Stock market bull run unlikely to persist for long

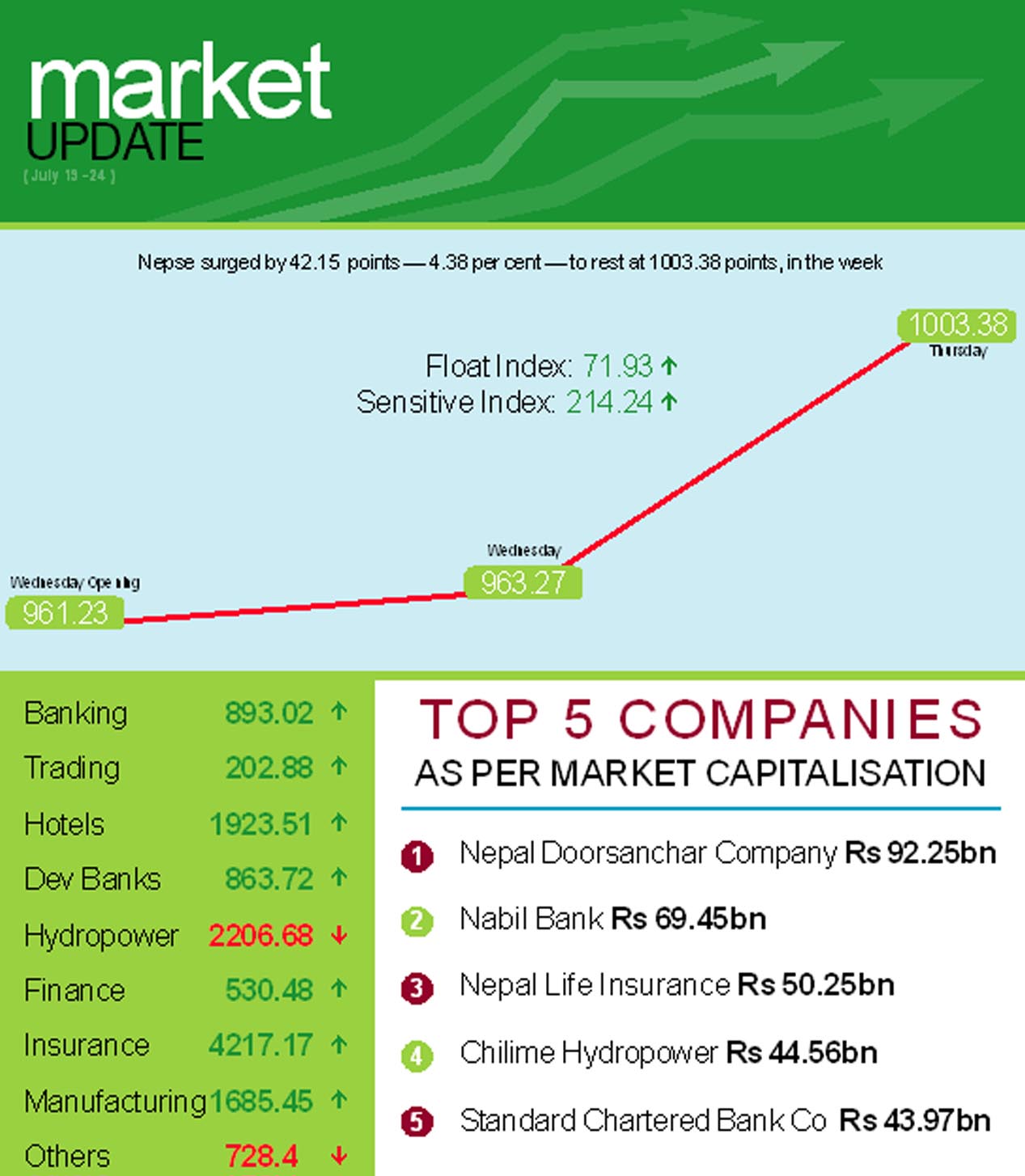

Unveiling of the Monetary Policy 2015-16 resulted in a massive bull run in the country’s only secondary market, causing the Nepal Stock Exchange (Nepse) index to surge by 42.15 points or 4.38 per cent week-on-week to close at nearly a one-year high of 1,003.38 points.

