Govt unveils Rs 1.53 trillion budget

- Focus on infra development

- Inflation to remain within 6pc

- Elderly allowance up by Rs 1,000

- Civil servants’ salaries raised by up to 20pc

- Economic growth projected at 8.5pc in next fiscal

Kathmandu, May 29

Finance Minister Yubaraj Khatiwada today presented Rs 1.532 trillion federal budget of fiscal 2019-20 in the joint session of the House of Representatives and National Assembly, with due priority to infrastructure development.

The second federal budget has laid high emphasis on development of roadways, railways, waterways, hydropower and airports, and has projected that the country’s economy will grow at 8.5 per cent and inflation will remain below six per cent in the upcoming fiscal.

The government has also expressed its commitment to complete major projects, including Melamchi Water Supply Project, Bhairahawa International Airport and Motihari-Amlekhgunj Oil Pipeline Project within 2019-20. It has prioritised completion of pending projects during the year.

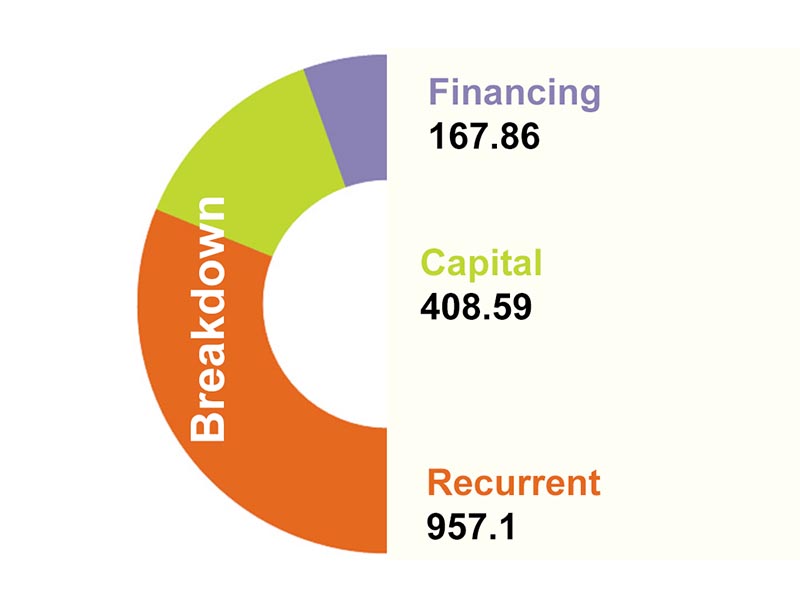

Of the total budget for 2019-20, the government aims to utilise Rs 957.1 billion as recurrent expenditure; it has earmarked Rs 408.59 billion and Rs 167.86 billion for capital expenditure and financing provision, respectively.

The budget has set federal government’s revenue collection target of Rs 981.12 billion for the next fiscal. The government plans to seek foreign grants and loans worth Rs 298.8 billion and Rs 58 billion, respectively. Internal borrowing worth Rs 195 billion is expected to balance the expenditure and source for the budget.

The budget has transferred Rs 55.3 billion to seven provinces and Rs 89.95 billion to local bodies in equalisation grants and Rs 44.55 billion to provinces and Rs 123.87 billion to local bodies as conditional grants.

Under the revenue-sharing scheme, the provinces and local bodies are expected to receive Rs 130.89 billion in the next fiscal.

The budget has given priority to domestic industries, especially export-oriented industries, generation of employment opportunities, promotion of agriculture and tourism sector and enhancement of public service delivery.

Prime Minister KP Sharma Oli-led government, which was under pressure to satisfy lawmakers and civil servants, has raised the budget for constituency development programme and increased salaries of civil servants. While the government has increased budget for the constituency development programme by Rs 20 million to Rs 60 million, salaries of civil servants have been raised by up to 20 per cent — 20 per cent for non-gazetted staffers and 18 per cent for gazetted officers.

The government has also raised elderly allowance by Rs 1,000 to Rs 3,000 per month and monthly allowance for single women, people with disabilities, Dalits and other marginalised communities has also been increased by Rs 1,000.

The budget has given continuity to health insurance worth Rs 100,000 for senior citizens.

It has also announced restructuring of the Prime Minister Agriculture Modernisation Project and effectively implementing it in the upcoming fiscal year, thereby creating more employment opportunities.

The government has announced tax of one rupee per litre on petrol and diesel for road maintenance purpose, in addition to five rupees per litre being levied for the construction of the Budigandaki hydropower project.

The government has announced it will develop nine cities, including Kathmandu, Birgunj and Biratnagar, as megacities and connect every rural municipality with at least one strategic road.

The government has also announced it will adopt policies to encourage mergers of banks and financial institutions, including insurance firms. In a bid to ensure that public enterprises operate effectively, the government has announced it will bring in strategic partners in such enterprises as per necessity.

In a bid to make effective the collection of Value Added Tax, the government has also announced a 10 per cent rebate on the VAT levied on total transaction made by a customer while purchasing goods and services through digital payments.

The government has also exempted income tax for individuals with annual income of Rs 400,000 and married couples with annual income of Rs 450,000. Previously, individuals earning over Rs 350,000 annually and couples earning over Rs 400,000 annually were levied income tax.

The government has also slashed advance capital gains tax on real estate to five per cent in sub-metropolitan cities and to 10 per cent in metropolitan cities.

Meanwhile, economist Bishwo Poudel, said the budget had followed the previous trend of being distributive in nature and had failed to adopt austerity measures necessary to ensure economic growth.

“The recurrent budget and the size of revenue collection is almost the same, which clearly shows that majority of the collected revenue will be spent on recurrent expenditure. This is not good,” he said.

However, unchanged income tax slabs and no additional tax burden in the budget are certain to encourage the business community, he added.

Provincial governments will present their budget before provincial assemblies by mid-June and local governments will present their budget 20 days before the beginning of the fiscal year calendar.

READ ALSO: