Nepse index records marginal gain

Kathmandu, October 3

Despite the favourable declaration of paid-up capital plans by banks and financial institutions (BFIs), the political uncertainty caused Nepal Stock Exchange (Nepse) index to see-saw throughout the week.

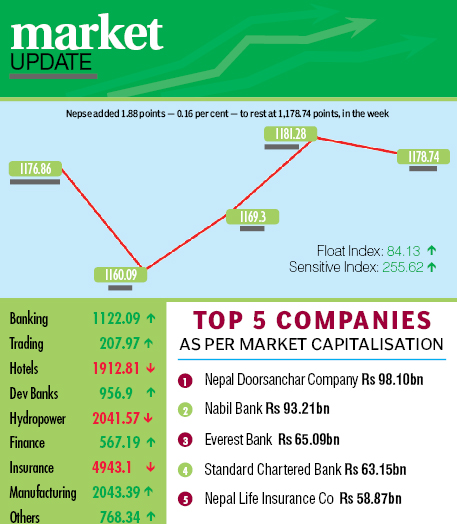

Consequently, the benchmark index managed to record a minimal gain of 1.88 points or 0.16 per cent week-on-week to rest at 1,178.74 points, from September 28 to October 1.

“Had the political situation also been positive, Nepse would have easily breached previous high,” said Raj Kumar Timilsina, a stock market analyst.

Stating that the paid-up capital plans that the BFIs have made public are extremely encouraging, he said it would definitely help push the Nepse index to a newer height once the political situation stabilises.

The country’s only secondary market remained closed on Sunday in celebration of Indrajatra festival. Opening at 1,176.86 points on Monday, the benchmark index slumped by 16.77 points by the day’s closing. However, the local bourse recovered all the loss by adding 9.21 points on Tuesday and another 11.98 points on Wednesday.

On Thursday, Nepse shed 2.54 points, mainly due to profit-booking on murky political scenario.In total, 3.07 million units of shares of 151 listed companies worth Rs 1.99 billion were traded in the stock market during the week through 9,914 transactions.

The traded amount was 23.04 per cent higher than preceding week when 7,864 transactions of 2.57 million scrips of 155 firms amounting to Rs 1.62 million had been undertaken.

The sensitive index inched up 1.16 points to 255.62 points. Similarly, the float index also added a marginal 0.2 point to 84.13 points, during the review period.

The subgroups recorded mixed results, with six sub-indices ascending and three south-bound.Banking, the subgroup with the highest stake in Nepse’s market capitalisation, went up 0.60 per cent to 1,122.09 points.

Everest Bank’s share value surged by Rs 137 to Rs 3,300 and that of Standard Chartered closed at Rs 2,815, up Rs 20.

Finance recovered the previous week’s loss by adding 0.69 per cent to 567.19 points. ICFC Finance gained Rs 21 to Rs 330, and Central Finance went up seven rupees to Rs 263, among others.

Development banks ascended 0.51 per cent to 956.9 points on the back of Chhimek rising by Rs 100 to Rs 1,700 and Reliable by Rs 44 to Rs 326.

Salt Trading Corporation’s stock price went up by eight rupees to Rs 236, which in turn helped trading increase by 0.47 per cent to 207.97 points.

Nepal Telecom’s share price rose by two rupees to Rs 654 and lifted others subgroup by 0.31 per cent to 768.34 points.

Manufacturing managed to land in the green zone by adding just 0.04 per cent to 2,043.39 points, with Unilever Nepal’s scrips edging up Rs 80 to Rs 28,990.

On the flip side, insurance plunged by 1.84 per cent to 4,943.1 points, weighed down by Nepal Life Insurance losing Rs 55 to Rs 3,395, and National Life down Rs 28 to Rs 2,272, among others.

The sub-index of hotels was down 0.65 per cent to 1,912.81 points because of Oriental’s scrips dropping by Rs 16 to Rs 596 and Soaltee dipping by two rupees to Rs 448.

Hydropower’s slide was limited to 0.25 per cent to 2,041.57 points.Everest Bank took the lead in terms of turnover with Rs 274.61 million, followed by Sanima Bank with Rs 152.94 million, Global IME Bank with Rs 104.25 million, Bank of Kathmandu with Rs 94.9 million and Nepal Investment Bank (Promoter Share) with

Rs 90.02 million.

Global IME Bank was the forerunner in terms of number of shares traded with 194,000 of its scrips changing hands.

Meanwhile, Sanima Bank recorded the most number of transactions with 744 deals.