The fallacy of false precision

Kathmandu, April 22

Precisely Rs 9,246,390,000,000, or approximately Rs 9.3 trillion. That’s the amount the country needs to invest in the next five years to attain average economic growth of 9.6 per cent per annum, according to the National Planning Commission’s five-year plan, which will be rolled out in the next fiscal.

The amount, which is three times the gross domestic product of 2017-18, looks very precise. But the catch is there is no assurance investment of that level will generate growth of 9.6 per cent per annum in the next five years.

This is because the so-called ‘investment need’ was calculated using the obsolete Harrod-Domar growth model, which was disowned by its inventor over six decades ago, as it was not invented to derive “an empirically meaningful rate of growth”.

“It is a fallacy of false precision to convey a sense of rigour and accuracy by using large numbers when the underlying technique used to derive them is not robust,” Swarnim Wagle, former vice-chairman of the National Planning Commission, told THT, urging the government to be “candid and humble about the limitations of its tools, and use complementary methods, such as computable general equilibrium modelling”.

The Harrod-Domar growth model, which was coined in the aftermath of the Great Depression in the US, basically states that there is direct link between economic growth and investment. The model assumes that investment of certain rupees will help a country produce certain volume of goods and services.

Based on this assumption, economists coined Incremental Capital Output Ratio, or ICOR, which outlines additional unit of capital or investment that is needed to produce an additional unit of output. Nepal’s ICOR, according to NPC’s latest five-year plan, stands at 4.9. This means investment of every Rs 4.9 will raise output, or gross domestic product, by Re 1. It was on this assumption the NPC said the country needed to make capital investment of Rs 9.3 trillion in the next five years to attain average annual growth rate of 9.6 per cent between the fiscals 2019-20 and 2023-24.

“At best, ICOR can provide a very, very rough estimate of investment requirement for economic growth. So, total dependency on ICOR could mislead the public because it does not take factors such as availability of workers, labour productivity or human capital into account,” said another former NPC vice chairman, Shankar Sharma.

ICOR, therefore, is not a predictor of growth target, two senior economists associated with multilateral lending institutions said on condition of anonymity.

Globally, only 11 per cent of 138 countries surveyed between 1950 and 1992 reported “positive and significant relationship” between growth and investment, according to former World Bank economist William Easterly’s paper, ‘The Ghost of Financing Gap: How the Harrod-Domar Growth Model Still Haunts Development Economics’, published in the reputed Journal of Development Economics in December 1999.

Guyana’s experience is striking: The country’s total GDP fell sharply from 1980 to 1990 even when investment increased from 30 per cent to 42 per cent of GDP.

This is the reason why the model has fallen out of favour in academic literature, states Easterly’s paper.

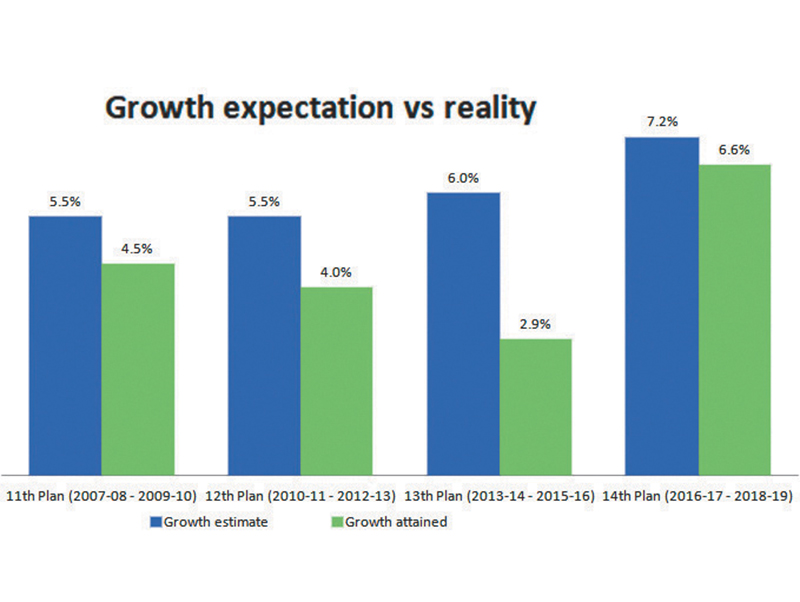

Yet Nepal has been using it for years.

“This is because the model makes a very simple prediction that economic growth is proportional to the share of investment spending,” said Pushpa Shakya, former NPC joint secretary, who still helps the government to derive ICOR.

Yet he could not vouch on the model’s accuracy.

“Yes, the model has limitations,” said Shakya.

“But we do not have reliable data on productivity, price, distributive effects, linkages between various sectors and so on to use sophisticated models. If we have those data our predictions on investment needs and growth will be more accurate.”

This implies government’s investment needs for the next five years are based on an imagined growth target and an unverifiable assumption about ICOR, according to Wagle.

He said economists needed to speak the language of “uncertainty and confidence intervals” because “illusory numbers about investment needs can misallocate resources and distort priorities”.