Q1 results of BFIs hit local bourse

Kathmandu, November 4

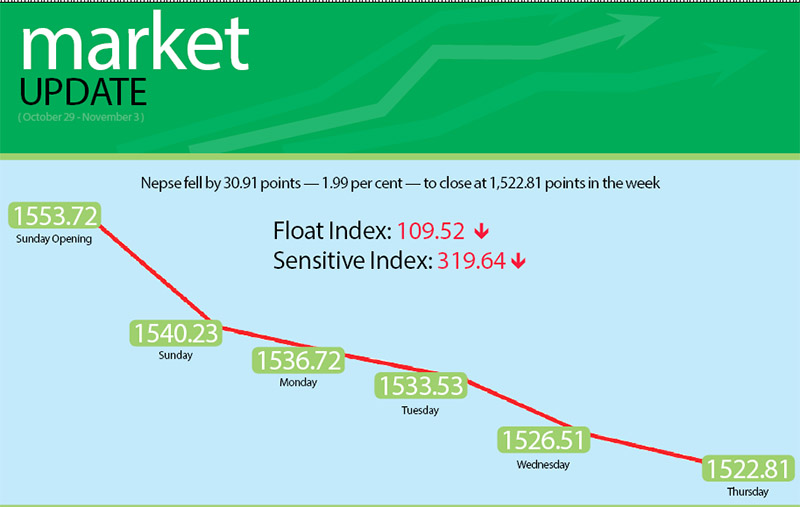

The Nepal Stock Exchange (Nepse) index dropped by 1.99 per cent or 30.91 points during the trading week between October 29 and November 2. The benchmark index, which had opened at 1,553.72 points on Sunday closed at 1,522.81 points on Thursday.

The country’s sole secondary market was southbound throughout the five trading days of the week. The benchmark index had dropped to 1,540.23 points by the time of closing on Sunday, to 1,536.72 points on Monday, to 1,533.53 points on Tuesday, to 1,526.51 points on Wednesday and to 1,522.81 points on Thursday.

Following Nepse index’s lead, the sensitive and float indices also dropped in the review period. The sens

itive index slipped by 2.57 per cent or 7.38 points to 319.64 points and the float index dipped to 109.52 points, down 2.18 per cent or 2.44 points in the week.

Analysts said that the market was affected by the first quarter reports of financial institutions that have majority share in the secondary market. “Investors had expected that the financial institutions would be able to maintain their earnings per share in the first quarter of the fiscal year. However, with their huge capital base, the financial institutions were unable to fulfil the expectations of investors, thereby dragging down investor sentiment,” explained Dhruba Timilsina, chief executive officer of Siddhartha Capital.

Timilsina also pointed out that investors are concerned about how the government will implement the federal system after the elections and how the centralised resources will be decentralised.

“Some policies are yet to be formed and investors are closely watching how the government will take decisions on decentralising the centralised resources,” he stated.

During the week, the sub-index of class ‘A’ financial institutions dropped by 2.22 per cent or 29.66 points to 1,301.31 points. Share price of commercial banks like Everest, Nepal Investment and Nabil dropped during the review period. Share value of Everest Bank dropped by 2.54 per cent to Rs 1,190 per unit, that of Nepal Investment Bank fell by 2.48 per cent to Rs 628 and Nabil’s dropped by 1.62 per cent to Rs 1,215 per unit during the review period.

Sub-index of development banks dipped by 3.07 per cent to 1,825.27 points during the week. Share price of Jyoti Bikash Bank fell by 2.7 per cent to Rs 180 per unit during the review period.

Nepse separated the indices of development banks and microfinance institutions on Wednesday. Subsequently, the sub-index of microfinance closed at 1,818.26 points on Thursday, down 14.26 points.

The hotels sector fell by 2.88 per cent or 68.41 points during the week to 2,310.91 points.

Likewise, the sub-index of manufacturing also dipped by 1.03 per cent or 25.58 points to 2,447.43 points.

The sub-index of insurance sector slipped to 8,392.73 points, dropping by 125.5 points or 1.47 per cent in the review period. The finance sector fell by 8.42 points or 1.07 per cent to 774.99 points.

Similarly, the sub-index of others, hydropower and trading sector dipped slightly during the week. Others sector landed at 829.17 points, falling by 7.23 points or 0.86 per cent. Likewise, hydropower sector fell by 6.12 points or 0.33 per cent to 1,826.96 points. Trading sector also dipped by 1.85 points or 0.81 per cent during the review period.

Altogether, 6.63 million shares of 181 companies worth Rs 2.24 billion were traded through 22,882 transactions during the week. The traded amount was 31.27 per cent higher than the total weekly turnover of the previous week.

Rastriya Beema Company secured the top position in terms of total turnover with Rs 113.27 million. It was followed by Nepal Bangladesh Bank with Rs 83.32 million, Nepal Doorshanchar Company with Rs 78.8 million, Nepal Life Insurance Company with Rs 69.5 million and Standard Chartered Bank with Rs 63.4 million.

Jyoti Bikash Bank topped the list in terms of trading volume, with 358,000 of its shares changing hands and Nepal Grameen Bikas Bank was the forerunner in terms of number of transactions — 2,426.

NEW LISTINGS

Company

Type

Unit

Gurkha Finance

Rights

2,893,313

Gurans Life Insurance Company

Bonus

440,000

Machhapuchhre Bank

Rights

7,757,697.36

Nepal Grameen Bikas Bank

Ordinary

975,000