Non-life insurers settle 42.38 per cent claims

Kathmandu, August 7

Non-life insurance companies have settled 42.38 per cent of the claims related to the devastating earthquakes of April and May, which regulators say is ‘satisfactory’.

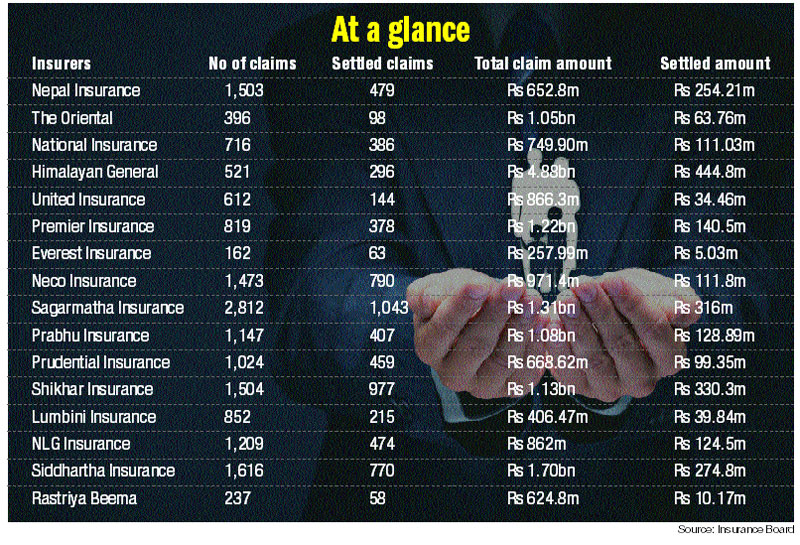

As of Thursday, 16 non-life insurers had received 16,603 claims, of which 7,037 have been settled, shows the latest report of the Insurance Board (IB), the insurance sector regulator.

“The pace at which insurance firms are settling claims is satisfactory. But, of course, it would be better if they could further speed up the claim settlement process,” said Bhoj Raj Sharma, advisor at the IB.

The claims received so far by non-life insurers are worth Rs 18.43 billion. Of this amount, Rs 2.49 billion has been extended to clients as compensation. However, the compensation extended to clients so far is 13.51 per cent of the total claim amount.

The discrepancy in percentage of settled claims and settled claim amount shows that non-life insurers are currently focusing on settlement of smaller claims.

“It takes time to settle claims of bigger amount as damage assessment process is longer. In such cases, we even have to bring in people from reinsurance companies abroad to determine the loss,” officials of insurance companies said.

As of Thursday, the highest number of claims was received by Sagarmatha Insurance. The company received 2,812 claims worth Rs 1.31 billion. It has so far settled 1,043 claims, or 37.09 per cent, worth Rs 316 million.

The second highest number of claims was received by Shikhar Insurance. It had received 1,504 claims worth Rs 1.13 billion as of Thursday. Of these, 977, or 64.96 per cent, claims worth Rs 330.30 million have been settled.

Next in the line of largest claim recipients is Nepal Insurance Company. It had received 1,503 claims worth Rs 652.84 million as of Thursday. Of these, 479, or 31.87 per cent, claims worth Rs 254.21 million have been settled.

Although non-life insurers are sitting on quite a good number of unsettled claims, they do not seem much worried as very few new cases are being filed these days.

Because of this, insurers are becoming more and more confident about being able to manage the situation.

This, in turn, has relieved regulators.

“It now appears no non-life insurance will go bust, although many may be forced to bear losses,” said IB Director Raju Raman Paudel, adding, “We were fortunate because the earthquake did not affect industrial areas. Had those areas been hit, many non-life insurance companies probably would have to shut their businesses.”

The devastating quakes of April and May caused widespread destruction in 14 districts. The tremors claimed 9,000 lives, completely damaged some 508,000 private houses and over 19,000 classrooms, and rendered thousands of people homeless.

The losses triggered by the quakes have squeezed the income of thousands of households and pose a threat to the country which had begun gearing up for a higher trajectory of economic growth.