Weekly turnover at stock market takes a hit

Trading volume and turnover both took a hit in the trading week of June 25 to 29 as the market remained open for only three days out of the normal five. Nepal Stock Exchange (Nepse) index, nevertheless, managed to snap the bout of two consecutive weekly losses by edging up 4.32 points or 0.28 per cent during the review period.

While the secondary market remained closed on Monday due to public holiday, stockbrokers halted the trading on Thursday over differences related to tax issues. The tax dispute is regarding the demand made by tax offices to the broker commission to submit the value added tax (VAT) dating back from fiscal year 2012-13. The Stock Brokers’ Association of Nepal (SBAN), however, argued that the government’s policy to impose retrospective tax was not justifiable as the broker companies have not been collecting VAT from their clients.

Though the officials of Securities Board of Nepal (SEBON) and SBAN sat for talks to find a way out to the dispute on Thursday morning, the meeting ended inconclusively, thus prompting the stockbrokers to halt the share trading for the entire day.

Nepal Investors Forum, meanwhile, termed the brokers’ move ‘irresponsible’ and cited it as ‘yet another example of cartelling, monopoly and syndicate’.

Issuing a media release, the forum urged the regulatory bodies to provide brokerage licence to commercial banks to ensure more reliability, transparency, enhanced competition and greater access to the secondary market for share investors.

Nevertheless, following discussions among officials of SBAN, SEBON and Ministry of Finance, the stockbrokers’ association has declared trading would resume on Sunday. “It has been decided to let stockbrokers conduct their business in the same terms as before for the time being, which is why trading will resume on Sunday,” read a press statement issued by SBAN today, which has also apologised for the inconvenience caused to the share investors on Thursday..

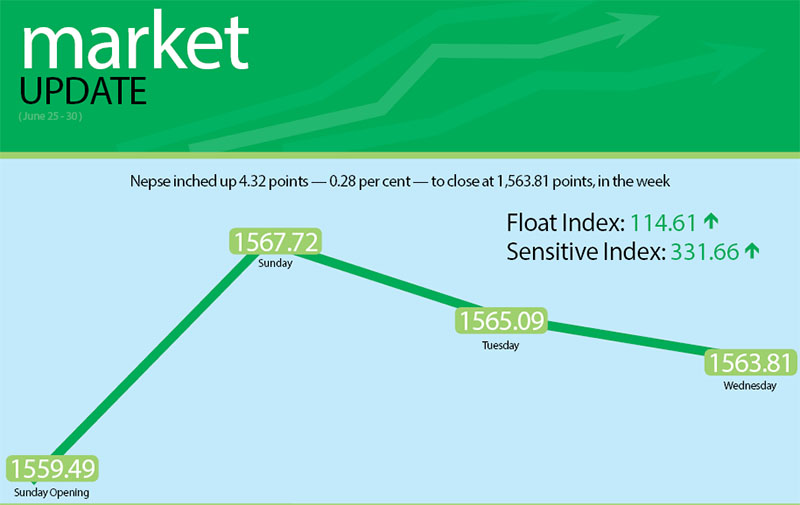

Starting the week at 1,559.49 points on Sunday, the benchmark index had added 8.23 points by the day’s closing. The market remained closed on Monday as the country observed Eid al-Fitr. The optimism seen in the first trading day, however, could not sustain as the local bourse shed 2.63 points on Tuesday and dipped 1.28 points on Wednesday. Nonetheless, the gain witnessed on the first day was enough to offset the subsequent losses, with Nepse index resting at 1,563.81 points for the week.

The sensitive index, which gauges the performance of class ‘A’ stocks, inched up 0.76 point or 0.23 per cent to 331.66 points. Similarly, the float index that measures the performance of shares actually traded also edged up 0.19 point or 0.17 per cent to 114.61 points.

In total, 3.41 million shares of 160 companies that amounted to Rs 1.85 billion were traded through 16,006 transactions during the review period. The traded amount was 37.36 per cent lower than the preceding week when 25,858 transactions of 5.29 million shares of 164 firms worth Rs 2.96 billion had been undertaken.

Among the subgroups, trading continued to hold steady at 212.76 points for the seventh consecutive week.

Hydropower, finance and others landed in the red, although their losses were limited to below one per cent. Hydropower fell by 15.45 points or 0.79 per cent to land at 1,946.88 points, finance was down 2.05 points or 0.27 per cent to settle at 746.91 points and others shed 0.87 point or 0.13 per cent to close at 687.18 points.

The gainers, too, did not have much to show — with hotels being the sole subgroup to record a gain of over one per cent. The subgroup went up by 35.78 points or 1.62 per cent to 2,242.40 points on the back of Soaltee rising by 1.69 per cent to Rs 361, Taragaon Regency up 1.14 per cent to Rs 265 and Oriental gaining 1.93 per cent to Rs 685.

Development banks rose by 10.02 points or 0.52 per cent to 1,927.74 points and banking went up by 5.56 points or 0.40 per cent to 1,396.94 points.

Similarly, manufacturing landed at 2,379.40 points with a gain of 3.42 points or 0.14 per cent and insurance sub-index settled at 8,196.62 points by nudging up 7.64 points or 0.09 per cent.

Meanwhile, Himalayan General Insurance topped the chart in terms of turnover with Rs 126.71 million, followed by Prabhu Bank (Promoter Share) with Rs 123.82 million, Lumbini General Insurance with Rs 105.16 million, Standard Chartered Bank with Rs 92.94 million and Everest Bank with Rs 83.60 million.

Prabhu Bank (Promoter Share) was the best performer in terms of trading volume, with 652,000 of its shares changing hands. Along with recording highest weekly turnover, Himalayan General Insurance was also the forerunner with regard to most number of transactions, with 915 transactions recorded under its name.