Remittances and microfinance: Risks, hurdles and opportunities

In the case of Nepal, the link between microfinance and remittances has taken an upward trend in recent years with a focus on linking the inflows of remittance money to MFIs who are often better positioned than banks to offer money transfer services

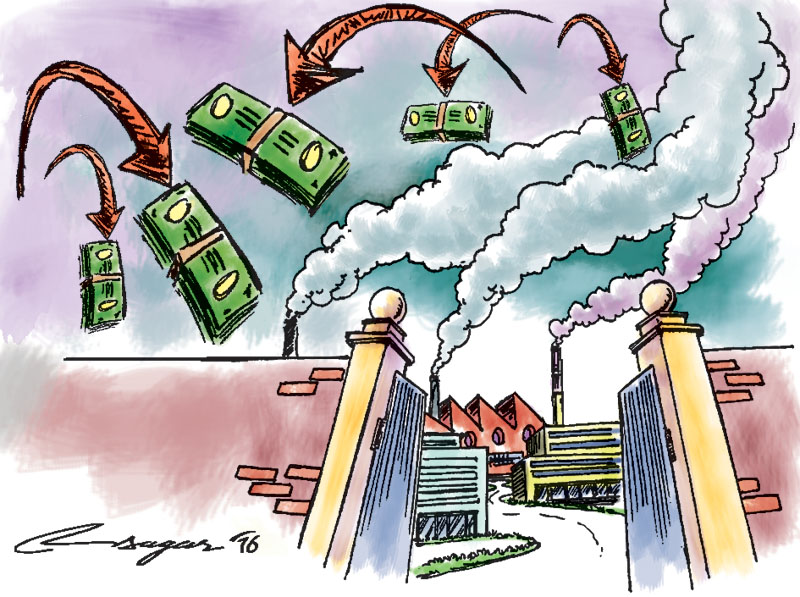

There have been ample discussions on the proposition that linking remittances and microfinance has a positive development impact on recipient communities. This is because many similarities exist between the goals of microfinance and remittances; both are targeted at poverty reduction, both can increase a safety net for households and families, and both have the potential for employment generation and economic development through investment in small and micro-enterprises. The involvement of microfinance institutions (MFIs) in the remittance transfer process is, thus, a promising means for expanding financial services access to the poor, particularly in rural areas that do not have access to commercial banks.

While remittances have the potential to spur development, relying too much on them can create problems. Coordinating with the microfinance sector could help in counterbalancing many of these risks. One risk is that people might become so dependent on the remittances to the extent that they stop to undertake economic activities at home and instead concentrate on dispatching young adults abroad to make money and send remittances home. This would restrain economic development in the home country and stimulate the “brain drain” wave. Hence, it is crucial to leverage the potential for remittances to raise job creation in recipient communities.

Likewise, though remittances ameliorate the lives of those who procure them and have a positive multiplier effect on the domestic economy, there exist hurdles to effectively investing remittances into micro- and small enterprises. Recipients who might otherwise be encouraged to begin a small business are constrained by the absence of a safe place to save their remittances, the inability to leverage the remittances through a loan, and the paucity of an infrastructure for participating in a market. In this respect, combining microfinance opportunities with remittances could mitigate these gaps and thus improve the prospect of developing lasting and sustainable business ventures.

Hence, microfinance is quite appropriate for remittance-associated financial services. Since they are poor, many remittance recipients lie outside typical bank client profiles, but are well within the market segment targeted by MFIs. Likewise, MFIs can render a money transfer service in underserved areas and at a lower cost than mainstream providers owing to their social mission of serving the poor and unbanked people. By employing lending techniques that take into consideration the lack of collateral and low individual sums, MFIs are often better prepared than commercial banks to overcome the information asymmetries that thwart the poor from having access to credit. Studies have also revealed the potential for microfinance loans that can help recipients establish new businesses.

Despite their potential, however, MFIs face several obstacles in linking remittances with financial services. For instance, though MFIs match the socio-economic profile of remittance receivers better than traditional banks, they often do not have the institutional capacities for complex cross-border transfers in terms of liquidity management and information-management systems, among others. Moreover, there could be regulatory controls with respect to activities in foreign currencies or restrictions in offering certain financial services.

In the case of Nepal, the tie between microfinance and remittances has taken an upward trend in recent years with a focus on linking the inflows of remittance money to MFIs who are often better positioned than banks to offer money transfer services to remittance recipients in remote rural areas with low-cost transfer products due to their close proximity to client groups and communities that receive remittances. MFIs can support clients’ family members in developing micro enterprises through entrepreneurship development by extending access to finance and enabling them to meet the capital needs of their enterprises. Likewise, the remittance business can be a crucial avenue of income and funds for MFIs because most of them rely predominantly on interest income and are vulnerable to potential volatilities in the income from this source. MFIs, on their part, could also offer special deposits, investment loans and other type of loans to the families who receive remittances.

Over time, with increasing experience, innovative MFIs will find concrete ways of transforming workers’ remittances into a productive business that would contribute to their social mission and profitability. However, for all of this to translate into reality, the regulatory and legal aspects need to be properly addressed and appropriate policies need to be designed and implemented.

All in all, microfinance is well-suited to address the demand for remittance-linked financial services, particularly among poor and/or geographically isolated populations and MFIs can act as a conduit through which remittances can be saved and reinvested in rural communities. With an upsurge in the number of Nepalese migrant workers and subsequent inflow of remittances, it is the extensive network of MFIs that has the potential to leverage remittances as one of the sources of development finance for setting up sustainable rural enterprises.

Dr. Pant is Director at Nepal Rastra Bank.