Record-setting week at Nepse

KATHMANDU, NOVEMBER 28

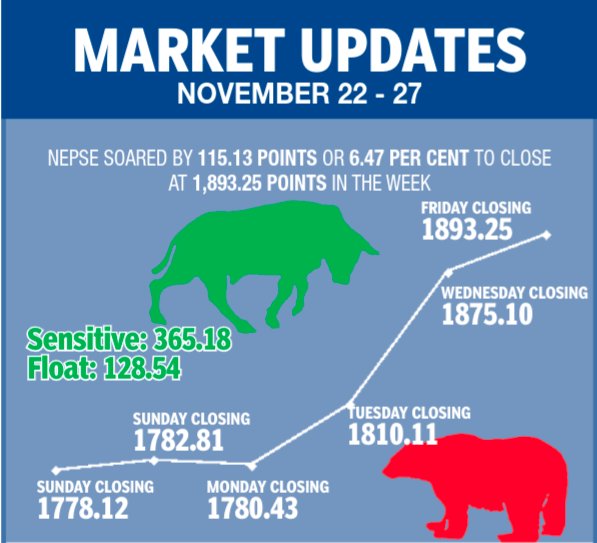

The country’s sole secondary market witnessed a number of records broken in the trading week between November 22 and 26, with the Nepal Stock Exchange (Nepse) index surging by 6.47 per cent or 115.13 points week-on-week to scale to a new peak.

Opening at 1,778.12 points, benchmark index had gained 4.69 points by the time of closing.

The daily turnover of Rs 6.9 billion topped the earlier highest turnover of Rs 6.12 billion recorded in the last trading day of the previous week.

Then on Monday, despite advancing to as high as 1,792.41 points, Nepse index shed 2.38 points by the time of closing owing to selling pressure in latter part of the day.

But the local bourse more than made up for the loss the very next day as Nepse index jumped 29.68 points to sail past psychological threshold of 1,800 points. The last time Nepse had closed at this level was back in October of 2016.

The benchmark index was basically northbound on Wednesday and had soared by 64.98 points by the time of closing, edging near the alltime high of 1,881.45 points recorded on July 27, 2016.

Although scaling as high as 1,926.91 points during the intra-day session on Thursday, Nepse index rested at 1,893.25 points by the time of closing, which was still a record high.

Moreover, 17.19 million shares traded hands via 70,003 transactions that amounted to daily turnover of Rs 7.61 billion — also a record number.

The sensitive index, which measures the performance of class ‘A’ stocks, jumped by 6.44 per cent or 22.11 points to 365.18 points. The float index that gauges the performance of shares actually traded also rose by 6.24 per cent or 7.55 points to 128.54 points.

Altogether, 75.84 million shares of 212 companies were traded through 287,130 transactions during the review week that amounted to Rs 31.54 billion. The weekly turnover was a staggering 189.18 per cent higher than the preceding week when 100,014 transactions of 25.74 million shares of 200 companies had been undertaken that totalled Rs 10.91 billion.

It is to be noted that the market had opened for only two days in the preceding week after the Tihar holidays against the normal five days in the review week. But even so, the average daily turnover jumped by 15.67 per cent to Rs 6.31 billion in the review period compared to Rs 5.45 billion of the past week.

While investor optimism shows no sign of dampening, market analysts advise adopting caution while investing as ‘especially the rookie investors run the risk of making costly mistakes in bull market’.

According to experts, lack of other investment avenues due to the coronavirus pandemic, ample liquidity in the market and easy availability of margin loans are some of the prime reasons for the bull run and hence not backed by fundamentals. “However, the market movement is unpredictable, so investors should put in their money in shares only after analysing and studying the financials and the history of the listed companies,” said a share broker, seeking anonymity.

Further explaining, he said, “What matters is how the stock behaves in the future.

While it is not possible to predict the future with certainty, one needs to have an investment thesis.”

Although all the subgroups had recorded gains in the previous week, three of them landed in the red this time around. Nevertheless, two of the subgroups soared by more than 10 per cent. These included manufacturing that surged by 14.93 per cent or 572.22 points to 4,406.09 points and others sub-index, which advanced by 11.48 per cent or 157.37 points to 1,528.06 points.

The banking subgroup, which has the highest weightage in the local bourse and had seen muted gain in the past week, jumped 8.70 per cent or 115.09 points to 1,437.57 points.

Trading rose by 5.76 per cent or 126.38 points to 2,320.32 points; microfinance went up by 3.25 per cent or 90.02 points to 2,859.2 points; development banks climbed 2.16 per cent or 45.35 points to 2,144.27 points; and hydropower ascended by 2.05 per cent or 29.74 points to 1,477.81 points.

Non-life insurance gained 1.15 per cent or 110.08 points to 9,720.71 points, trailed by finance which went up by 1.09 per cent or 9.72 points to 898.94 points.

At the other end of the spectrum, hotels — which had surged by 11.66 per cent in the previous week — saw some of the earlier gains wiped out as the subgroup slumped by 4.12 per cent or 87.38 points to 2,031.21 points.

Life insurance lost 1.41 per cent or 156.57 points to 10,970.29 points. Mutual funds shed 0.93 per cent or 0.11 point to rest at 11.67 points for the week.

Meanwhile, Nepal Reinsurance Company Ltd was the forerunner in terms of number of transactions and weekly turnover, with 15,123 transactions and Rs 2.08 billion, respectively.

Nepal Telecom with Rs 1.29 billion, Nepal Bank Ltd (NBL) with Rs 1.20 billion, Nepal Life Insurance Co Ltd with Rs 1.11 billion and Himalayan Distillery Ltd with Rs 1.10 billion were the other companies with highest weekly turnover.

Sanima General Insurance Ltd with 8,916 transactions, Prabhu Bank Ltd (PBL) with 8,491 transactions, Reliance Life Insurance Ltd with 7,866 transactions and NIC Asia Bank Ltd with 7,466 transactions rounded up the top five in this category.

In terms of trading volume, NBL topped the chart with 3.21 million shares traded, followed by PBL with 2.77 million shares, National Hydro Power Co Ltd with 2.14 million shares, Kumari Bank Ltd with 2.05 million shares and Prime Commercial Bank Ltd with 1.72 million shares.