‘Concurrent rights in the constitution need to be defined clearly’

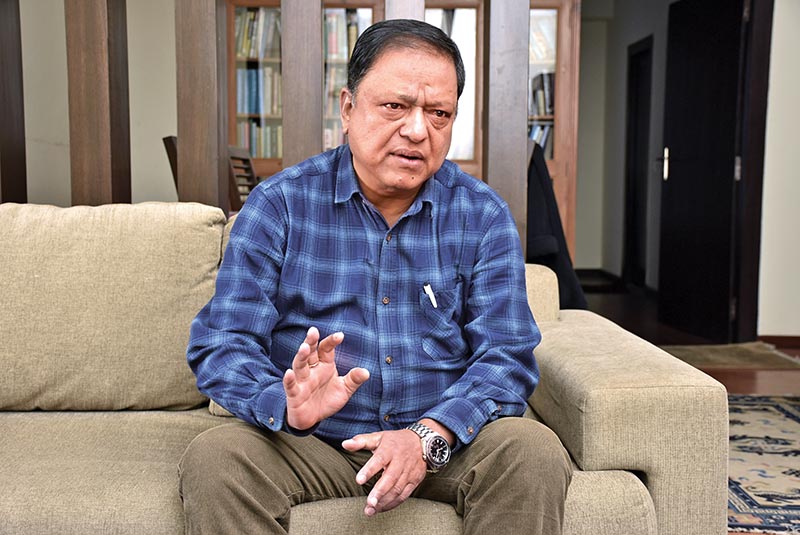

With the provincial and parliamentary elections over, the country has formally institutionalised the federal system of governance. Along with the political agenda, the fiscal policy that the country will adopt in the future has become a major topic of discussion. Though the constitution has demarcated the working areas of the federal, provincial and local levels, there still are practical difficulties to implement them. To implement the federal system properly, programme formation, realisation and revenue collection will be challenging issues in the coming days. Sabin Mishra of The Himalayan Times caught up with Bimal Koirala, former chief secretary of the government, to learn about the prospects and challenges in implementing fiscal plans and programmes in a federal system. Excerpts:

The budget of the current fiscal has created a base to implement the federal system in the country. The constitution has also specified the working areas of different levels of government. What could be the best way to implement the fiscal policy in the new system?

The country has decided to adopt the federal system of governance but we have not done proper homework for the paradigm shift in the form of government. If there was proper groundwork on it, we would not face any problem in implementing the federal system. To implement the fiscal policy in a federal system, the Natural Resources and Fiscal Commission (NRFC) should be formed as early as possible as we have not yet been able to create a scientific base for distribution of resources. Besides this, the federal system is an even more expensive system than the current unitary system. The local governments will not be able to function to their full capacity because there is no proper administrative structure created till now. Conceptually, we formed the local units as the local government but unfortunately they are not functioning well. So, the government should form NRFC as soon as possible. Another thing is that the government is facing resource crunch. Due to lack of sufficient budget it will be difficult to handle the administrative expenditure of the seven provinces and 753 local units. The new government will face this challenge. The government has already started borrowing domestically in the beginning of the fiscal year, which is unfortunate. Moreover, there is a limit to domestic borrowing. So, if we cannot form a proper mechanism to mobilise resources, it may hurt the country.

The government’s recurrent expenditure has been ballooning over the years. Similarly, demand for development is also increasing by the day. What can the government do to boost resources?

There is no possibility of overnight change in the domestic basket. If the government had conducted research on the strength of provinces and local units, the federal system could have functioned well from the very first day. But, we do not have any study on it. If we are not aware of the ground reality regarding resources and the government does not take proper decisions to mobilise revenue, the government mechanism could become dysfunctional. And consequently, the supply system could take a hit. Since we have not done proper homework on this we will not be able to derive the benefits of a federal system as of now. Meanwhile, the country is transforming into a federal system, so we have to create its base as soon as possible. All the government bodies will have to function at full speed in the future.

The government has provided grants to the local bodies and they are also collecting revenue. However, the implementing capacity is the same. What do you have to say on this?

The government has to spend to enhance the capacity of the local bodies. The administrative structure of local bodies should be completed as soon as possible. Local units are not functioning because the administrative structure is not complete yet. The central government should help in strengthening them. On one hand we don’t have enough money and on the other hand the available resources are not being utilised properly. It is not a good sign for development. Another bitter reality is that we have taken the state organs as ‘big’ and ‘small’. But the reality is all the levels are equal — central, province and local levels are equal as per the provision of the constitution. Each level has autonomous rights and working areas. They have to utilise their rights and provide service to the public. We can see the central level giving directives to the local level and this not the principle of federalism. Autonomous power is very important in a federal system. If the central level tries to guide the local level it will be against this principle.

There are some rights that the constitution has provided to all three levels of the government. Don’t you think such concurrent rights will affect the functioning of the state

organs?

There are some concurrent rights and powers in the constitution that need to be defined clearly. There should be a straight demarcation in the working areas of the central, provincial and local levels. I think it will take some time to make this demarcation. If the rights and working areas of the three levels were determined before the elections, the elected bodies could have functioned from the very first day. But it has been delayed.

The private sector fears that there is a possibility of double taxation after implementation of federal system. How can it be simplified?

Double taxation is an extra burden on the people. If there is double taxation, the whole state mechanism will be a failure. And it could disrupt the supply system. Moreover, unequal economy will develop in the country. If there is an unequal economy in the country it will be another unfortunate situation for the nation. Moreover, if such a situation is created the government will not be able to intervene in any area. However, in some cases, the government can tax the richer areas more and channel that money to the poorer areas. The system of piggybacking is in practice around the world. But double taxation cannot be implemented at all. We are all talking about these doubts at the moment because there has been no proper study before implementing the federal system. If we look at the situation carefully, it will be a bother to local and provincial governments to collect taxes because they have not yet done so. Local representatives will be apprehensive about implementing the tax system due to fear of becoming unpopular and losing votes in future elections.

Economic prosperity is the major agenda of all the parties. But the situation is such that the available resources will not be able to fulfil demand. What will be the challenges for the new finance minister?

The new government will face multiple challenges, but it must not come up with cheap and populist agendas. There should be prudential use of resources. The government should make and follow the criteria of distributing grants to the local and provincial levels. Grants can be distributed in a symmetrical as well as asymmetrical manner. Development cost in Humla and Morang is different. So, there can be asymmetrical ways to distribute grants but there should be a proper mechanism developed for the purpose. The finance ministry must be more determined and prudent in revenue mobilisation and management than in the earlier days. The other thing is that populist programmes should not be introduced. The government should be totally focused on mega and long-term effective programmes. The new finance minister should have the will power to use revenue in productive sectors which can drive the country towards economic prosperity. If the finance minister adopts populist programmes, the country will not be able to develop economically. The leadership should work without any bias and prejudices while implementing economic agenda.