UK hopes former colonies can give trade boost after Brexit

LONDON: After decades of sidelining the Commonwealth as a relic of their imperial past, many in Britain are now promoting the group of ex-colonies as a ready-made market for what they hope to be the country’s buccaneering global business spirit after the exit from the European Union.

It’s unlikely to be that easy.

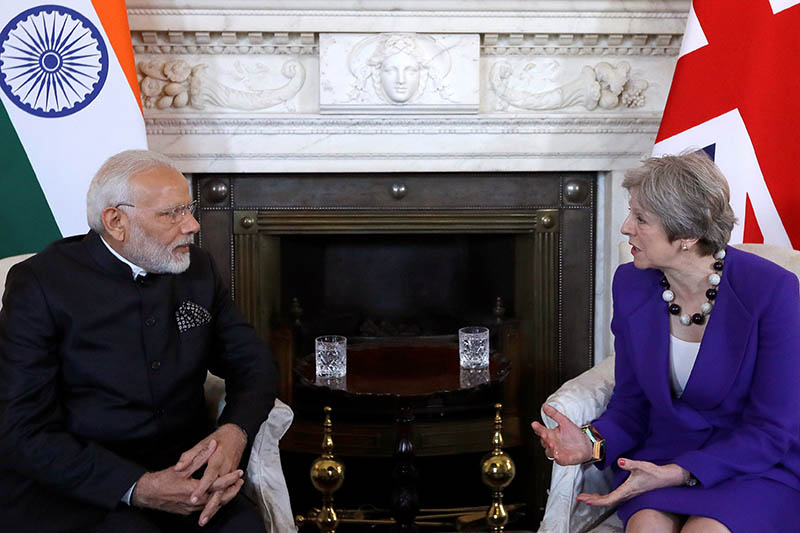

At this week’s summit in London of leaders from the Commonwealth, Prime Minister Theresa May and her international trade secretary, Liam Fox, sought to underline the group’s importance to a “Global Britain” after Brexit in less than a year.

Brexit proponents like Fox cast the Commonwealth as a more natural fit for Britain than the centralized EU. Ever since the Brexit vote campaign, they referred to the “old friends” in the Commonwealth, some of whom still have Queen Elizabeth II as their sovereign, use English as their official language, and share a cultural and sporting heritage.

“As the United Kingdom leaves the European Union, we have the opportunity to reinvigorate our Commonwealth partnerships and usher in a new era, harnessing the movement of expertise, talent, goods and capital between our nations, in a way that we have not done for a generation or more,” Fox said.

The potential of the Commonwealth, a varied group of 53 countries that includes Australia, Canada, countries in sub-Saharan Africa, many of the islands of the Caribbean and India, is “vast,” according to Fox. He cited forecasts that trade between Commonwealth countries is expected to total $700 billion by 2020, up from $560 billion now.

However, the idea that the Commonwealth can ever match the EU as a trading partner is widely dismissed by experts, as is the notion that striking new deals will be simpler.

“The great myth is that withdrawing from the EU would enable the UK to trade more easily with the Commonwealth, whereas in fact Britain already has trade agreements in place or in negotiation with the vast majority of Commonwealth members through the EU,” said Philip Murphy, director of the Institute of Commonwealth Studies at London University.

In 2017, nearly half of Britain’s exports went to the 27 other EU countries. Less than 10 percent went to Commonwealth countries. EU states accounted for 7 of Britain’s top ten export markets. Singapore is the top Commonwealth destination at 16th, accounting for just 1.5 percent of Britain’s total export of goods.

There’s room for growth, particularly in India, which is one of the fastest-expanding economies in the world. But it’s coming from a low level: Britain sold only 4.4 billion pounds ($6.25 billion) worth of goods to India in 2017 and imported 7.5 billion over the same period.

Rakesh Bharti Mittal, president of the Confederation of Indian Industry, said trade between Britain and India is “very, very small” but that there is “huge potential.”

Doubling or even trebling trade volumes between the two countries would still leave it far short of the levels between Britain and Germany. In 2017, Britain exported 37.7 billion pounds of goods to Germany, making it its second-biggest export market. On the imports side, Britain brought in 69.5 billion pounds worth of goods from Germany, more than any other country.

It’s these hard economic realities that are front and center in the Brexit discussions with the EU. And it’s the reason why the British government was so keen to agree on the outlines of a transition deal whereby Britain would remain part of the EU’s tariff-free and frictionless single market and customs until after Brexit day.

Even the Brexit-backer Fox is aware of the risks to British businesses of an abrupt rupture with the EU on March 29, 2019. Fox says one of his priorities is to make sure Britain duplicates the trade deals the EU has with scores of countries around the world.

“As we leave the European Union our first aim is to ensure stability with our trading partners, to those countries with whom we have an agreement by virtue of our EU membership,” Fox said.

After that, Fox is clear he wants to see Britain’s trading compass turn away from the EU toward the faster-growing economies of Asia and Africa, many of whom are what he has termed as some of Britain’s “oldest and most resilient friendships and partnerships.”

That will not only be up to Britain, however, as its significance as an export market for many of those developing countries has declined since Britain joined an early version of the EU in 1973.

Most observers think Britain will be able to strike swift trade deals with the likes of Australia and New Zealand, which together account for less than 2 percent of British trade.

“Trade deals with the key Commonwealth partners such as Canada, Australia and New Zealand will not come anywhere near to make up for any losses stemming from the new barriers to trade between the UK and the EU,” said Peg Murray-Evans of the University of York.

Other trade deals with the likes of India will take longer — if they ever happen. India has stressed that it wants its people, particularly students, to have easier access to Britain, a stance that’s at odds with one of the primary motivations of the Brexit vote — clamping down on immigration.

In any case, Britain’s ability to influence the Commonwealth is likely to wane in coming years as India’s clout grows.

“There’s also an illusion in the UK that when it leaves the EU, former Commonwealth members will embrace it like a long-lost mother, and that of course is utter nonsense,” said Murphy, author of ‘The Empire’s New Clothes: The Myth of the Commonwealth.’

“You can’t under-estimate the sensitivity of many Commonwealth states to the legacy of imperialism and that is not going to make them inclined to bail out Britain if it gets itself into economic trouble over Brexit.”