Share market nearly salvages previous week’s loss

KATHMANDU, OCTOBER 3

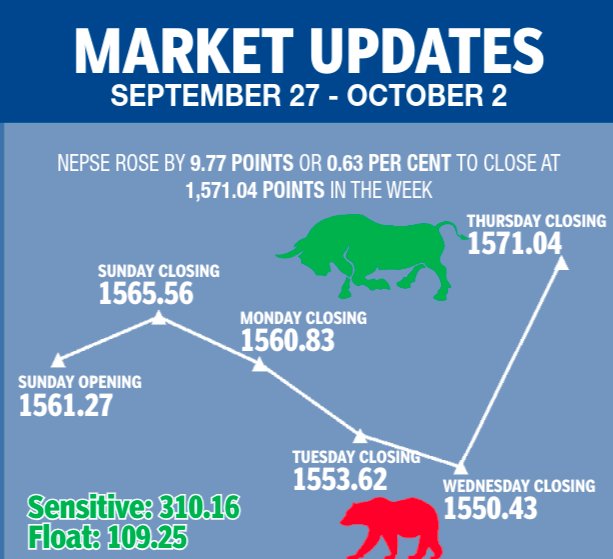

The Nepal Stock Exchange nearly recovered all of the loss of the previous week, with the benchmark index going up by 0.63 per cent or 9.77 points in the trading period between September 27 and October 1. In the trading week of September 20 to 24, the local bourse had slipped by 0.69 per cent or 10.92 points.

“Investors continue to be attracted to the secondary market,” said a share market analyst, pointing at the trading volume and the fact that the total market capitalisation has surged to an all-time high of Rs 2.09 trillion.

“Slight correction is actually a sign of healthy market and ensures no sector is being overheated,” the analyst explained.

The benchmark index had opened at 1,561.27 points on Sunday and had added 4.29 points by the time of closing.

While Nepse index reversed course over the next three days, dropping by 4.73 points on Monday, by 7.21 points on Tuesday and by 3.19 points on Wednesday, the local bourse more than recovered the losses by jumping 20.61 points on Thursday to close the trading week at 1,571.04 points.

Sensitive index, which measures the performance of class ‘A’ stocks, inched up by 0.19 per cent or 0.59 point to 310.16 points. The float index that gauges the performance of shares actually traded also went up by 0.94 per cent or 1.02 points to 109.25 points.

In the review week, altogether 52.22 million shares of 201 companies were traded through 189,951 transactions that amounted to Rs 11.42 billion. The traded amount was 6.04 per cent less than the preceding week when 261,849 transactions of 40.48 million shares of 206 companies had been undertaken that totalled Rs 12.15 billion.

Half of the subgroups landed in the green, while the remaining were in the red during the review period.

Investors had been especially attracted to the stocks of development banks during the week, causing the sub-index of development banks to soar 6.25 per cent or 114.59 points to 1,946.9 points.

Adding to the previous week’s gain of 3.9 per cent or 28.36 points, the finance subgroup rose by 3.85 per cent or 29.09 points to rest at 784.31 points this time around.

Non-life insurance advanced by 1.43 per cent or 113.51 points to 8,044.05 points; mutual funds rose by 1.12 per cent or 0.12 point to 10.81 points and banking ascended by 0.19 per cent or 13.57 points to 1,258.48 points.

Hotels, meanwhile, inched up by 0.88 per cent or 15.33 points to 1,749.17 points.

After leading the pack of gainers in the previous week with a surge of 7.15 per cent or 72.68 points, the trading subgroup landed at the bottom of the pile in the review week. The sub-index slumped by 2.95 per cent or 32.18 points to 1,057.33 points.

The loss of the remaining five subgroups was limited below one per cent.

Others slipped by 0.63 per cent or 6.38 points to 1,011.61 points; life insurance was down 0.60 per cent or 57. 81 points to 9,639.14 points; microfinance fell by 0.54 per cent or 13.87 points to 2,556.86 points; manufacturing lost 0.49 per cent or 15.12 points to 3,039.98 points; and hydropower shed 0.31 per cent or 4.02 points to settle at 1,292.38 points.

Meanwhile, Soaltee Hotel was the forerunner in terms of trading volume and weekly turnover, with 8.59 million of its shares changing hands that amounted to Rs 502.80 million.

Himal Dolakha Hydropower Co Ltd with Rs 472.37 million, Nepal Reinsurance with Rs 428.80 million, Arun Kabeli Power Ltd with Rs 420.51 million and Arun Valley Hydropower Development Co Ltd with Rs 398.99 million rounded up top five companies with highest weekly turnover.

In terms of trading volume, Himal Dolakha Hydropower Co Ltd with 4.17 million shares, National Hydropower Co Ltd with 2.58 million shares, Arun Valley Hydropower Development Co Ltd with 1.89 million shares and Arun Kabeli Power Ltd with 1.86 million shares were other top firms.

Reliance Life Insurance Ltd with 14,338 transactions was the topper in terms of number of trades, followed by Nepal Reinsurance Co Ltd with 6,256 transactions, Himal Dolakha Hydropower Co Ltd with 5,933 transactions, Liberty Energy Co Ltd with 5,712 transactions and NRN Infrastructure and Development Ltd with 5,029 transactions.

A version of this article appears in e-paper on October 4, 2020, of The Himalayan Times.