Nepse snaps out of two weekly losses

Kathmandu, November 18

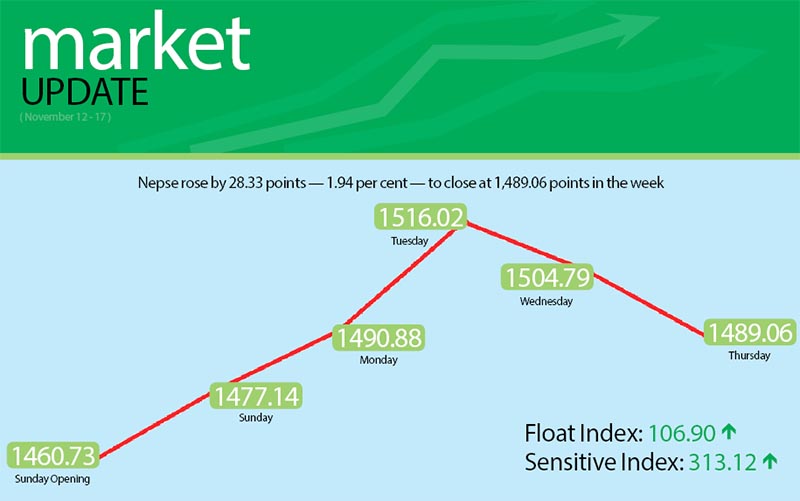

Snapping two consecutive weekly losses, the country’s secondary market rebounded by 28.33 points or 1.94 per cent during the trading week between November 12 and 16.

The benchmark index had opened at 1,460.73 points on Sunday and closed at 1,477.14 points at the end of the day. Similarly, it rose to 1,490.88 points on Monday and surged to 1,516.02 points on Tuesday. The secondary market had crossed the threshold of 1,500 points after nine trading days on Tuesday. However, the local bourse reversed course thereafter, landing at 1,504.79 points on Wednesday and retreating below 1,500 points again on Thursday to rest at 1,489.06 points for the week.

Along with the Nepse index, the sensitive index and the float index also rose in the review period. The sensitive index went up to 313.12 points, increasing by 6.33 points or 2.06 per cent and the float index rose by 2.02 points or 1.93 per cent to 106.9 points in the week.

Stock market investors said that the secondary market is waiting for post-election stability in the country and the movement of the market seemed normal in review period.

“The secondary market had dropped significantly in the previous two weeks and the rebound in the beginning of the week was basically just a market correction. In fact, share investors are waiting for the elections to end, which is expected to usher in a stable political situation in the country,” Ambika Prasad Poudel, chairman of Nepal Investors’ Forum, informed.

He also added that investors were feeling psychological pressure, which could be witnessed in the market movement. “There was no fundamental reason behind the movement of the market, only the pressured psychology of investors played a role on the movement.”

During the review period, the hydropower sector led the pack of gainers, surging by 5.17 per cent or 92.12 points to 1,873.17 points. Share price of Chilime Hydropower Company soared by 9.67 per cent to Rs 839 per unit during the week.

Similarly, sub-indices related to financial sectors also ascended. Sub-index of class ‘A’ financial institutions rose by 24.44 points or 1.96 per cent to 1,270.7 points. Share price of Nabil Bank increased by 4.60 per cent to Rs 1,182 per unit and share price of Standard Chartered Bank rose by 1.86 per cent to Rs 2,022 per unit.

The microfinance sector rebounded by 2.25 per cent or 39.20 points to 1,777.7 points. Share price of Summit Micro Finance Development Bank increased by 3.33 per cent to Rs 1,800 per unit.

The development banks, insurance and finance went up by nominal numbers in the week. Sub-index of development banks went up to 1,749.98 points, up 7.34 points or 0.42 per cent. Similarly, the insurance sector rose by 73.18 points or 0.92 per cent to 8,047.69 points. Likewise, finance sector gained 0.89 point or 0.12 per cent to 755.68 points.

The manufacturing sector advanced by 70.91 points or 2.96 per cent in the week and the sub-index of others group ascended by 31.81 points to 3.93 per cent to 841.6 points. Share price of Nepal Telecom — the company with the highest market capitalisation among the listed companies and is categorised in ‘others’ subgroup — increased by 4.24 per cent to Rs 850 per unit.

At the other end of the spectrum, hotels and trading sectors landed in the red during the week. The hotels group dropped by 33.8 points or 1.55 per cent to 2,141.22 points. Likewise, trading fell to 214.95 points, descending by 7.18 points or 3.23 per cent in the review period.

Altogether, 6.68 million shares of 180 companies worth Rs 2.92 billion were traded through 29,330 transactions during the week. The traded amount was 15.6 per cent higher than the total weekly turnover of the previous week.

Chilime Hydropower Company secured the top position in terms of total turnover with Rs 161.99 million. It was followed by Prabhu Bank (Promoter Share) with Rs 126.28 million, Gurans Life Insurance Company with Rs 112.43 million, Standard Chartered Bank with Rs 107.6 million and Nepal Telecom with Rs 93.85 million.

Prabhu Bank (Promoter Share) topped the list in terms of trading volume, with 698,000 of its shares changing hands and Nepal Grameen Bikas Bank was the forerunner in terms of number of transactions — 1,609.

New listings

Company

Type

Unit

Development Bond 2022 ‘E’

Ordinary

50,000,000

Development Bond 2024 ‘A’

Ordinary

31,400,000

Development Bond 2024 ‘B’

Ordinary

50,000,000

Development Bond 2026 ‘B’

Ordinary

50,000,000

Development Bond 2027 ‘B’

Ordinary

50,000,000

Development Bond 2031 ‘A’

Ordinary

50,000,000

Goodwill Finance

Rights

2,722,500

Kamana Sewa Development Bank

Rights

2,413,137.60

Kankai Development Bank

Rights

3,210,000

Nepal Insurance Company

Bonus

143,804.10

Prime Life Insurance Company

Bonus

1,220,400

Sunrise Bank

Rights

710,709