Sovereign investors tweak portfolios for environmental risk

- Norway, NZ, France SWFs leading the way on divestment

- Others looking to increase renewables exposure

- Paris climate agreement adds to pressure on investors

- TABLE-SWFs and climate change risk management

LONDON: Some sovereign investors are reducing their exposure to fossil fuels or seeking clean alternatives to protect their portfolios from rising environmental risk.

Norway's $900 billion sovereign wealth fund (SWF) -- itself financed by oil sales -- and the New Zealand Super Fund (NZSF) are among those adjusting investments in anticipation of tougher environmental rules or damage from the impact of global warming.

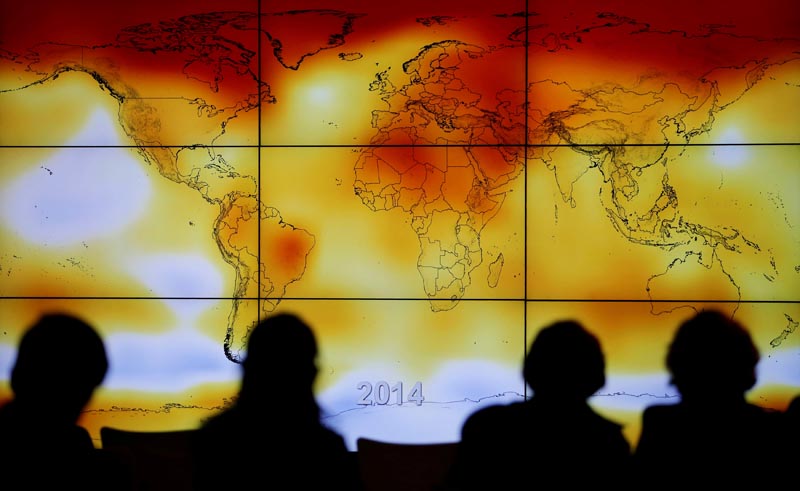

Rising temperatures could lead to more violent storms and flooding, posing a threat to infrastructure and prime real estate, both favoured by sovereign investors.

UN scientists say greenhouse gases are the main cause of warming and while the US administration has questioned the science, many countries are introducing rules to cut emissions.

Norway's SWF, the world's largest, is divesting from companies that derive more than 30 percent of their turnover or activity from coal, a major source of greenhouse gases. It is also investing in alternative fuel companies such as NextEra Energy, a US wind farm developer.

By July the fund's ethics watchdog is likely to recommend the fund excludes or puts on a watch list the first of several firms in the oil, cement and steel industries. The fund is also pushing companies to disclose carbon emissions and plans to handle climate change risk.

"In terms of greenhouse gas emissions, we are actually expecting companies to increase reporting on it," the fund's chief executive Yngve Slyngstad told Reuters.

"We want to have more transparency on investment plans and how they are affected."

The NZSF said last year it would set a target by the end of June to reduce its carbon footprint.

"We should be able to increase our returns for the same risk, or get the same returns with less risk," Adrian Orr, chief executive of NZSF, said in November.

In an update, an NZSF spokeswoman said the fund was looking at its passive portfolio rules and this would lead to a reduction in fossil fuel holdings. More details would be given when the changes have been made, she said.

It has already invested in energy efficient glass manufacturer View and waste gas-to-fuel firm LanzaTech.

France's SWF Caisse des Depots (CDC) is also aiming to reduce the carbon footprint of its equity portfolio by 20 percent by 2020, and is exiting companies that derive more than 20 percent of revenue from coal.

"Coal is a 19th century energy, it is not the energy of the future," said Joel Prohin, head of portfolio management at CDC.

COUNTING THE COST

Investors have committed to divesting some $5 trillion from fossil fuel companies, according to Arabella Advisors, with pension funds leading the way.

In June, Swedish pension fund, AP7 sold its investments in six energy-related companies it says violate the 2015 Paris Agreement, which aims to limit global warming to below 2 degrees Celsius and has pushed environmental risk up the agenda.

That is despite US President Donald Trump's decision last month to take the United States out of the agreement, which attracted international condemnation.

A 2016 study by the London School of Economics and others put value at risk at $2.5 trillion in a 'business as usual' emissions scenario of 2.5 degrees Celsius of warming by 2100.

"If you believe climate change is happening and there's going to be a cost to that, do you pay that cost upfront as a preventative measure, or wait for the impacts to happen and then pay the bills?" said Alex Millar, head of EMEA sovereigns at Invesco.

One SWF official, speaking on condition of anonymity, said it was steering clear of Miami real estate given the risk of rising sea levels in the low lying area.

"It's very likely that in 10 years' time the parking is going to be flooded," he said.

A 2017 Invesco study of sovereign investors found climate change was the most important environmental, social and governance (ESG) issue for those that had already incorporated ESG factors into their investment process. Seventy percent of ESG adopters perceived an increase in long-term returns.

But it also noted adoption of ESG practices was patchy, with some investors in the United States and emerging markets reluctant to commit without harder data on risks and returns.

ENERGY FOR FREE

The International Forum of Sovereign Wealth Funds (IFSWF) is exploring the investment implications of the global commitment to curb greenhouse gas emissions and will report back to its members in September.

"Funds that are primarily funded through fossil fuel production will feel an accelerated demand to diversify as quickly as possible," said NZSF's Orr, who also chairs the IFSWF.

Even where fossil fuel divestment is not a priority, more investors want to capture the upside in the green economy.

The Abu Dhabi Investment Authority has invested in renewable energy firms Greenko and ReNew Power while Singapore's GIC has targeted investments in electric vehicles.

Ithmar Capital, Morocco's strategic investment fund, wants to raise $1-2 billion from infrastructure specialists and other SWFs for its Africa-focused green infrastructure fund.

"Africa is contributing the least to climate change, but it is suffering the most so it needs a specific action plan," Tarik Senhaji, chief executive of Ithmar Capital, said.

Mahmood Alkooheji, chief executive of Bahrain's SWF Mumtalakat, also described renewables as "the way forward".

"We can't not be thinking of the environment," he told Reuters. "For Bahrain it's a very promising area, we have sunshine 366 days in a year ... so that's a lot of energy being wasted. It's energy for free so why not invest in it?"