11pc capital adequacy ratio must for banks from mid-July

Kathmandu, January 4

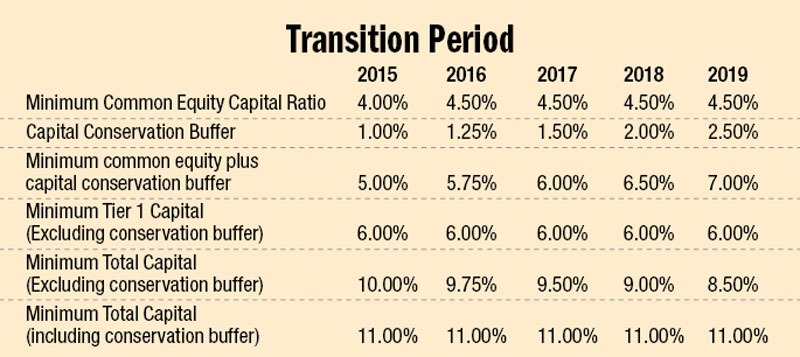

Commercial banks will have to maintain capital adequacy ratio (CAR) of 11 per cent from mid-July, as Nepal Rastra Bank (NRB), the banking sector regulator, gears up to meet global banking standards in regulation, supervision and risk management by rolling out Basel III capital framework.

Basel III capital framework, introduced by Basel Committee on Banking Supervision — a global standard-setter for the prudential regulation of banks — mainly seeks to raise the quality and level of capital to ensure banks are in a better position to absorb shocks arising from financial and economic stress. It also seeks to raise the standards for supervisory review process and puts emphasis on public disclosures.

Commercial banks in Nepal will have to roll out Basel III capital framework on a test phase beginning mid-January and will have to fully implement it by mid-July, says a directive issued by NRB today.

As per the new capital adequacy framework, commercial banks will have to maintain minimum total capital ratio of 11 per cent within mid-July. Currently, Class ‘A’ financial institutions are required to maintain CAR of 10 per cent. However, those that wish to extend dividend to shareholders must maintain CAR of 11 per cent.

Because of this provision, most banks are currently maintaining minimum total capital ratio of 11 per cent. This means they need not worry about mobilising additional funds to meet revised regulatory requirement. The minimum total capital held by commercial banks, among others, includes Tier (Core) 1 capital, which should be at least six per cent of the risk weighted assets by mid-July.

Although the existing requirement for Tier 1 capital stands at six per cent, the new capital framework has divided Tier 1 capital into Common Equity Tier 1 Capital and Additional Tier 1 Capital.

Common Equity Tier 1 Capital, among others, includes common shares, share premium, funds in statutory general reserve, retained earnings available for distribution to shareholders and unaudited current year cumulative profit. Additional Tier 1 Capital, among others, includes Perpetual Non-Cumulative Preference Share and Perpetual Debt Instruments.

As per the latest capital adequacy framework, banks must maintain Minimum Common Equity Tier 1 Capital Ratio of 4.5 per cent by mid-July. It could then use Additional Tier 1 Capital to push up the level of Tier 1 Capital to six per cent.

Also, banks will have to maintain Capital Conservation Buffer Ratio of 1.25 per cent within mid-July. This ratio has to be raised to 2.5 per cent by mid-July, 2019.

Capital Conservation Buffer, as per NRB, must be in the form of Common Equity Tier 1 Capital. This virtually means banks must maintain Minimum Common Equity Tier 1 Capital Ratio of 5.75 per cent within mid-July. This implies that only 3.75 percentage points of the 11 per cent minimum total capital ratio can be fulfilled through the use of Tier 2 (Supplementary) Capital in mid-July. Tier 2 Capital, among others, includes Preference Share Capital Instruments, debt and certain portion of funds allocated for loan-loss provision.

Also, there are provisions for counter cyclical buffer, leverage ratio and liquidity coverage ratio in latest capital adequacy framework, which NRB does not intend to introduce at the moment.