Commercial banks’ profit surges by 16.24pc

Profit of commercial banks went up by a whopping 16.24 per cent in the third quarter of this fiscal year despite the unfavourable economic situation.

As per the unaudited financial reports published by the 29 commercial banks in operation, they made profits worth Rs 23.78 billion in between mid-July to mid-April as against Rs 20.46 billion in the corresponding period of the previous fiscal.

Profit growth of the commercial banks has not retarded despite the slow economic growth in the review period as the central bank introduced relief packages to cover the impact of the devastating earthquakes of April and May and supply disruptions along border points on the banking sector.

In the view of the earthquakes and border blockade, Nepal Rastra Bank (NRB), the central bank, allowed borrowers whose cash flow had shrunk due to the earthquakes and border blockade, to defer loan repayment period and restructure debt, without provisioning extra funds.

NRB had relaxed provisions for affected borrowers under ‘watch list’ category while making loan-loss provisioning. Unlike the requirement to increase the provisioning by 0.5 percentage point every quarter for loans under the ‘watch list’ category, banks and financial institutions (BFIs) were allowed to set aside only two per cent of the loan-loss provisioning until the third quarter of this fiscal.

The central bank also extended the recovery period to mid-April for the loan issued for importers from 120 days to 180 days following the border blockade. All the aforementioned provisions helped the banks make profit.

“The relief packages introduced by NRB for the borrowers and relaxation for BFIs regarding loan-loss provisioning supported commercial banks to make sound profit despite the unfavourable situation in this fiscal,” Sanima Bank CEO Bhuvan Kumar Dahal said.

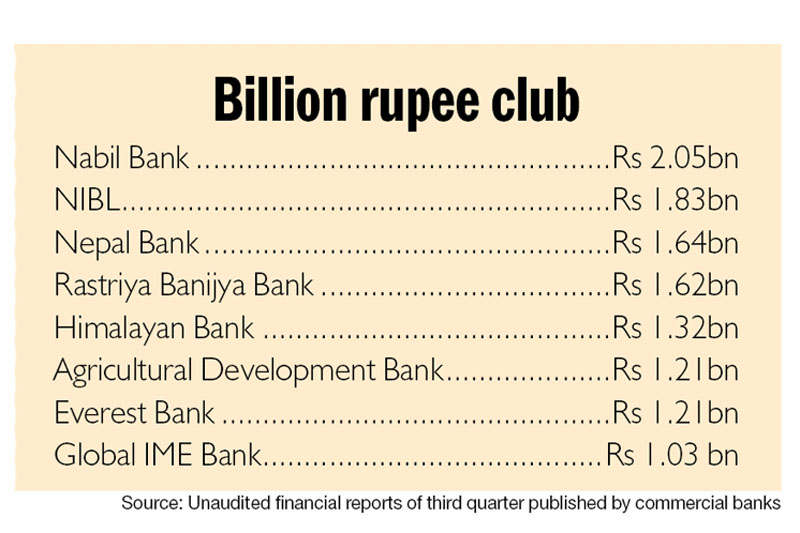

Eight out of 29 commercial banks in operation made profit of more than Rs one billion. The biggest profit generator in the third quarter was Nabil Bank. The bank’s net profit went up by a whopping 26.71 per cent to Rs 2.05 billion. Second in the league table of biggest earners was Nepal Investment Bank, which booked a net profit of Rs 1.83 billion, up 19.88 per cent than in the same period last fiscal year. Next in line was Nepal Bank, whose net profit surged by a startling 355.49 per cent to Rs 1.64 billion.

Of the profit generated by these class ‘A’ financial institutions, two banks, however, saw their profit growth rate shrink in the third quarter. These institutions include Rastriya Banijya Bank (RBB) and Standard Chartered Bank. RBB’s profit declined by over 60 per cent as compared to the same period of the previous fiscal to Rs 1.62 billion and Standard Chartered Bank’s by five per cent to Rs 906.78 million.