Tax evaders will not be excused, warns FinMin

Kathmandu, August 30

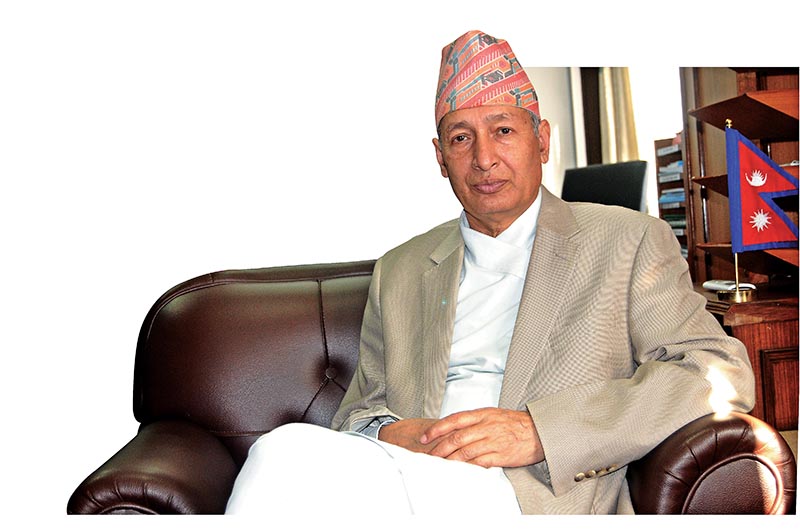

Finance Minister Yubaraj Khatiwada today said that the government will not excuse traders and businesses that are found to be evading taxes.

Speaking at a programme organised by Nepal Chamber of Commerce (NCC) in the Capital on ‘Contemporary prospects and challenges of Nepali economy’ today, Minister Khatiwada said that evading taxes and intentional leakages of revenue are serious offences and people involved in such activities will be penalised.

“The private sector undoubtedly is the major force to drive the economy and the intention of the government is to facilitate businesses, not to trouble them. However, businesses should be conducted by complying with the existing legal framework and government is obliged to take legal action against tax evaders,” he said.

The minister urged traders to come and have discussions with the government regarding their concerns or any change in policies that is hampering business growth. “But they should not breach existing laws.”

Similarly, Minister Khatiwada said that the government is tightening imports in a bid to give a boost to domestic production and encourage exports. “Among different other products, the country will have surplus production of electricity soon. As soon as domestic production of electricity is able to cater to the demand, we will stop import of power from India,” he said.

Currently, the country has been producing 1,205 megawatts of electricity. As major hydropower projects, like 456-megawatt Upper Tamakoshi, are expected to be completed within this fiscal, the government expects addition of almost 1,000 megawatts of power to the national grid by this year. Based on the projection of the government, Nepal will start producing more than 2,200 megawatts of electricity by 2019-20.

Government statistics show that Nepal imported electricity worth Rs 22 billion in the last fiscal year while power import from the southern neighbour stood at Rs 19.5 billion in the previous fiscal.

On the occasion, Khatiwada also said that the government will prioritise agriculture and tourism promotion along with facilitation of trade.

Regarding the implementation of permanent account number (PAN) and vehicle and consignment tracking system (VCTS), Khatiwada said that their implementation will prove to be a boon for the economy in the long run. “Initially, traders and businesses were against these provisions due to lack of proper awareness on these provisions. These provisions have been introduced to facilitate businesses and the government will implement them gradually in close coordination with the private sector and other stakeholders,” he said.

Meanwhile, Rajesh Kazi Shrestha, president of NCC, said that the government should hold enough consultations with the private sector before introducing any business-related policies. Citing that the government is preparing to introduce tough penalties for tax evaders, including jail terms, Shrestha urged the government to limit the punishment only to fines.