Secondary market slightly down

Kathmandu, August 12

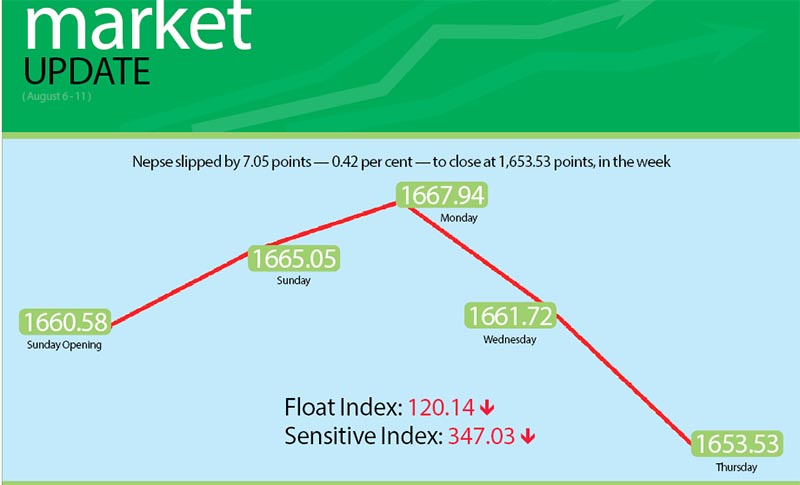

Nepal Stock Exchange (Nepse) index closed at 1,653.53 points in the trading week between August 6 and 10, with a minor drop of 0.42 per cent or 7.05 points. The secondary market had remained closed on Tuesday as the country observed Gaijatra.

The sensitive index also fell by 0.34 per cent or 1.19 points to 347.03 points. Likewise, the float index declined by 0.76 per cent or 0.92 points to 120.14 points.

Opening at 1,660.58 points on Sunday, the benchmark index had gained 4.47 points to close at 1,665.05 points for the day. Nepse index remained northbound the next days by edging up 2.89 points to 1,667.94 points. However, the local bourse reversed course over the next two days, dropping to 1,661.72 points on Wednesday and further

to 1,653.53 points on Thursday.

According to Ishwari Rimal, chief executive officer of Nepal Stock House — a brokerage company —sufficient flow of stocks affected the market in the week. “Flow of shares in the market has increased, and so investors were lured towards the rights shares and auction shares of different companies,” he explained.

Rimal also said that the huge profit reported by the commercial banks could not attract the share investors. “This is because while their profits went up, their earnings per share went down,” he added.

Sub-indices of hydropower and development banks primarily weighed on the market during the trading week. Hydropower sector fell to 1,917.23 points, declining by 41.98 points or 2.14 per cent. Share price of Api Power Company lost 1.71 per cent to Rs 644.

Likewise, sub-index of development banks also dropped to 2,063.61 points with a fall of 24.1 points or 1.15 per cent. Swabalamban Bikas Bank dropped by 3.71 per cent to Rs 1,890.

In the week, sub-index of class ‘A’ financial institutions retreated by 0.40 per cent or 5.82 points to 1,433.14 points. According to Nepse, share price of few commercial banks contributed to the decline. Secondary market price of Janata Bank fell by 4.69 per cent to Rs 277.

The sub-index of hotels closed at 2,507.7 points, dipping by 0.70 per cent or 17.65 points.

Following the trend of previous week insurance sector declined by 54.92 points or 0.58 per cent to 9,397.48 points.

Meanwhile, sub-index of manufacturing sector saw nominal growth of 1.45 points or 0.05 per cent to 2,752.91 points. Similar was the fate of finance subgroup, which advanced by 4.38 points or 0.53 per cent to 822.51 points.

Nepal Telecom’s share value went up by 2.62 per cent to Rs 706, which propped up the others subgroup by 2.04 per cent to 722 points.

Sub-index of trading remained unchanged at 214.11 points.

During the review period, altogether 10.21 million unit shares of 168 companies were traded through 34,773 transactions that amounted to Rs 3.81 billion.

The total traded amount in the review period was 27.30 per cent less than the previous week.

In terms of total turnover, Citizen Investment Trust (CIT) was at the top with Rs 195.31 million. Likewise Nepal Life Insurance Company with Rs 159.32 million, Standard Chartered Bank with Rs 144.57 million, National Hydropower Company with Rs 135.83 million and Prime Commercial Bank with Rs 115.22 million rounded up the top five.

Siddhartha Investment Growth Scheme-1 topped the list in terms of trading volume with 3.12 million of its scrips changing hands. Likewise, Nepal Life Insurance Company was the forerunner in terms of number of transactions with 1,761.

New listings

Company Type Units

Himalayan Water Partner Ordinary 10,654,170

Janautthan Samudayic Laghubitta Bikash Bank Bonus 40,000

Source: Nepse