Investors lose hope in stock market

Kathmandu, September 14

As the government has not responded to the demands set forth by the investors the secondary market has been in a continuous downward trend for the eighth straight week, losing 33.19 points in the review week between September 8 and 12.

Secondary market investors have said that the long running dispute with the government on various issues has resulted in a panic situation in the market.

Radha Pokharel, chairperson of Nepal Punjibazaar Laganikarta Sangh, said that investor sentiment is totally down as the government has not been able to come up with viable solutions for various issues, including capital gains tax calculation method in share transactions.

“Investors are losing hope with the government and most are preparing to exit the market as soon as possible as they see no conducive investment climate in the near future,” she said.

“We have talked with officials from the finance ministry and other line agencies for possible solutions, however they have not done anything concrete till date. Their assurances have remained in talks only,” Pokharel added.

Meanwhile, she mentioned that since the festive season is fast approaching investors are unloading their stocks whether at a profit or loss and this has resulted in selling pressure in the local bourse.

Pokharel opined that the government should allow Citizen Investment Trust and Employees Provident Fund to invest in secondary market. “Once CIT and EPF enter the market, the liquidity problem and other types of problems will gradually be resolved,” she added.

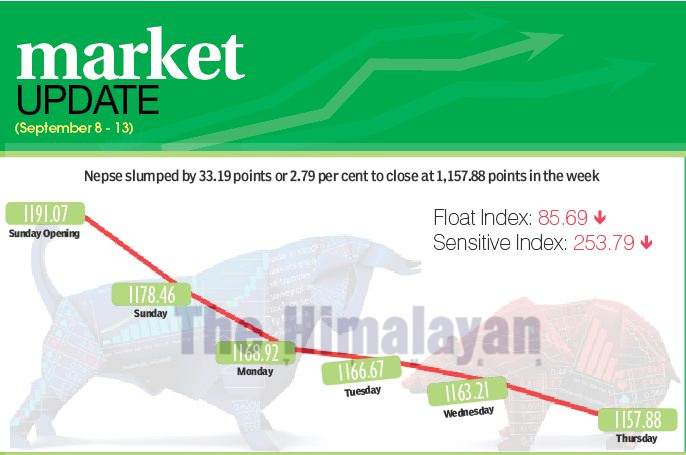

The Nepal Stock Exchange (Nepse) index was southbound throughout the review week, falling by 2.79 per cent or 33.19 points to 1,157.88 points. Sensitive index also went down by 2.35 per cent or 6.11 points to 253.79 points and float index dipped by 2.55 per cent or 2.24 points to 85.69 points.

The weekly turnover fell by 7.37 per cent as compared to the previous week to Rs 1.80 billion. In the previous week, the market had witnessed transactions worth Rs 1.94 billion. However, the trading volume increased to 7.65 million shares changing hands this week from 7.04 million in previous week.

The secondary market had opened on Sunday at 1,191.07 points and dropped by 12.61 points by the end of the trading day. The market again fell by 9.54 points on Monday and 2.25 points on Tuesday. The market was again down by 3.46 points on Wednesday and dropped further by 5.33 points on Thursday to close the week at 1,157.88 points.

In the review week, all the sub-indices landed in the red zone.

Non-life insurance was the biggest loser of the week, sliding by 4.93 per cent or 228.84 points to 4,407.31 points. The share price of IME General Insurance dipped by Rs 18 to Rs 320 and that of Everest Insurance also dropped by Rs 20 to Rs 280.

Similarly, life insurance sub-index plummeted by 4.48 per cent or 241.59 points to land at 5,146.85 points, due to share price of Nepal Life Insurance Co going down by Rs 28 to Rs 780. Likewise, share price of Asian Life Insurance Co fell by Rs 11 to Rs 318.

Moreover, hotels subgroup descended by 4.30 per cent or 84.30 points to 1,874.59 points due to share price of Soaltee Hotel dipping by five rupees to Rs 217 and of Oriental Hotels also going down by Rs 53 to Rs 513.

Similarly, hydropower subgroup fell by 4.15 per cent or 41.34 points to 955.53 points, with share price of Chilime Hydropower Company declining by eight rupees to Rs 438 and Upper Tamakoshi Hydropower also dropping by eight rupees to Rs 237.

The others subgroup, meanwhile, lost 3.87 per cent or 25.76 points to rest at 645.72 points, which was due to share price of Nepal Telecom descending by Rs 25 to Rs 626 and that of Hydroelectricity Investment and Development Company going down by five rupees to Rs 134.

Likewise, microfinance subgroup dipped by 2.94 per cent or 37.62 points to 1,467.98 points, due to share price of Chhimek Laghubitta Bikas Bank edging down by two rupees to Rs 976 and Asha Laghubitta Bittiya Sanstha falling by

Rs 17 to Rs 431.

Moreover, banking subgroup dropped by 2.20 per cent or 24.06 points to 1,066.19 points as share price of Everest Bank slid by Rs 42 to Rs 580 and of Nabil Bank fell by Rs 10 to Rs 770.

The manufacturing sub-index also went down by 2.04 per cent or 50.72 points to 2,425.31 points due to share price of Himalayan Distillery dropping by Rs 50 to Rs 1450. Moreover, trading subgroup dipped by 1.85 per cent or 5.24 points to rest at 276.90 points and

mutual funds went down by 1.84 per cent or 0.18 point to 9.55 points.

Similarly, development banks sub-index fell by 1.52 per cent or 24.27 points to 1,564.81 points and finance subgroup went down by 1.24 per cent or 7.20 points to rest at 569.98 points.