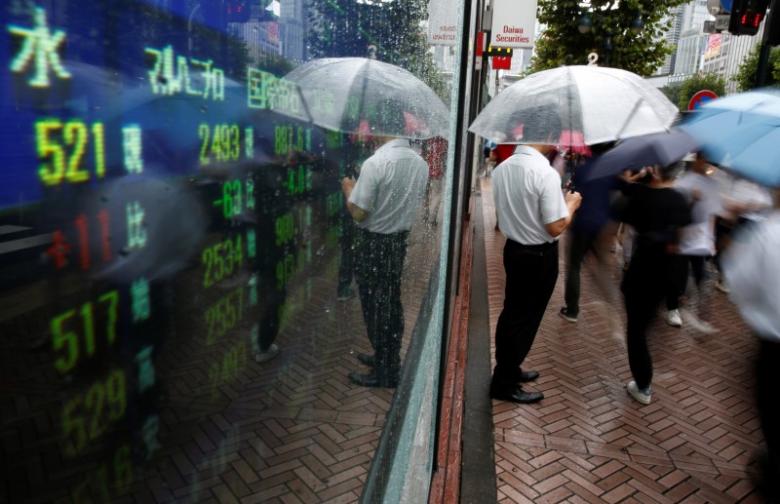

Asia stocks weak, dollar shines as rate view unchanged; China eyed

HONG KONG: Asian stocks held near three-week lows and the greenback consolidated recent gains on Thursday after minutes of the last US Federal Reserve policy meeting indicated a December rate increase was still on the cards.

Risk appetite waned, with MSCI's broadest index of Asia-Pacific shares outside Japan easing 0.2 percent, its lowest since Sept. 21. Early stock markets were mixed with Australia down 0.5 percent while New Zealand stocks up 0.4 percent.

"In our view, if you came into these minutes with a December hike penciled in, there is no reason to change your stance," Omair Sharif, an economist at Societe Generale, wrote in a note.

Wall Street struggled to find fresh momentum after breaking conclusively below a 100-day moving average this week.

The Dow Jones industrial average closed up 0.09 percent, to 18,144.2. The S&P 500 gained 0.11 percent, to 2,139.17 and the Nasdaq Composite .IXIC slipped 0.15 percent, to 5,239.02 with corporate earnings firmly in focus. Volumes were light. [.N]

Chinese stocks and the Australian dollar will be firmly in focus with trade data due shortly. Economists will be watching the trade breakdowns carefully to see whether the yuan's recent weakness has had a beneficial impact.

The CBOE Volatility Index, the "fear gauge" of near-term investor anxiety held below 16, indicating broader market uncertainty.

Elsewhere, sterling treaded water after British Prime Minister Theresa May's offer to give UK lawmakers a say in plans to leave the European Union and the US dollar basked in the glow of a likely widening interest rate differential in its favor relative to other currencies.

Within Asia, the Thai baht will be in focus after falling to a eight-month low in the previous session on concerns about the health of 88-year-old King Bhumibol Adulyadej.

Oil prices struggled after falling 1 percent overnight after the Organization of Petroleum Exporting Countries reported its output hit an eight-year high in September, offsetting optimism over the group's pledge to restrict output.

US West Texas Intermediate crude slipped 0.62 percent to trade at $49.87 a barrel. Gold stabilized around the $1,250 per ounce level after falling sharply last week.