Stock market sheds 0.73pc

Kathmandu, August 26

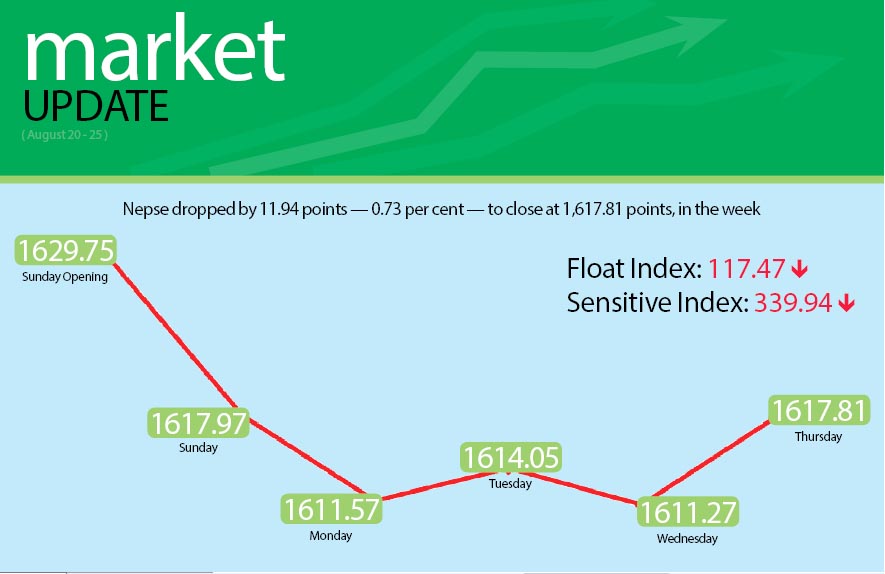

The secondary market recorded a second consecutive week-on-week drop, with the Nepal Stock Exchange (Nepse) index down 11.94 points or 0.73 per cent over the five trading days between August 20 and 24. The benchmark index, which had opened at 1,629.75 points on Sunday had dropped to 1,617.81 points at the end of the trading week, that is, by Thursday’s closing.

The benchmark index had fallen by 11.78 points and 6.4 points on Sunday and Monday, respectively. While the market recouped some of the loss on Tuesday by edging up by 2.48 points, it saw the gain wiped out the very next day as the local bourse dropped by 2.78 points on Wednesday. Even as Nepse index advanced by 6.54 points on the last trading day of the week, the gain was insufficient to offset the earlier losses.

Mekh Bahadur Thapa, chief executive officer at NIBL Capital, said the market has been relatively stable in the last few weeks. “We haven’t seen any big movements in the market,” he said. “Investor sentiment, which had taken a hit following Nepal Rastra Bank’s directives related to calculation of core capital-cum-deposit, propped up due to positive political cues.”

He also advised investors to adopt caution while investing in the secondary market. “The market could swing either way, so investors should be conscious in this scenario,” he said.

Sub-indices of commercial banks, manufacturing and hotels declined by more than one per cent in the week.

The banking sector sub-index rested at 1,401.6 points, with a drop of 15 points or 1.06 per cent. Share price of commercial banks like Civil fell to Rs 242, a drop of 3.2 per cent. Likewise, shareholders of Century Commercial Bank also saw the value of their stocks fall by 2.75 per cent to Rs 248.

The sub-index of manufacturing sector declined by 1.32 per cent or 34.8 points to 2,593.91 points. Share price of Himalayan Distillery saw a steep decline of 15.41 per cent to Rs 1,279 per unit.

Hotels sector dropped by 29.77 points or 1.21 per cent to 2,426.08 points in the review period. Share price of Oriental fell by 6.28 per cent to Rs 851.

The hydropower sector dipped by 0.32 per cent to 1,859.95 points.

Likewise, sub-index of insurance sector also retreated by 54.31 points or 0.59 per cent to 9,187.67 points.

Share index of finance and development banks also landed in the red in the week.

Sub-index of finance landed at 816.6 points, down 0.85 per cent and development bank sub-index also edged down by 0.65 per cent to 2,016.34 points.

Increase in the share price of Nepal Telecom (NT) and Hydropower Investment and Development Company Ltd (HIDCL) pushed up the sub-index of others by 1.46 per cent to 723.91 points. Share price of NT went up by 1.43 per cent to Rs 709 and share price of HIDCL rose by 1.62 per cent to Rs 188.

The trading sector remained unchanged at 214.11 points.

Stocks of 175 companies were traded in the week with total weekly turnover at Rs 3.31 billion, an increase of 8.45 per cent when compared to the transaction amount of the previous week.

According to Nepse, 1.48 billion shares were traded through 40,183 transactions in the review period.

Prime Life Insurance Company topped the list in terms of turnover with Rs 197.58 million.

Nepal Bank came in second with Rs 145.82 million, Nepal Life Insurance Company was third with

Rs 105.53 million, Citizens Bank International was in the fourth position with Rs 104.93 million and Siddhartha Investment Growth Scheme 1 rounded up the top-five with Rs 98

million.

Likewise, Siddhartha Investment Growth Scheme 1 topped the list in terms of trading volume with 2.62 million units of its scrips changing hands and Himalayan Power Partner was the forerunner in terms of number of transactions — 11,889.