Foreign employment bonds undersubscribed

Kathmandu, July 8

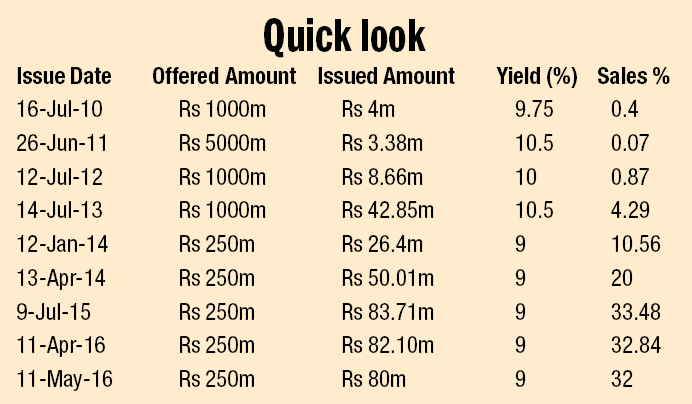

Foreign employment savings bonds floated by Nepal Rastra Bank (NRB) are most likely to remain undersubscribed this time as well, as the government has failed to draw the interest of Nepalis working or residing abroad towards this debt instrument.

NRB, the central bank, floated five-year foreign employment bonds worth Rs 337.9 million on June 5. The sales of these debt instruments, which provide a yield of nine per cent per annum, were open till today.

But as of yesterday, agents reported sales of bonds worth Rs 92.1 million, Min Bahadur Shrestha, head of the Public Debt Management Department at NRB, told The Himalayan Times. “This means a big portion of securities floated this time will remain unsubscribed,” he added.

NRB, on behalf of the government, had floated Rs 500 million worth of foreign employment savings bonds in this fiscal year. These bonds were floated in two tranches of Rs 250 million each.

NRB drew investment worth Rs 82.1 million when the first tranche of bonds worth Rs 250 million were offered. During the second time, bonds worth Rs 80 million were sold.

NRB then bundled bonds that remained unsubscribed during the first two offerings and floated them on June 5.

“We did this because lots of people working or living abroad complained they were not informed about the previous offerings,” said Shrestha. “Yet, not all the bonds we floated could have been sold albeit response this time was better than in the previous times.”

NRB has been floating foreign employment savings bonds since July 2010. The bonds are exclusively sold to overseas migrant workers, non-resident Nepalis or those, who returned home from foreign employment destinations less than four months ago.

One of the purposes of issuing these bonds is to inculcate savings culture among Nepalis working abroad and pool their resources for the country’s development.

In return for buying these bonds, the government guarantees a fixed return which can be collected every six months till the time of the maturity of the securities. Also, these securities carry zero risk because they are issued by the state and they can be used as collateral to obtain loans.

Despite this, these bonds have never been fully subscribed since their launch almost six years ago.

“This shows that we have not been able to generate adequate awareness about these instruments among Nepalis working and living abroad,” said Shrestha.

Currently, NRB has appointed agents in eight different foreign employment destinations, ranging from Malaysia and Gulf countries to Australia, to promote sales of these bonds.

But one of the queries these agents face is whether any mechanism has been created to absorb the loss generated by continuous weakening of Nepali rupee, according to Shrestha.

Those working abroad exchange currency of the country where they are employed into Nepali rupees to buy these bonds. Since Nepali rupee has been depreciating by 3.35 per cent per year for the last one decade, those who invest in these bonds incur certain losses.

“Also, the diaspora community is seeking round-the-year supply of these instruments because many Nepalis, especially those working in the Gulf countries and Malaysia who do not earn much, may not have cash in hand when we float these instruments,” said Shrestha, adding, “We are thinking of selling these bonds throughout the year.”