Nepse mostly stable before budget

Kathmandu, May 25

As a sign of investor optimism, the weekly turnover and number of transactions in the country’s only secondary market improved in the trading week between May 19 and 23, compared to the previous week.

In the review period, Nepal Stock Exchange (Nepse) witnessed 57,076 transactions worth Rs 5.02 billion against 50,928 transactions amounting to Rs 4.95 billion recorded last week.

“Share investors are optimistic as a rumour has been doing the rounds that the government will address the concerns raised by them through the budget,” said Radha Pokharel, chairperson of Nepal Punjibazaar Laganikarta Sangh.

Recently, share investors met Finance Minister Yubaraj Khatiwada and submitted a 10-point memorandum seeking reduction in interest on margin loans, margin trading through brokers, and opening the share market to NRNs, among other provisions.

Even as the main indices dipped slightly, Pokharel termed the slight fluctuations as ‘normal’ movement and said the market will likely see an upsurge if the rumours turn out to be true.

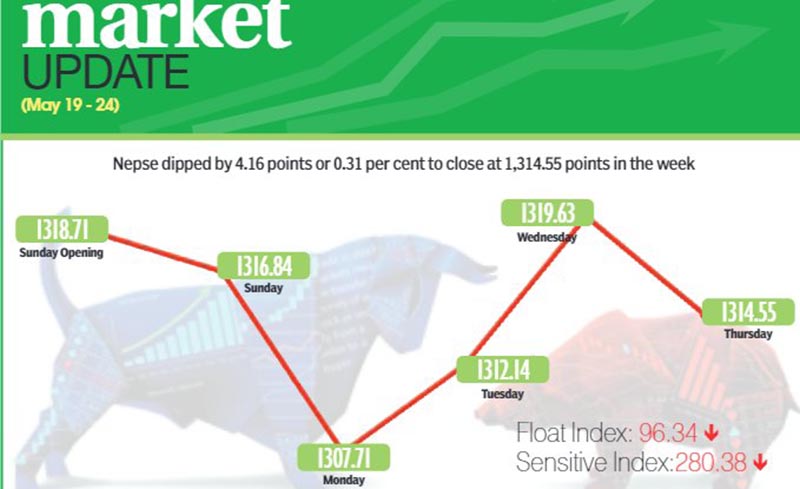

Opening at 1,318.71 points on Sunday, the benchmark index had shed 1.87 points by the day’s closing and fell by another 9.13 points on Monday. Nevertheless, the local bourse managed to recover the loss over the following two days — adding 4.43 points on Tuesday and 7.49 points on Wednesday. On Thursday, however, Nepse reversed course again dropping by 5.08 points to close the week at 1,314.55 points.

Week-on-week, benchmark index fell by 0.31 per cent or 4.16 points.

Not surprisingly, the sensitive and float indices — which track the performance of class ‘A’ stocks and performance of shares actually traded, respectively — also dipped.

Sensitive index fell by 0.37 per cent or 1.06 points to rest at 280.38 points, whereas float index landed at 96.34 points, down 0.32 per cent or 0.31 point.

Although hydropower, hotels and others subgroups witnessed significant buying pressure, the gains were offset by the remaining subgroups landing in the red.

Hydropower saw the biggest surge of 7.40 per cent or 88.07 points to 1,278.88 points. This was on the back of share value of Chilime up 3.06 per cent to Rs 539 and that of Butwal Power Co advancing by 9.28 per cent to Rs 424, among others. Hotels rose by 3.53 per cent or 73.88 points to 2,166.38 points in the week. Oriental jumped by 7.75 per cent to Rs 695 and Soaltee gained 2.51 per cent to Rs 245.

Share price of Nepal Telecom going up 2.35 per cent to Rs 740 pushed others sub-index up 1.67 per cent or 12.61 points to 765.02 points.

Meanwhile, the recently introduced mutual funds subgroup landed at the other end of the spectrum — plunging by 2.82 per cent or 0.29 point to 9.80 points. Laxmi Equity lost 3.15 per cent to Rs 7.98 and NIBL Pragati descended by 10.67 per cent to Rs 7.28.

Even as Unilever Nepal’s share price went up by 1.03 per cent to Rs 20,000, the manufacturing subgroup was weighed down by Himalayan Distillery taking a steep fall of 5.78 per cent to Rs 1,809 and Bottlers Nepal (Tarai) down 1.99 per cent to Rs 7,101. Hence, the manufacturing sub-index dropped by 2.66 per cent or 70.80 points to 2,591.65 points.

The performances of non-life insurance and trading subgroups were slightly better. Non-life insurance sub-index closed at 5,894.23 points, down 2.25 per cent or 135.57 points, while trading landed at 257.61 points, recording a fall of 2.21 per cent or 5.83 points.

Life insurance subgroup retreated by 1.54 per cent or 104.11 points to 6,650.28 points. Share investors of Nepal Life saw the value of their holdings drop by 2.29 per cent to Rs 940 and that of Prime Life by 3.31 per cent to Rs 467. Similarly, microfinance was down 1.27 per cent or 19.46 points to 1,506.46 points, and finance fell by 1.13 per cent or 7.09 points to 618.87 points.

Commercial and development banks managed to limit their losses below one per cent in the review period.

Banking subgroup shed 0.83 per cent or 9.77 points to settle at 1,167.42 points, while development banks dipped by 0.76 per cent or 12.25 points to 1,599.68 points.