Share market falls prey to coronavirus

Kathmandu, March 21

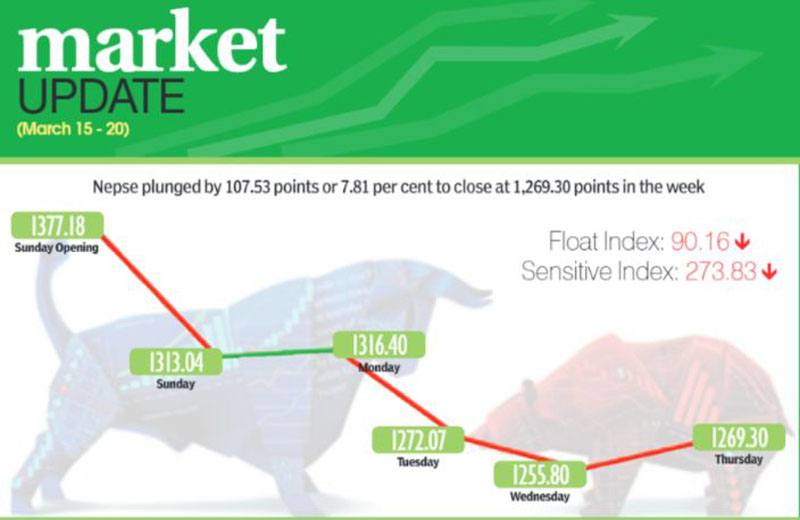

Due to fears that the coronavirus or COVID-19 is going to hit the country’s economy severely, Nepal Stock Exchange (Nepse) index dropped by 7.81 per cent or 107.53 points in volatile trading between March 15 and 19 and edged closer to the psychological threshold of 1,250 points.

“The fear that the virus is going to have a severe impact on the economy has tremendously hit investor sentiment because of which the market has witnessed a significant drop,” said Uttam Aryal, chairperson of Investors Association of Nepal.

He further added that the market is about to be closed for at least a week from Sunday and the shutdown might be extended. “And investors fear that when the market does open, share prices are going to plummet, hence there was panic selling in the last few days.”

Against this backdrop, the weekly turnover increased by 50.23 per cent as compared to the previous week to Rs 8.27 billion. In the previous week, the market had witnessed transactions worth Rs 5.50 billion.

The trading volume also rose to 22.71 million stocks changing hands this week from 14.05 million last week.

However, in the previous week, the secondary market had remained closed on Sunday and Monday due to Women’s Day and Holi festival and was open for only three days. Therefore, even as the weekly traded amount rose significantly in the review period, the average daily turnover fell to Rs 1.65 billion from Rs 1.83 billion in the preceding week.

The secondary market had opened on Sunday with benchmark index at 1,377.18 points. It had plummeted by 64.14 points by the end of the first trading day. The market went up by 3.35 points on Monday but again dropped by 44.33 points on Tuesday. The local bourse again dipped by 16.26 points on Wednesday. However, it ascended by 13.50 points on Thursday to close the week at 1,269.30 points.

In the review week, all the sub-indices landed in the red zone.

The life insurance subgroup was the biggest loser of the week, falling by 12.61 per cent or 996.14 points to 6,901.19 points due to share price of Nepal Life Insurance Co dropping by Rs 128 to Rs 1,059 and Life Insurance Co Nepal down by Rs 220 to Rs 1,180.

Similarly, non-life insurance slumped by 12.26 per cent or 736.65 points to 5,270.49 points as share price of Himalayan General went down by Rs 65 to Rs 335 and that of Neco Insurance by Rs 86 to Rs 486.

Manufacturing also plunged by 9.94 per cent or 274.70 points to 2,488.62 points due to share price of Himalayan Distillery falling by Rs 212 to Rs 1,304 and Bottlers Nepal (Tarai) going down by Rs 85 to Rs 6,598.

The hotels sub-index contracted by 8.38 per cent or 138.19 points to 1,510.47 points. Share price of Soaltee Hotel was down by nine rupees to Rs 258 and Taragaon Regency Hotel by Rs 42 to Rs 210.

Moreover, trading subgroup plunged by 8.05 per cent or 67.77 points to 774.29 points as share price of Salt Trading Corporation fell by Rs 170 to Rs 2,440 and Bishal Bazar Company by Rs 271 to Rs 1,528.

Banking — subgroup with highest weightage in the country’s sole secondary market — dropped by 7.53 per cent or 91.22 points to 1,120.39 points. It was due to share price of NIC Asia Bank descending by Rs 41 to Rs 509 and Nepal Investment Bank by Rs 23 to Rs 379.

Finance sub-index went down by 7.40 per cent or 50.87 points to 636.30 points as share price of Best Finance Company dipped by five rupees to Rs 96.

Microfinance also dropped by 7.24 per cent or 161.51 points to 2,068.24 points with share price of Chhimek Laghubitta Bikas Bank decreasing by Rs 49 to Rs 965.

Moreover, development banks subgroup descended by 6.14 per cent or 112.97 points to 1,726.69 points as share price of Excel Development Bank fell by Rs 19 to Rs 375.

The hydropower sub-index slipped by 4.37 per cent or 42.93 points to 937.93 points as share price of Chilime Hydropower dropped by Rs 22 to Rs 377 and Upper Tamakoshi by four rupees to Rs 230.

Similarly, others subgroup fell by 4.03 per cent or 28.28 points to 672.66 points as stock price of Nepal Telecom went down by Rs 23 to Rs 610.

Likewise, mutual fund went down by 3.96 per cent or 0.40 point to 9.69 points.

In the review week, Nepal Life Insurance Co recorded highest turnover of Rs 608.50 million. It was followed by NIC Asia Bank with Rs 523.45 million, Himalayan Distillery with Rs 484.61 million, NMB Bank with Rs 425.78 million and Nepal Bank with Rs 215.12 million.

In terms of weekly trading volume, NMB Bank was the forerunner with 1.06 million shares. It was followed by NIC Asia Bank with 1.02 million shares, Nepal Bank with 826,000 shares, Prabhu Bank with 788,000 shares and Global IME Bank with 748,000 shares.

Meanwhile, Nepal Life Insurance Co witnessed most number of transactions — 4,439. It was followed by NMB Bank with 3,837, NIC Asia Bank with 3,236, Himalayan Distillery with 2,835 and Global IME Bank with 2,556 transactions.