Investor optimism spurs Nepse to double-digit rise

Kathmandu, December 14

The country’s sole secondary market recorded a double digit growth in the trading week between December 8 and 12, propelled by rising investor confidence as the listed companies have announced impressive dividends through their annual general meetings.

Nepal Stock Exchange (Nepse) index, which began climbing from December 3, remained northbound throughout the review week. With the liquidity situation easing, the number of share investors entering the market has also gone up, as evidenced by both gone up, as evidenced by b the trading volume and transaction amount clocking impressive improvement.

During the review week, 8.25 million shares of 190 companies that amounted to Rs 2.56 billion were traded through 36,445 transactions. The traded amount was a staggering 86.94 per cent higher than preceding week when 4.60 million shares of 187 firms worth Rs 1.37 billion had been undertaken through 23,209 transactions.

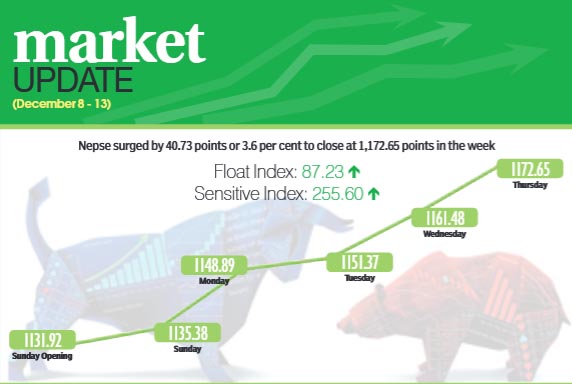

The sensitive index, which measures the performance of class ‘A’ stocks, gained 2.74 per cent or 6.83 points to 255.60 points. Similarly, the float index that gauges the performance of shares actually traded also rose by 3.51 per cent or 2.96 points to 87.23 points.

The benchmark index had opened at 1,131.92 points on Sunday and inched up by 3.46 points by the day’s closing. It gained 13.51 points on Monday and added another 2.48 points on Tuesday to breach the psychological level of 1,500 points. The local bourse advanced by 10.11 points on Wednesday and jumped 11.17 points on Thursday to close at 1,172.65 points for the week.

Nepse index recorded a week-on-week gain of 3.6 per cent or 40.73 points compared to the previous week’s closing of 1,131.92 points.

Apart from manufacturing, all the subgroups landed in the green during the review week.

Investors mostly scooped up shares of insurance companies during the week, causing the sub-index of non-life insurance firms to surge by a whopping 13.63 per cent or 564.26 points to 4,704.76 points and life insurance subgroup to ascend by 7.74 per cent or 416.45 points to 5,794.55 points.

Trading subgroup also witnessed immense buying pressure that resulted in the sub-index soaring by 13.26 per cent or 59.92 points to 511.87 points. Salt Trading Company’s share price surged by 17.97 per cent to Rs 1,490.

Microfinance rose by 7.65 per cent or 118.26 points to 1,663.45 points on the back of share value of Deprosc soaring by 22.28 per cent to Rs 900 and that of Chhimek going up by 3.85 per cent to Rs 810, among others.

Hydropower subgroup went up by 4.59 per cent or 42.82 points to 976.23 points as Upper Tamakoshi ascended by 3.81 per cent to Rs 245 and Chilime rose by 1.11 per cent to Rs 363.

Even as Soaltee’s share value slumped by 7.73 per cent to Rs 191 and Taragaon Regency’s share price dropped by 1.08 per cent to Rs 275, Oriental’s gain of 0.23 per cent to Rs 430 propelled the hotels sub-index by 3.91 per cent or 69.26 points to 1,839.30 points.

Close on its heels, development banks advanced by 3.6 per cent or 55.18 points to 1,589.02 points.

While finance subgroup rose by 2.38 per cent or 13.32 points to 572.28 points, banking — the subgroup with the most weightage in the benchmark index — jumped by 2.2 per cent or 22.57 points to 1,048.98 points.

Commercial banks like Nepal Investment gained 4.13 per cent to Rs 429 and Everest climbed by 3.11 per cent to Rs 563.

Others landed at 660.03 points, up 10.70 points or 1.65 per cent, whereas mutual funds inched up by 1.19 per cent or 0.11 point to 9.34 points.

Conversely, Unilever Nepal’s share price plunging by 7.74 per cent to Rs 17,542 weighed heavily on manufacturing subgroup, as the sub-index fell by 2.8 per cent or 62.36 points to 2,166.09

points. Bottlers Nepal (Tarai)’s share price going up by 0.15 per cent to Rs 6,085 and Himalayan Distillery’s by 0.48 per cent to Rs 1,241 limited the loss.

Meanwhile, NMB Bank topped the charts in terms of number of transactions and weekly turnover, recording a total of 1,330 transactions that totalled Rs 139.35 million.

Deprosc Laghubitta Bittiya Sanstha with Rs 99.54 million, Nepal Bank with Rs 92.24 million, Machhapuchchhre Bank with Rs 88.63 million and Swabalamban Laghubitta Bittiya Sanstha (Promoter Share) with Rs 82.85 million rounded up the top five companies with highest turnover in the week.

In terms of transactions, other top companies included Sanjen Jalavidhyut Co (1,019), Rasuwagadhi Hydropower Co (941), Deprosc Laghubitta Bittiya Sanstha (908) and Nepal Life Insurance Co (870).

Meanwhile, Machhapuchchhre Bank was the forerunner in terms of trading volume with 407,000 of its shares changing hands. It was followed by NMB Bank with 355,000, Nepal Bank with 293,000, Lumbini Bikas Bank with 290,000 and Prabhu Bank with 245,000 shares.