Demand for FESBs subdued

The government was able to sell only a third of foreign employment saving bonds (FESBs) up for grabs, indicating subdued demand for these securities.

Nepal Rastra Bank (NRB), on behalf of the government, floated FESBs worth Rs 250 million on June 21. The securities, with a maturity period of five years, were floated exclusively for overseas migrant workers, non-resident Nepalis or those who returned home from foreign employment destinations less than four months ago.

But by the time their sales were closed on July 4, securities worth only Rs 83.71 million were subscribed. In other words, the securities were undersubscribed by Rs 166.29 million. These securities were formally issued to subscribers today.

“One of the reasons for low demand for these securities is mismatch in yield offered by the bonds and the currency depreciation rate,” said Nara Bahadur Thapa, executive director of Public Debt Management Department at NRB.

The bonds offered annual yield of nine per cent. But the value of Nepali rupee vis-a-vis US dollar depreciated by about six per cent in one-year period to July 9. So, there is not much gain in holding these securities.

“Also, capital gains are higher in investment tools like stocks than in bonds. So, there is more interest in capital appreciation instruments than fixed-income instruments,” said Thapa.

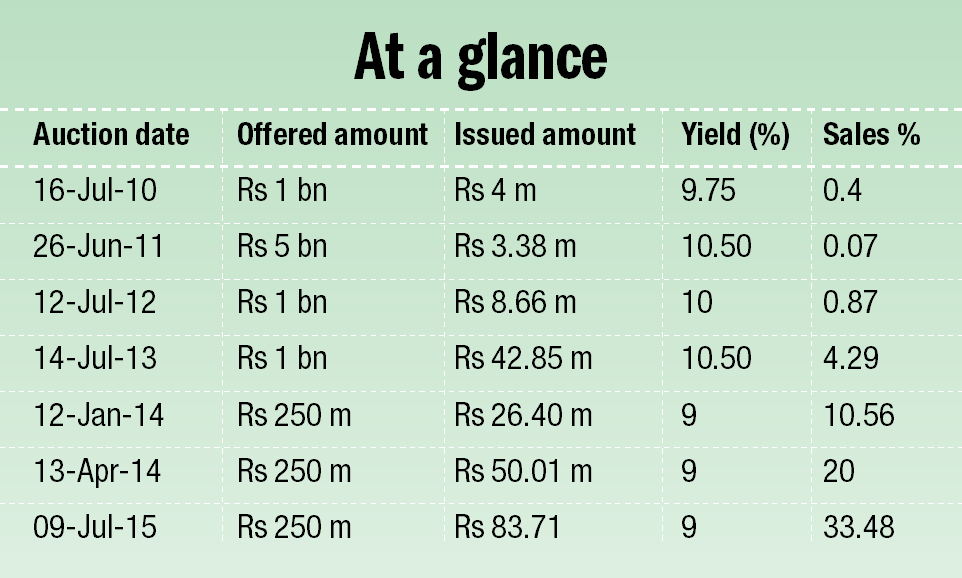

Although sales of these FESBs remained low this fiscal, this result was the best since the introduction of these securities in July 2010.

When these bonds were introduced for the first time, the government was able to sell only 0.40 per cent of the securities up for grabs. The sales further fell the next year, when only 0.07 per cent of the securities offered by the government were subscribed.

Since then, demand for these bonds has gradually picked up, with the government being able to sell 20 per cent of the securities in April 2014. This year, 33.48 per cent of the securities up for grabs were sold.

Foreign employment saving bonds can be used as collateral to obtain loans. They can be bought in the form of promissory notes or stocks.

Bonds bought in the form of promissory notes can be traded by owners any time based on mutual understanding.

But bonds purchased in the form of stocks can only be traded in the presence of NRB officials because it is aimed at those who cannot read or write.