Share market plunges to one-month low

Kathmandu, December 23

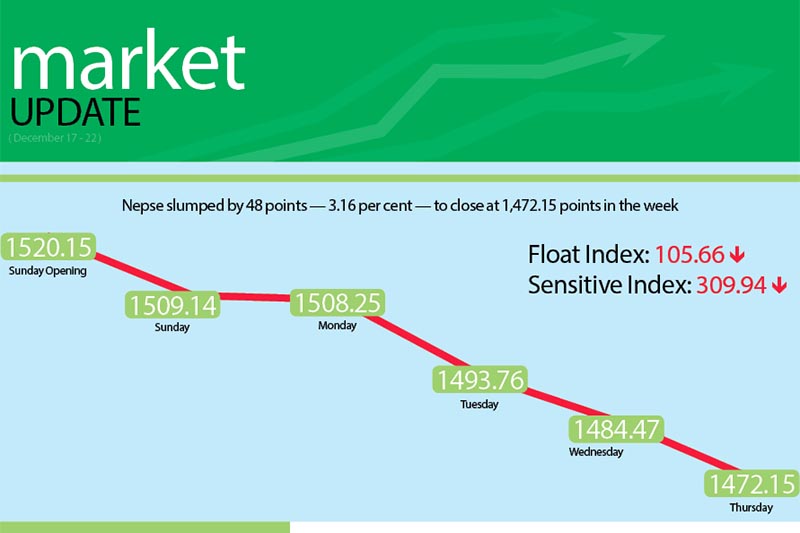

The country’s sole secondary market index fell for the third consecutive week by more than three per cent. The Nepal Stock Exchange (Nepse) index plunged by 48 points or 3.16 per cent to nearly a month low in the trading week between December 17 and 21.

The secondary market, which has been southbound after the elections retreated below the threshold of 1,500 points during the review period. The last time the market index had closed at the current level was on November 23.

Along with the Nepse index, the sensitive and float indices also dropped significantly. The sensitive index plunged by 10.71 points or 3.34 per cent to 309.94 points and the float index fell by 3.23 points or 2.97 per cent to 105.66 points in the week.

The secondary market remained splattered in red throughout the five days of the trading week. The market had opened at 1,520.15 points on Sunday and fell to 1,509.14 points by the time of closing. Similarly, the market descended to 1,508.25 points on Monday. On Tuesday, the market fell below 1,500 points and closed at 1,493.76 points. Continuing the same trend, the local bourse closed at 1,484.47 points on Wednesday and at 1,472.15 points on Thursday — the last trading day of the week.

Analysts and investors pointed out that the market has been affected due to both external and internal factors. President of Nepal Investors Forum, Ambika Prasad Paudel, said that the market has been affected due to tight liquidity in banks and financial institutions and the possibility of the interest rates going up in the near future.

“Margin lending has been affected because of tight liquidity condition in the banks and investor sentiment has also been affected by the possibility of interest rates rising,” Paudel said. “Moreover, delays in formation of a new government after the elections and the ongoing disputes among the political parties also affected the market movement.”

The sub-index of class ‘A’ financial institutions plunged by 2.76 per cent or 35.78 points to 1,260 points. Share price of Nepal Investment Bank dropped by 3.27 per cent to Rs 650 per unit, secondary market price of Standard Chartered Bank fell by 4.27 per cent to Rs 2,086 per unit and share price of Everest Bank plunged by 4.73 per cent to Rs 1,128 per unit in the week.

The sub-index of others group also fell by 53.21 points or 5.89 per cent to 849.7 points. Share price of Nepal Telecom plummeted by 6.52 per cent to Rs 860 per unit.

Sub-indices of development banks, microfinance institutions, hydropower, trading and insurance companies also slumped by more than three per cent. Development banks’ sub-index fell by 64.35 points or 3.68 per cent to 1,683.88 points. Likewise, microfinance’s sub-index plunged by 63.40 points or 3.43 per cent to 1,782.08 points.

Hydropower group also plunged to 1,990.06 points, down 3.25 per cent or 66.77 points. Trading group fell by 6.25 points or 3.04 per cent to 198.99 points in the week. Similarly, the sub-index of insurance sector dropped by 294.40 points or 3.73 per cent to 7,600.44 points.

The sub-index of finance companies fell by 11.16 points or 1.47 per cent to 749.24 points in the week. Hotels also fell in the week by 29.58 points or 1.38 per cent to 2,116.67 points.

Meanwhile, sub-index of manufacturing sector went up slightly to 2,541.53 points, gaining 18.52 points or 0.73 per cent.

Altogether, 5.71 million shares of 177 companies worth Rs 2.58 billion were traded through 24,655 transactions during the week. The traded amount was 11.92 per cent less than the total weekly turnover of the previous week.

Nepal Telecom secured the top position in terms of total turnover with Rs 205.03 million. It was followed by Standard Chartered Bank with Rs 151.13 million, Nepal Grameen Bikas Bank with Rs 122.74 million, Prime Commercial Bank with Rs 106.22 million and Everest Bank with Rs 96.36 million.

Nepal Grameen Bikas Bank topped the list in terms of trading volume and number of transactions, with altogether 359,000 of its shares changing hands through 2,676 transactions during the week.

New listings

Company

Type

Unit

Arun Finance

Rights

1,500,000

Citizen Investment Trust

Bonus

1,327,648.73

NIC Asia Bank

Bonus

13,385,195

Prabhu Insurance

Bonus

1,108,845.39

Saptakoshi Development Bank

Rights

2,743,000

Source: Nepse