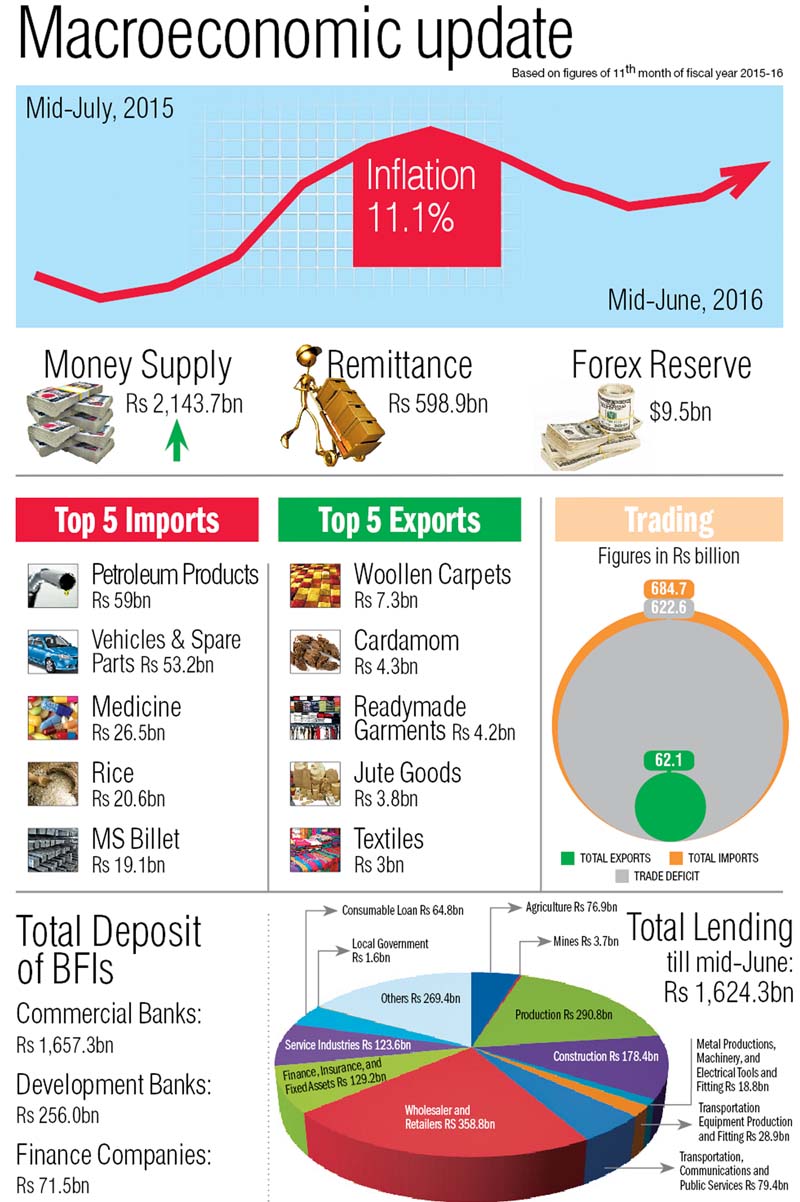

Inflation at four-month high of 11.1 per cent

Kathmandu, July 15

Consumer prices soared by 11.1 per cent in June, as prices of vegetables, pulses, legumes, clothes and footwear items jumped by 16 to 29 per cent.

Many were expecting inflation to moderate after normalisation in supply situation following formal end of blockade on Nepal-India border points on February 8.

Price hike had, in fact, started to subside after supply of fuel and other consumable items smoothened following restoration of normalcy in the Tarai. This led inflation to moderate to 9.7 per cent in April from as high as 12.1 per cent in January.

But the spike seen in prices of food items, such as vegetables, legumes and pulses, and non-food items, such as clothing and footwear, drove up June inflation to the highest level in the last four months, shows the latest Macroeconomic Report of Nepal Rastra Bank (NRB), the central bank.

In June, prices of vegetables soared by a startling 29.4 per cent, while prices of pulses and legumes shot up by 21.5 per cent. Similarly, prices of clothes and footwear jumped by 17 per cent, while house rents and utility costs went up by 16.4 per cent.

One of the reasons for higher increment in prices here is inflationary pressure that is being built in India. India’s inflation stood at 5.8 per cent in June. Since Nepal imports over 60 per cent of its goods from India, price hike in the southern neighbour is automatically passed onto the country.

However, what is startling is the wedge in inflation of Nepal and India that is widening.

Inflation wedge between Nepal and India had widened to 6.4 per cent in January, as consumer prices in Nepal shot up by 12.1 per cent, as against 5.7 per cent in India.

But by May, the wedge had narrowed down to 4.2 per cent.

In June, the inflation wedge further widened to 5.3 per cent, shows the NRB report. In June last year, such wedge stood at two per cent.

This indicates supply-side constraints have once again started playing a bigger role in pushing up prices.

Supply-side constraints include transport bottlenecks and lack of raw materials, which lead to higher imports of finished goods, protests, and inadequate supply of electricity and key inputs to ramp up production. Also, ineffective market monitoring that has led to artificial price hike of many goods has built inflationary pressure.

“Besides, many house owners raised house rents after formal end of blockade, to cover price hike and income reduction seen during the period when supplies were disrupted,” said a senior NRB official on condition of anonymity.