Nepse continues downward trend

Kathmandu, June 15

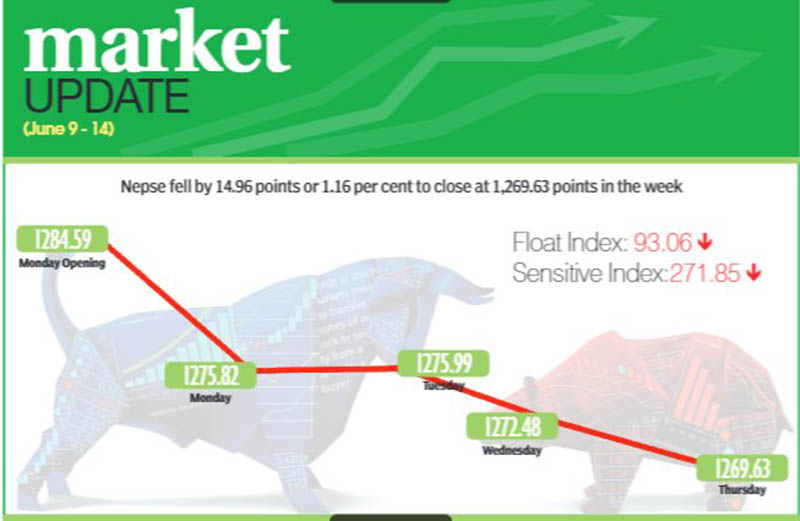

Selling pressure continued in the secondary market in the trading week between June 9 and 13, with the Nepal Stock Exchange (Nepse) index recording a week-on-week drop of 1.16 per cent or 14.96 points.

Share analysts attributed this trend to large investors distorting the market. “Our data shows that around 25 key investors are trying to maintain their monopoly, which is distorting the market and affecting small investors,” said a brokerage owner seeking anonymity, adding the market will hopefully bounce back and resume its normal movement in the near future.

He further said that investors are also not getting sufficient money to invest in the secondary market. Reportedly investors have been facing difficulties in getting money from banks and financial institutions this year compared to last year.

Consequently, the sensitive index went down by 0.74 per cent or 2.04 points to 271.85 points and float index also decreased by 1.06 per cent or one point to 93.06 points.

In the review period, weekly turnover plummeted by 25.61 per cent to Rs 2.05 billion against Rs 2.76 billion recorded in the previous week.

The daily average turnover also dropped to Rs 512.6 million, down 25.61 per cent compared to the preceding week’s Rs 689.07 million.

In the review week, trading of mutual funds fell by 18.31 per cent to Rs 2.9 million, against Rs 3.55 million in the past week.

The market remained closed on Sunday as the country observed a public holiday in celebration of Bhoto Jatra. The secondary market had opened at 1,274.59 points on Monday and dropped by 8.77 points by the end of the trading day. On Tuesday, it inched up by 0.17 point but then the gain was wiped out the very next day as the benchmark index fell by 3.51 points. On Thursday, local bourse again fell by 2.85 points to close the week at 1,269.63 points.

In the review week, only trading and development banks landed in green zone. The trading sub-index rose by 7.93 per cent or 19.39 points to 263.9 points. It was due to share price of Bishal Bazar ascending by Rs 92 to Rs 1,598. Development banks subgroup rose by 0.05 per cent or 0.9 point to 1,599.74 points.

Meanwhile, non-life insurance subgroup was the biggest loser in the week, dropping by 4.57 per cent or 257.83 points to 5,379.20 points, with share price of Rastriya Beema Company down Rs 601 to Rs 9,800.

The finance sub-index decreased by 2.41 per cent or 15.34 points to 621.78 points. Likewise, the hydropower subgroup also went down by 1.73 per cent to 21.12 points to land at 1,200.79 points. Moreover, life insurance sub-index dropped by 1.67 per cent or 105.59 points to 6,198.79 points. The others subgroup descended by 1.36 per cent or 10.13 points to 729.42 points.

The hotels sub-index fell by 1.33 per cent or 28.44 points to 2,102.20 points and microfinance subgroup went down by 1.21 per cent or 17.60 points to 1,441.44 points.

Similarly, banking subgroup was down 0.72 per cent or 8.26 points to 1,135.08 points and the manufacturing subgroup lost 0.70 per cent or 19.41 points to 2,744.52 points.

In the review week, Shivam Cements was the leader in terms of weekly turnover with Rs 145.65 million. It was followed by NIC Asia Bank with Rs 102.78 million, Global IME Bank (Promoter Share) with Rs 88.66 million, Nepal Bank with Rs 78.59 million and Prabhu Bank with Rs 72.69 million.

In terms of weekly trading volume, Global IME Bank (Promoter Share) took the lead with 509,000 of its shares changing hands. It was followed by Prabhu Bank with 269,000 shares, Nepal Bank with 241,000 shares, Mega Bank with 232,000 shares and NIC Asia Bank with 225,000 shares.

Meanwhile, Panchthar Power Company was the forerunner in terms of number of transactions with 1,863 deals. Upper Tamakoshi Hydropower with 1,385, Shivam Cements with 1,256, NIC Asia Bank with 783 and Mega Bank with 758 transactions were the other top companies in this category.