Stock market rally pulls share investors

KATHMANDU, NOVEMBER 21

Ample liquidity and lack of other investment avenues due to the coronavirus pandemic has lured investors to the local bourse, fuelling the market rally in recent days.

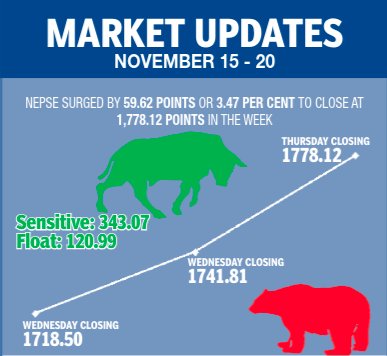

Continuing the trend after the Tihar holidays, the Nepal Stock Exchange (Nepse) index advanced by 3.47 per cent or 59.62 points in the trading week of November 15 to 19.

The benchmark index had opened at 1,718.50 points on Wednesday, when the market resumed trading after the Tihar holidays.

The local bourse had gone up by 1.36 per cent or 23.32 points by the time of closing. Nine of the subgroups had witnessed gains, while three landed in the red that day.

Then on Thursday, Nepse index surged by 2.08 per cent or 36.32 points to close the trading week at 1,778.12 points. The share market recorded highest single day turnover of Rs 6.12 billion, while total market capitalisation reached Rs 2.38 trillion, also a record-high. All subgroups witnessed gains on the last trading day of the review week.

Sensitive index rose by 1.17 per cent or 3.98 points to 343.07 points.

Float index also went up by 2.69 per cent or 3.17 points to 120.99 points.

Altogether, 25.74 million shares of 200 companies were traded through 100,014 transactions that amounted to Rs 10.91 billion in the review period. The weekly turnover was 46.13 per cent less compared to the preceding week when 214,234 transactions of 56.97 million shares of 208 companies amounting to Rs 20.25 billion had been undertaken.

However, considering that the market had opened for only two days in the review week against the normal five days in the past week, the average daily turnover in the review period surged by a staggering 34.67 per cent to Rs 5.45 billion, against Rs 4.05 billion of past week.

“There is no other reason for the bull run in the share market than lack of other investment avenues,” said a share market analysts, advising investors to be cautious and aware of the trend.

All the subgroups recorded gains in the trading week, with three of them soaring by more than 10 percentage points. Investors’ attraction to trading companies’ stocks propelled the subgroup by an eye-popping 20.91 per cent or 379.47 points to 2,193.94 points. Manufacturing saw a growth of 12.97 per cent or 440.17 points to 3,833.87 points and hotels surged by 11.66 per cent or 221.22 points to 2,118.59 points.

Non-life insurance jumped 9.04 per cent or 796.63 points to 9,610.63 points; life insurance saw the highest number of points gained with the sub-index up 8.76 per cent or 896.55 points to 11,126.86 points; and others rose by 6.87 per cent or 88.12 points to 1,370.69 points.

Finance went up by 2.56 per cent or 22.18 points to 889.22 points, trailed by microfinance that landed at 2,769.18 points, up 2.25 per cent or 60.97 points. Mutual funds subgroup ascended by 1.99 per cent or 0.23 point to 11.78 points.

Though in green, the gain of remaining three subgroups — development banks, hydropower and banking — was muted at less than one per cent.

In terms of share in the total weekly turnover, however, banking subgroup was the leader with Rs 2.38 billion or 21.83 per cent of the total traded amount in the week.

Non-life insurance companies’ total traded amount was Rs 1.85 billion or 17.01 per cent of the weekly turnover; that of others subgroup was Rs 1.59 billion or 14.58 per cent; and of life insurance firms was Rs 1.45 billion or 13.31 per cent.

Meanwhile, Nepal Reinsurance Co Ltd (NRCL) topped the chart in terms of weekly turnover with Rs 747.11 million. It was followed by Nepal Life Insurance Co Ltd (NLIC) with Rs 520.79 million, Nepal Telecom (NT) with Rs 481.71 million, Shivam Cements Ltd (SCL) with Rs 389.82 million and Himalayan Distillery Ltd (HDL) with Rs 359.91 million.

Prabhu Bank Ltd (PBL) was the forerunner in terms of trading volume with 993,000 of its shares changing hands. National Hydro Power Co Ltd’s 800,000 shares were traded and came in second; NRCL’s 715,000 shares were traded and it stood third. Arun Valley Hydropower Development Co Ltd with 711,000 shares traded was fourth and Arun Kabeli Power Ltd (AKPL) with 634,000 shares traded rounded up the top-five in this category.

Sanima General Insurance Ltd recorded highest number of transactions — 8,390. With 6,162 transactions, NRCL was second; PBL was third with 2,961 transactions; Reliance Life Insurance Ltd was fourth with 2,816 transactions and NLIC was fifth with 2,807 transactions in the review period.