Confusion related to CGT hits Nepse

Kathmandu, August 10

The confusion related to implementation of the earlier agreement reached between concerned stakeholders on capital gains tax (CGT) in share transactions took a toll on investor sentiment in the trading week between August 4 and 8, causing the country’s sole secondary market to drop by two per cent.

Following months-long dispute related to calculation of CGT in share transactions, the concerned stakeholders had finally reached an agreement last week. Back then it was decided that CDS and Clearing Ltd would determine the average price of shares from fiscal 2001-02 to fiscal 2018-19 and that amount would be used as the base price for CGT calculation.

“However, now government officials are saying that the provisions in the agreement clash with some of the existing rules,” informed Uttam Aryal, chairman of Investors Association of Nepal, adding the government was flip-flopping on the earlier consensus and creating confusion in the market.

“We will launch protest programmes if the earlier agreement is not implemented,” he warned.

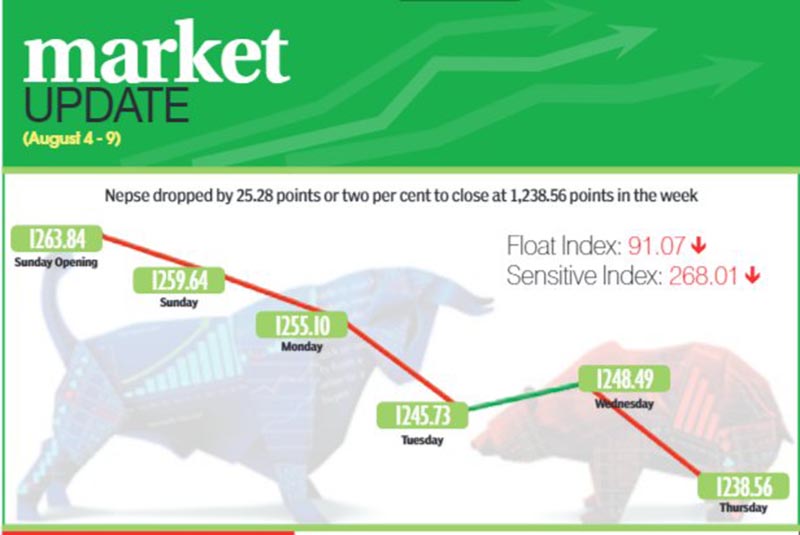

The Nepal Stock Exchange (Nepse) index slumped by two per cent or 25.28 points in the review week. Sensitive index also went down by 1.65 per cent or 4.52 points to 268.01 points and float index fell by 2.05 per cent or 1.91 points to 91.07 points.

The trading volume also fell from 7.48 million shares traded in previous week to 7.43 million stocks changing hands this week. On a positive note, though, the weekly turnover increased by 5.04 per cent to Rs 2.19 billion against Rs 2.08 billion in the preceding week.

However, trading of mutual funds plummeted by 54.13 per cent to Rs 7.34 million in the review period compared to Rs 16 million in the past week.

The secondary market had opened with the benchmark index at 1,263.84 points on Sunday. After falling by 4.20 points by the end of the first trading day, Nepse index dropped by 4.55 points on Monday and another 9.36 points on Tuesday. While the market went up by a marginal 2.75 points on Wednesday, the local bourse again went down by 9.72 points on Thursday to close the week at 1,238.56 points.

Trading was the only subgroup to land in the green zone, with the sub-index up 1.27 per cent or 3.23 points to 257.85 points.

Hydropower subgroup was the biggest loser in the review week, slumping by 6.02 per cent or 71.23 points to 1,111.55 points because of share price of Chilime Hydropower down Rs 24 to Rs 490. Microfinance sub-index went down by 2.90 per cent or 45.66 points to 1,523.99 points.

The manufacturing subgroup fell by 2.89 per cent or 76.81 points to 2,576.08 points, with the share price of Shivam Cements falling by Rs 18 to Rs 580.

Likewise, non-life insurance sub-index went down by 2.27 per cent or 115.44 points to 4,958.10 points and hotels subgroup also dropped by 1.73 per cent or 35.86 points to 2,030.80 points.

The finance subgroup descended by 1.61 per cent or 10.19 points to 620.77 points. Banking sub-index fell by 1.60 per cent or 18.26 points to 1,118.04 points and mutual funds went down by 1.38 per cent or 0.14 point to 9.94 points.

The development banks subgroup lost 1.35 per cent or 21.83 points to 1,595.08 points. The others subindex was down 1.25 per cent or 9.02 points to 709.37 points and life insurance subgroup shed 0.87 per cent or 51.54 points to 5,842.78 points.

In the review week, Agricultural Development Bank was the leader in terms of weekly turnover with Rs 174.06 million. It was followed by Nepal Bank with Rs 163.01 million, Rasuwagadhi Hydropower with Rs 99.79 million, NCC Bank with Rs 79.12 million and Prabhu Bank with Rs 68.74 million.

Nepal Bank was the forerunner in terms of weekly trading volume, with 493,000 of its shares changing hands. It was followed by Rasuwagadhi Hydropower with 457,000 shares, Agricultural Development Bank with 400,000 shares, NCC Bank with 325,000 shares and NMB Sulav Investment Fund-1 with 292,000 shares.

Meanwhile, Sanjen Jalavidhyut Company recorded the most number of transactions — 12,780. Rasuwagadhi Hydropower with 12,750, Infinity Laghubitta Bittiya Sanstha with 1,547, Upper Tamakoshi Hydropower with 1,140 and Nepal Bank with 1,094 transactions rounded up the top-five in this category.