“Nepse index rally may continue in the coming week but it is unlikely the bull run will sustain in long run,” said Rabindra Bhattarai, a stock market analyst.

Echoing concerns raised by bankers, he further explained that though increasing the capital base of the banks and financial institutions (BFIs) as provisioned in the monetary policy is good for sound financial health of the BFIs, the given time period of two years is insufficient to implement the new rule.

Bhattarai added that dividend per share will decrease in the coming days and it is not possible to meet the criteria set by the central bank within the stipulated time even if BFIs opt for merger.

While the stock market remained closed until Tuesday, the benchmark index opened for trading at 961.23 points on Wednesday. Nepse ended the first trading day of the new fiscal year on a positive note — adding 2.04 points. Following the launch of the monetary policy on Thursday, the local bourse was on an upward trajectory, as stock investors scrambled to grab stocks of commercial banks, development banks and finance companies.

Consequently, Nepse ascended by 40.11 points in the last trading day of the week to breach the four-digit mark after almost a year. Nepse had been unable to land above the psychological level of 1,000 points after August 19 last year, when it had closed at 1,013.62 points.

In total, 1.92 million units of shares of 163 companies worth Rs 932.40 million were traded during the trading week through 5,912 transactions. The traded amount was 29.54 per cent less than the preceding week when 3.49 million scrips of 172 listed firms worth Rs 1.32 billion changed hands through 7,443 deals. However, it is to be noted that the market was open for only two days this week, against the normal five days in the previous week.

The sensitive index ascended by 9.57 points to 214.24 points. Similarly, the float index also rose by 3.46 points to 71.93 points during the review period.

Apart from hydropower and others, all the subgroups recorded gains in the week.

Banking and insurance were almost neck-and-neck in terms of points gained. Insurance surged by 62.98 points to close at 4,217.17 points, as share value of firms like Nepal Life Insurance went up by Rs 72 to Rs 2,958 and of National Life Insurance by Rs 50 to Rs 1,890.

Trailing close behind, banking climbed an impressive 61.67 points to 893.02 points. Everest Bank’s scrips gained Rs 208 to Rs 2,328 and Citizens Bank added Rs 41 to Rs 530, among others. Development banks ascended by 54.68 points to 863.72 points. Nagbeli’s scrips rose by Rs 152 to Rs 2,152 and of Chhimek by Rs 102 to Rs 1,500.

Soaltee hotel’s share value closed at Rs 441, up Rs 16 and Taragaon added five rupees to end at Rs 257. This helped hotels subgroup rise by 42.59 points to 1,923.51 points.

The growth of manufacturing subgroup was muted compared to the previous week’s impressive gain of 82.2 points, as it added only 12.57 points to close at 1,685.45. This was mostly on the back of Himalayan Distillery’s share price going up by Rs 54 to Rs 738.

Adding to the previous week’s gain of 3.79 points, finance rose by 10.18 points to 530.48 points. Meanwhile, trading inched up 0.49 points to 202.39 points.

On the other hand, hydropower retreated by 39.43 points to land at 2,206.68 points. Even as Sanima Mai’s share value went up by nine rupees to Rs 709, the gain was offset by Chilime’s scrips losing Rs 50 to close at Rs 1,638 and Butwal Power Co’s dipping by Rs 11 to Rs 606.

Similarly, Nepal Telecom’s shares dropped to Rs 620 (Rs 16 less compared to previous week’s close), which in turn dragged down the others subgroup by 18.79 points to 728.4 points.

National Life Insurance came on top in terms of turnover with Rs 57.56 million. Nabil Balanced Fund-I claimed the top spot with regard to number of shares traded with 200,000 of its scrips changing hands. Meanwhile, Citizens Bank recorded the highest number of transactions — 335.