Local bourse witnesses gain on positive cues

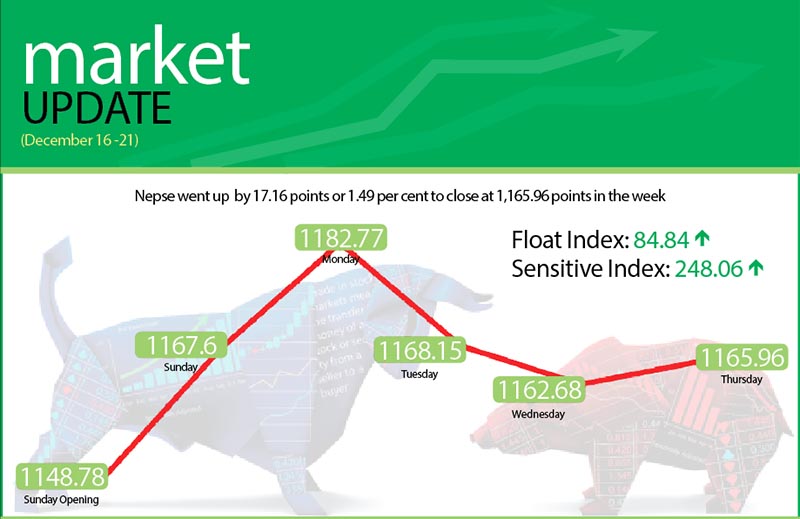

As the government has assured share investors that it would seriously look into the issues raised by them the domestic secondary market witnessed gains in the trading week between December 16 and 20. The Nepal Stock Exchange (Nepse) index went up by 1.49 per cent or 17.16 points.

Earlier on December 11, the government had formed a team of experts led by Shiva Raj Shrestha, deputy governor of Nepal Rastra Bank, after the stock market continued to remain in the red zone while lending rates shot up, eroding investor confidence. The team had submitted its 58-point recommendation to Finance Minister Yubaraj Khatiwada on December 19.

“We believe that the government will implement the suggestions of the expert team and the secondary market will again get a boost,” said Ambika Prasad Poudel, chairman of Nepal Investors’ Forum.

The study team was tasked to study various aspects challenging financial stability, including volatility in the bank interest rates and fluctuations in the capital market.

The team has recommended the government to raise the ceiling on loan-to-value ratio on margin lending by 15

percentage points to 65 per cent. If this suggestion is implemented, stock investors intending to obtain loans on the

back of their securities will get 65 per cent of the value of their stock as credit. Currently, loan-to-value ratio on margin lending is 50 per cent.

Meanwhile, Poudel clarified that the market is moving in its usual direction after the government started to hold discussions with the concerned stakeholders.

Along with the Nepse index, the sensitive index also increased by 1.37 per cent or 3.36 points to 248.06 points and the float index went up by 1.51 per cent or 1.27 points to land at 84.84 points.

In the review period, weekly turnover increased by 35.27 per cent as compared to the previous week to Rs 2.21 billion. In the previous week the market witnessed turnover of Rs 1.63 billion. Likewise, the daily average turnover also rose to

Rs 443.06 million, which was an increment of 35.27 per cent in comparison to the previous week when it stood at Rs 327.53 million.

The secondary market had opened at 1,148.78 points on Sunday and went up by 18.82 points by the end of the first trading day. On Monday, the market again ascended by 15.17 points. The local bourse, however, reversed course to

fall by 14.62 points on Tuesday and by 5.47 points the next trading day. However, it increased by 3.28 points on Thursday

to close the week at 1,165.96 points.

In the review week, eight sub-groups landed in the green zone. Life insurance sub-index led the pack of gainers, rising by 5.09 per cent or 262.35 points to 5,407.47 points. Share price of National Life Insurance hiked up by Rs 30 to Rs 960.

Similarly, the non-life insurance subgroup went up by 4.71 per cent or 239.78 points to 5,326.57 points as the share price of Rastriya Beema Company ascended by Rs 200 to Rs 9,250.

Likewise, microfinance sub-index increased by 4.26 per cent or 54.06 points to 1,322.79 points.

The development banks sub-index went up by 1.78 per cent or 25.76 points to 1,467.83 points. The share price of

Kailash Bikash Bank increased by four rupees to Rs 240.

Others subgroup, meanwhile, also edged up by 1.25 per cent or nine points to 725.62 points. Similarly, the manufacturing sub-index ascended by 1.19 per cent or 26.42 points to 2,236.28 points.

The banking sub-index also increased by 0.59 per cent or 6.12 points to 1,025.90 points and the hydropower subgroup inched up by 0.24 per cent or 2.98 points to 1,202.52 points.

Meanwhile, the trading sub-index was the biggest loser in the review week, dropping by 1.40 per cent or 3.38 points

to 237.43 points.

Likewise, the hotels subgroup went down by 0.51 per cent or 8.93 points to 1,708.37 points and the finance sub-index inched down by 0.50 per cent or 3.01 points to 594.89 points.

In the review week, Nepal Bank was the leader in terms of weekly turnover with Rs 187.49 million. It was followed by NMB Bank with Rs 184.84 million, Chhimek Laghubitta Bikas Bank with Rs 124.41 million, Nepal Investment Bank with

Rs 98.23 million and NCC Bank with Rs 77.68 million.

In terms of weekly trading volume too, Nepal Bank took the lead with 612,000 of its shares changing hands. NMB Bank with 486,000 shares, NCC Bank with 365,000 shares, Global IME Bank with 324,000 shares and Mega Bank with 235,000 shares were the other top firms to record high trading volume.

NMB Bank, meanwhile, topped the chart in terms of number of transactions — 1,612. It was followed by Nepal Investment Bank with 945, NCC Bank with 761, Mega Bank with 740 and Bank of Kathmandu with 738 transactions.

Meanwhile, Nepse had not been uploading data on its website since November 3. The stock exchange had cited that it was not able to do so as it was facing problems with its software. After more than one-and-a-half months Nepse finally was able to upload the overall data of stock trading on Friday.