India’s demonetisation could impact Nepal

The impact of the shock move by the Indian government to cease the legal tender of high value banknotes on November 8 could weigh on Nepal’s economy as well, a latest World Bank report says.

Stating that the ‘demonetisation’ could continue to disrupt business and household economic activities in India, weighing on growth, the World Bank Group’s flagship report titled ‘Global Economic Prospects - Weak Investment in Uncertain Times’ says, “Spillovers from India to Nepal and Bhutan, through trade and remittances channels, could also negatively impact growth in these neighbouring smaller economies.”

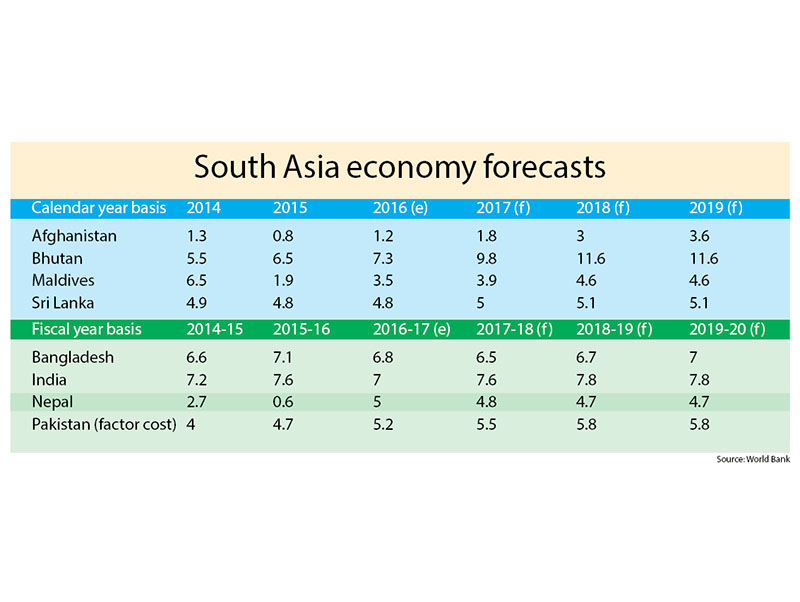

Despite the delays in post-earthquake reconstruction and disruptions in cross-border trade with India adversely affecting growth in Nepal, the country’s economy is set to rebound to an estimated five per cent growth in fiscal year 2016-17 (ending on July 15, 2017), up from 0.6 per cent posted in fiscal 2015-16, according to the World Bank.

This puts the country in the fifth position among the South Asian economies — a significant improvement from fiscal year 2015-16, when it had ranked at the bottom rung.

This is on the back of acceleration in post-earthquake reconstruction, together with favourable monsoon rains, which is expected to support economic activity. Lifting of the southern border blockade with India around the first week of February has normalised trade and eased supply-side bottlenecks.

However, a slowdown in growth of remittance inflows — which account for a third of the country’s gross domestic product — from the oil-rich Gulf Cooperation Council economies has weighed on consumption and investment.

The increased imports for post-earthquake reconstruction amid receding remittances in Nepal has, nonetheless, worsened the country’s current account balance.

Hence, Nepal’s growth is expected to ease to 4.8 per cent in fiscal 2017-18 ‘in line with the country’s potential’, the report says. While inflation is projected to subside to an average pace of eight per cent in the medium-term, continuing reconstruction-related imports, and slowdown in remittances, are expected to turn current account surpluses into deficits in the forecast period.

While over-dependence on remittance has been flagged as a major risk for the country, the World Bank report has also cited political unrest as a possible threat in retarding economic growth. Moreover, since Nepal’s currency is pegged to the Indian rupee, the country’s exports could suffer from a loss of competitiveness should India’s currency appreciate against major currencies, as per the report.

Also, preliminary data suggests continued investment weakness in 2016, according to the World Bank. Across the region, investment growth slowed sharply from 11 per cent in 2011 to three per cent in 2014, with only a modest rebound to six per cent in 2015. “The downward trend reflects a slackening in India, (which accounts for more than three-quarters of the region’s total investment), offsetting a pickup in Bhutan, Nepal, and Pakistan.”

In terms of the region, economic activity in South Asia expanded by an estimated 6.8 per cent in 2016, buoyed by robust domestic demand. India continued to post strong growth, reflecting ongoing tailwinds from low oil prices and support from structural reforms. Excluding India, regional growth is estimated at 5.3 per cent in 2016, according to the World Bank. “However, there were notable differences within the region depending on security issues, domestic policies, and reliance on remittance flows.”

Looking ahead, growth in the region is projected to edge up to an average of 7.3 per cent in 2017 to 2019, supported by dividends from ongoing policy reforms and strong domestic demand. Sluggish recovery in key export markets, weak private investment, and security challenges pose headwinds to the outlook. Risks are tilted to the downside, including reform setbacks, heightened domestic insecurity and political tensions, and unexpected tightening of financing conditions.

Structural reforms, aided by supportive macroeconomic policies, could help mitigate some of the risks, and bolster the region’s long-term growth prospects, according to the World Bank.

Meanwhile, it pared back its global growth estimate for this year a tenth from the June forecast to 2.7 per cent compared to 2.3 per cent growth seen last year.

But, uncertainty about economic policies of US President-elect Donald Trump is clouding the outlook. “We need to pay attention. All eyes are on US policymakers and how they will formulate their policies,” Ayhan Kose, main author of World Bank’s global forecast, was quoted by AFP as saying. “What happens in the United States does not stay in the United States.”