Mid-week loss limits Nepse’s gain

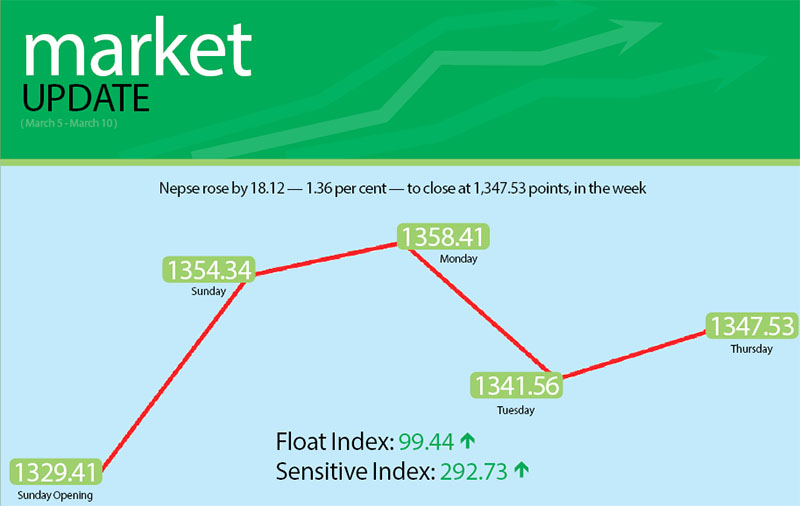

The gain of the domestic share market was capped by profit-booking towards the middle of the week of March 5 to 9, with the Nepal Stock Exchange (Nepse) index clocking a week-on-week rise of just 18.12 points or 1.36 per cent.

Starting the week on Sunday at 1,329.41 points, the benchmark index had surged by 24.93 points by the day’s closing. Nepse added another 4.07 points on Monday. However, following the unrest in the Tarai and deteriorating political situation, the local bourse dropped by 16.85 points on Tuesday. The country’s only secondary market remained closed on Wednesday as the country celebrated International Women’s Day. On Thursday, Nepse edged up 5.97 points to settle at 1,347.53 points for the week.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 3.95 points or 1.37 per cent to 292.73 points. Likewise, the float index that measures the performance of shares actually traded also went up by 1.28 points or 1.30 per cent to 99.44 points.

In total, 4.58 million shares of 156 companies that amounted to Rs 2.30 billion were traded through 18,533 transactions during the week. The traded amount was a whopping 50.15 per cent higher than the previous week when 15,734 transactions of 3.32 million shares of 150 firms worth Rs 1.53 billion had been undertaken.

Whereas trading remained steady at 206.16 points, trading was the only subgroup to record a loss in the review period.

After inching up 0.46 per cent in the preceding week, the insurance subgroup took the lead among the gainers this time around with the sub-index surging by 207.36 points or 3.52 per cent to 6,089.62 points. This was because of share value of insurance companies like National Life going up by 3.25 per cent to Rs 1,810 and Shikhar up 1.9 per cent to Rs 1,825, among others.

Hotels, which ceded its top position among gainers in the review period, rose by 39.79 points or 2.25 per cent to 1,807.17 points. Soaltee went up by 2.04 per cent to Rs 300, Taragaon Regency rose by 4.17 per cent to Rs 200 and Oriental ascended by 3.32 per cent to Rs 466.

Hydropower posted a gain of 30.44 points or 1.94 per cent to 1,599.33 points. On its heels, banking went up by 15.27 points or 1.20 per cent to 1,282.4 points.

Finance, development banks and manufacturing managed to land in the green, but their gains were limited below one per cent. Finance edged up 6.03 points or 0.99 per cent to 613.56 points, development banks rose 14.03 points or 0.96 per cent to 1,469.14 points and manufacturing inched up by 2.09 points or 0.1 per cent to 2,167.39 points.

Others — the lone subgroup to land in the red — dipped by 2.03 points or 0.31 per cent to 651.9 points, a small loss compared to the plunge of 6.57 per cent recorded in the past week.

Global IME Bank secured the top position in terms of trading volume and turnover with 680,000 of its shares changing hands that amounted to Rs 273.91 million.

The other companies to make it to the list of top five in terms of traded amount were Nepal Bangladesh Bank with Rs 176.80 million, Nepal Credit and Commerce Bank with Rs 168.71 million, Nepal Life Insurance Co with Rs 152.45 million and National Life Insurance Co with Rs 82.32 million.

Nepal Credit and Commerce Bank was the forerunner in terms of number of transactions — 1,346.