Investors flock to share market

KATHMANDU, SEPTEMBER 5

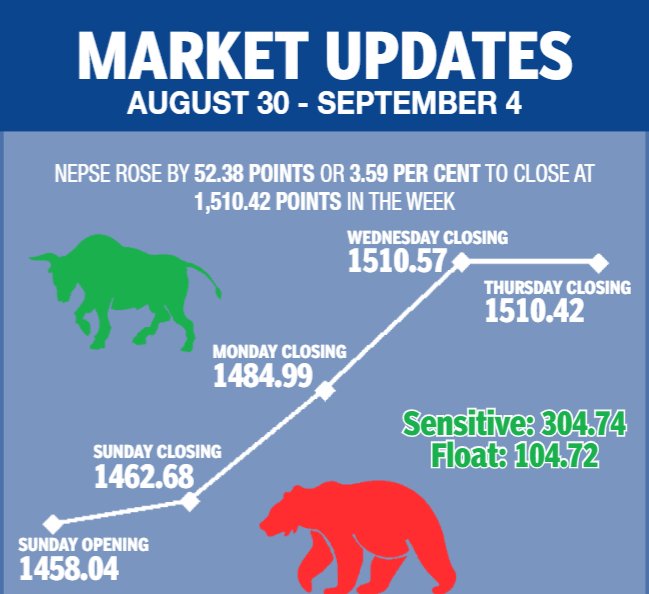

Encouraged by the recent rally in the share market, investors flocked to the Nepal Stock Exchange (Nepse), resulting in the benchmark index surging by 3.59 per cent or 52.38 points weekon-week in the trading period between August 30 and September 3.

“The unfavourable business climate due to the rapid spread of coronavirus infection in the country and the encouraging share market movement has attracted investors to the local bourse of late,” said a share market analyst, explaining the recent upsurge.

Consequently, the country’s sole secondary market witnessed an improvement in all three markers — turnover, trading volume and transactions.

The weekly turnover surged by 22.2 per cent to Rs 11.90 billion in the review week against the previous week’s total traded amount of Rs 9.74 billion. This is despite the fact that the market was open for only four days in the review week against the normal five days in the previous week. For a clearer picture, the average daily turnover in the review week soared by 52.75 per cent to Rs 2.97 billion compared to Rs 1.95 billion in the previous week.

The number of transactions also rose to 159,104 from 131,251 in the previous week and trading volume increased to 30.46 million shares changing hands against trade of 22.21 million shares in the preceding week.

The benchmark index had opened at 1,458.04 points on Sunday and rose by 4.64 points by the end of the day. Nepse index jumped by 22.31 points on Monday.

The share market remained closed on Tuesday due to Indrajatra festival. On Wednesday, the local bourse advanced by 25.58 points to breach the threshold of 1,500 points after six months. On Thursday, Nepse shed 0.15 point to close the week at 1,510.42 points.

The sensitive index, which measures the performance of class ‘A’ stocks, gained 2.57 per cent or 7.64 points to 304.74 points, and float index that gauges the performance of shares actually traded also went up by 2.80 per cent or 2.85 points to 104.72 points.

While the trading subgroup had landed in the red in the previous week, all the subgroups clocked gains this time around.

Adding to the previous week’s gain of 6.26 per cent or 51.89 points, others sub-index soared by 12.91 per cent or 113.61 points to 993.87 points on the back of share value of Nepal Reinsurance Co Ltd surging by 25.39 per cent to Rs 889 and that of Nepal Telecom up 8.73 per cent to Rs 722.

After inching up 1.99 per cent or 18.96 points in the preceding week, the hydropower subgroup jumped by 11.57 per cent or 112.24 points to 1,082.22 points this week.

Trading more than recovered last week’s dip of 0.84 per cent or 7.32 points by advancing 4.92 per cent or 42.25 points to 901.79 points.

Manufacturing, the subgroup to lead the pack of gainers in the past week with a surge of 7.21 per cent or 194.40 points, ascended by 3.83 per cent or 110.75 points to 3,001.66 points this week.

Non-life Insurance climbed 3.74 per cent or 269.46 points to 7,470.29 points, life insurance rose by 2.59 per cent or 233.29 points to 9,235.03 points and hotels went up 2.16 per cent or 32.61 points to 1,544.36 points.

The gain of the rest of the subgroups was less than two per cent.

Mutual funds was up 1.69 per cent or 0.18 point to 10.84 points; finance closed at 675.02 points, up 1.59 per cent or 10.55 points; with an increase of 1.44 per cent or 35.69 points, microfinance closed at 2,508.31 points; development banks went up by 1.30 per cent or 22.79 points to 1,781.45 points; and banking rose by 1.17 per cent or 14.33 points to 1,234.80 points.

Nepal Reinsurance Company Ltd topped the charts in terms of trading volume and weekly turnover, with 2.24 million of its shares exchanged that amounted to Rs 1.72 billion.

Neco Insurance with Rs 504.54 million, Nepal Life Insurance Co Ltd with Rs 455.70 million, Shivam Cements Ltd with Rs 399.67 million and Shikhar Insurance Co Ltd with Rs 383.74 million rounded up the top five companies to record highest weekly turnover in the review period.

Meanwhile, in terms of other top companies with high number of trading volume, Arun Kabeli Power Ltd’s 1.26 million shares changed hands, followed by Nepal Bank with 856,000 shares, Neco Insurance Co Ltd with 641,000 shares and Global IME Bank with 595,000 shares.

NRN Infrastructure and Development Ltd was the forerunner in the category of most number of transactions — 28,157. Nepal Reinsurance Company Ltd was second with 16,656 transactions, Ajod Insurance Ltd was third with 4,484 transactions, Neco Insurance Co Ltd was fourth with 3,061 transactions and Shivam Cements Ltd was fifth with 2,790 transactions.

A version of this article appears in e-paper on September 6, 2020, of The Himalayan Times.