Passengers killed in road accidents likely to get Rs 500k compensation

Kathmandu, June 24

If things go according to plan, every passenger who dies in road accidents will soon start getting compensation of Rs 500,000, as the Insurance Board (IB), the insurance sector regulator, has started laying the groundwork to raise the insurance coverage amount.

Currently, passengers who get killed while travelling in four-wheelers, like cars and buses, are entitled to compensation of Rs 100,000 each. This coverage amount is strictly for passengers and does not provide cover to drivers and helpers. However, in the case of two-wheelers, family members of pillion rider as well as the driver can claim for compensation of Rs 100,000 each in case of death.

“We are now making necessary arrangements to raise the coverage amount because the existing compensation is very low, while deaths caused by road accidents are going up,” IB Director Shreeman Karki told The Himalayan Times.

After raising the coverage amount by five fold, the IB — which has made passenger liability coverage mandatory for vehicle owners — hopes to see fall in cases of fraud in passenger insurance business.

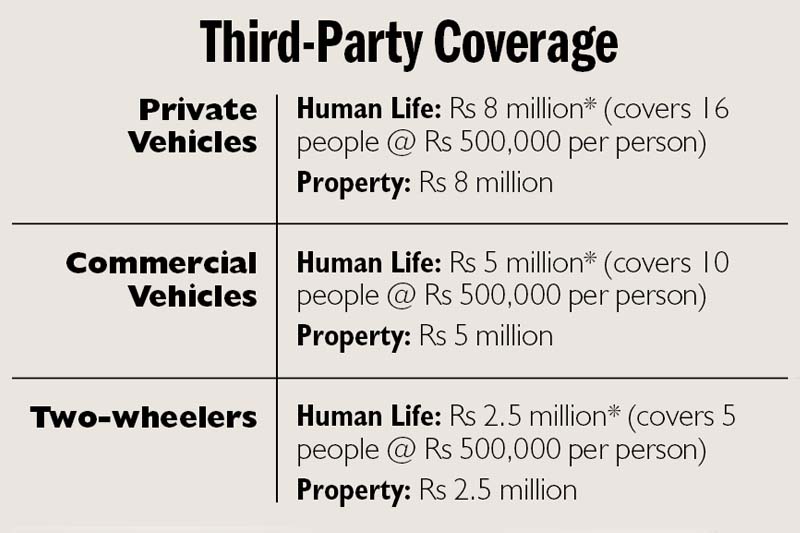

Currently, many family members of passengers who die in road accidents cite the deceased was not inside the vehicle when the mishap took place while filing the insurance claim. They do this because insurance coverage for deaths related to third-party, or people who were outside the vehicle that killed them, stands at Rs 500,000 per person.

In other words, family members of people, who were, say, walking on the street when a vehicle hit and killed them, get compensation of Rs 500,000 per person, whereas those who die while travelling inside the vehicle get a compensation of only Rs 100,000 per person.

“What we are now trying to do is bring third-party liability coverage and passenger liability coverage to the same level. Once we do this, insurance companies engaged in passengers’ insurance business will not have to deal with fake claims,” Karki said.

The IB had made an attempt to put passenger liability coverage on a par with third-party liability coverage around four years ago. But it could not do so because of severe opposition from public transport entrepreneurs associations. They were against this move because hike in passenger liability coverage would have also raised insurance premium fee, which would have added financial burden on them.

Currently, public transport operators are paying a premium of Rs 150 per year to get a cover of Rs 100,000 for each passenger.

“Premium fee will definitely go up once we raise the passenger liability coverage to Rs 500,000. But we have not fixed the premium yet and are still working on it,” Kakri said, adding, “We will try to come up with a fee that neither hurts transport operators nor insurance companies.”

Once the premium is raised, the IB is planning to increase medical coverage for automobile passengers, who get injured in road accidents, to Rs 300,000 per person from existing Rs 100,000.

However, the IB is yet to determine the medical coverage for drivers and pillion riders of two-wheelers. Currently, medical coverage for drivers and pillion riders of two-wheelers has been fixed at Rs 5,000 each.