerunner in terms of number of transactions — 4,693.

New listings

Company

Type

Units

Kisan Microfinance Bittiya Sanstha

Rights

78,000

Kanchan Development Bank

Rights

1,039,500

Sanima Mai Hydropower

Rights

10,550,000

Summit Microfinance Development Bank

Rights

716,560