Nepse index surges 6.84 per cent

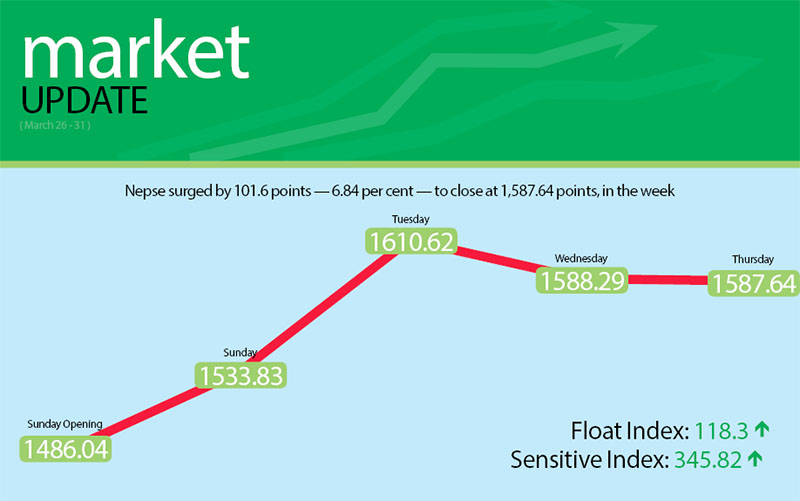

In line with investor optimism, the Nepal Stock Exchange (Nepse) index advanced by 101.6 points or 6.84 per cent to rest at 1,587.64 points in the trading week of March 26 to 30.

Starting the week at 1,486.04 points, the benchmark index had surged by 47.79 points by Sunday’s closing. The country’s sole secondary market remained closed on Monday due to Ghode Jatra festival. On Tuesday, the local bourse gained 76.79 points. But due to profit-booking, Nepse slipped by 22.33 points on Wednesday and shed 0.65 points on Thursday.

The sensitive index rose by 22.56 points or 6.98 per cent to 345.82 points. Likewise, the float index also went up by eight points or 7.25 per cent to 118.3 points.

Altogether 14.04 million shares of 159 firms that amounted to Rs 7.20 billion were traded through 45,072 transactions during the week. The traded amount was 24.60 per cent higher than the previous week when 41,363 transactions of 10.83 million shares of 155 firms worth Rs 5.78 billion had been undertaken.

Manufacturing was the lone subgroup to land in the red with a dip of 0.58 per cent to 2,168.79 points. The sub-index was weighed down by Unilever Nepal’s share value slipping by 0.70 per cent to Rs 29,988 and Bottlers Nepal (Tarai) down 1.71 per cent to Rs 3,450.

Despite soaring by 8.63 per cent to 7,850.99 points, insurance subgroup ceded its lead among the gainers in the review period to hydropower, which advanced by 9.53 per cent to 2,010.3 points. In the previous week, insurance had ascended by 15.39 per cent, while hydropower by 11.65 per cent.

Finance went up by 8.87 per cent to 724.78 points. Development banks rose by 7.32 per cent to 1,776.47 points. Banking subgroup climbed 6.84 per cent to 1,493.82 points.

Hotels advanced by 5.45 per cent to 2,064.37 points. Others rose by 2.60 per cent to 684.29 points, while trading inched up 0.81 per cent to 207.84 points.

Meanwhile, Sanima Bank secured the top position in terms of turnover with Rs 461.90 million, followed by Nepal Bangladesh Bank with Rs 417.86 million, Nepal Bangladesh Bank (Promoter Share) with Rs 380.61 million, Laxmi Bank with Rs 291.89 million and Nepal Credit and Commerce Bank with Rs 281.27 million.

With regard to trading volume, Nepal Bangladesh Bank (Promoter Share) topped the chart with 1.047 million of its shares changing hands. Nepal Bangladesh Bank was forerunner in terms of transactions, 3,053.