New rule dampens share investor sentiment

Kathmandu, September 28

With the new rule requiring investors to mandatorily reveal source of large amounts of money invested in secondary market, Nepal Stock Exchange has been in a bearish trend since last 10 consecutive weeks.

The government has announced that share investors investing more than Rs one million would have to reveal the source of the money. Moreover, the government would probe anyone investing up to Rs 2.5 million and thoroughly investigate any investment of Rs 10 million and above.

Stating that there was no real factor to weigh on the investor sentiment at the moment, Prakash Rajhaure, an independent share market analyst, said, “It seems share investors are just anxious about the rule that requires them to show the source while investing any large sum in the share market.”

Rajhaure said while government has addressed some major issues, long-pending dispute related to calculation method of capital gains tax on share transactions is yet to be resolved. “As per our analysis, downward cycle is nearing an end and market will rebound soon,” he said, adding that the process will be accelerated if the government addresses some of the disputes related to the share market.

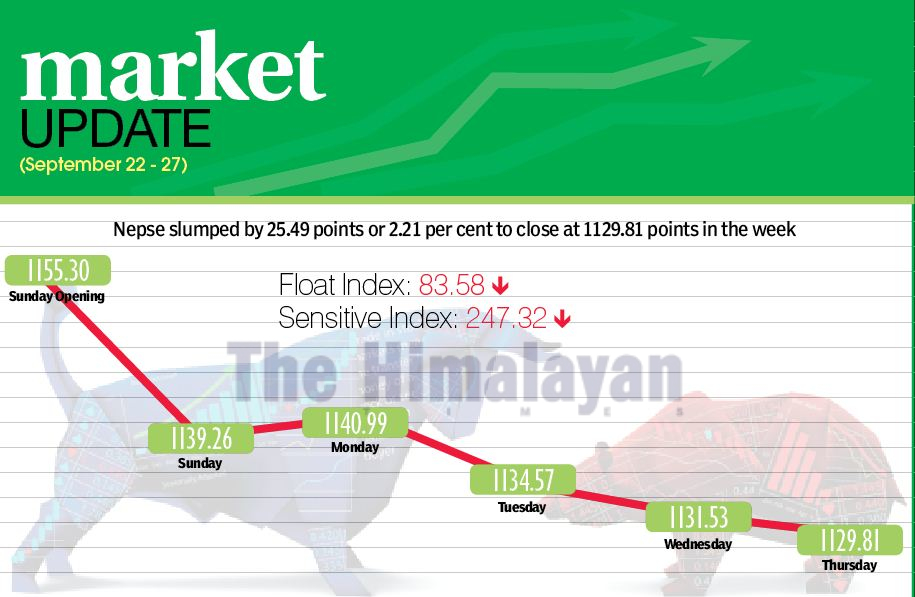

The benchmark index plunged by 2.21 per cent or 25.49 points in the review week between September 22 and 26. Sensitive index also went down by 1.94 per cent or 4.89 points to 247.32 points and float index fell by 2.30 per cent or 1.97 points to 83.58 points.

The weekly turnover slumped drastically by 47.06 per cent as compared to the previous week to Rs one billion. In the previous week, the market had witnessed transactions worth Rs 1.89 billion. The trading volume also decreased to 4.04 million stocks changing hands this week from 6.58 million in previous week.

Nepse had opened on Sunday with the benchmark index at 1,155.30 points. It dropped by 16.04 points by end of first trading day. It inched up by 1.73 points on Monday. However, market remained southbound for the rest of the week — falling 6.42 points on Tuesday, 3.04 points on Wednesday and 1.72 points on Thursday to close the week at 1,129.81 points.

In the review week, only trading and others sub-indices managed to land in green zone.

Trading rose by 1.61 per cent or 4.63 points to 292.51 points, due to share price of Salt Trading Corporation jumping by Rs 30 to Rs 658. Others sub-index rose by 0.26 per cent or 1.67 points to 640.41 points on the back of Nepal Telecom’s share price rising by Rs 10 to Rs 627.

Hydropower plunged by 4.24 per cent or 40.87 points to 921.32 points. Shareholders of Upper Tamakoshi saw their investment contract by Rs 13 to Rs 231 per unit and those of Chilime by Rs 22 to Rs 411.

Non-life insurance lost 4.19 per cent or 184.52 points to 4,213.44 points as share price of Everest Insurance fell by Rs 23 to Rs 239. Similarly, manufacturing fell by 3.60 per cent or 90.24 points to 2,413.56 points with Unilever Nepal’s share value down by Rs 650 to Rs 18,350.

The microfinance subgroup fell by 2.57 per cent or 38.32 points to 1,449.13 points. Life insurance sub-index descended by 2.46 per cent or 125.96 points to 4,992.44 points and hotels subgroup went down by 2.39 per cent or 45.68 points to 1,864.85 points.

Banking subgroup dropped 2.04 per cent or 21.65 points to 1,036.77 points, with commercial banks like Himalayan down Rs 20 to Rs 487. Similarly, development banks decreased by 1.80 per cent or 28.29 points to 1,538.71 points.

The finance subgroup inched down by 1.75 per cent or 10.04 points to 562.97 points and mutual funds dipped 0.63 per cent or 0.06 point to 9.36 points.

In the review week, Sanima Bank was the leader in terms of weekly turnover with Rs 61.68 million. It was followed by Shivam Cements with Rs 47.61 million, Prabhu Bank with Rs 41.61 million, Nepal Life Insurance Co with Rs 34.86 million and Machhapuchchhre Bank with Rs 33.45 million.

In terms of weekly trading volume too Sanima Bank topped chart with 177,000 of its shares changing hands. Prabhu Bank with 160,000 shares, Machhapuchchhre Bank with 136,000 shares, Rasuwagadhi Hydropower with 128,000 shares and Mega Bank Nepal with 110,000 shares rounded up the top five in this category.

Meanwhile, Rasuwagadhi Hydropower recorded most number of transactions — 2,191. It was followed by Sanjen Jalavidhyut with 2,105, Upper Tamakoshi Hydropower with 828, Shivam Cements with 606 and Nepal Life Insurance with 539 transactions.

New listings

Company Type Units

Lumbini Bikas Bank Bonus 3,771,972.36

Sagarmatha Insurance Bonus 4,629,310

Siddhartha Insurance Bonus 1,340,816.5

Siddhartha Mutual Fund Ordinary 120,000,000

(Siddhartha Investment Growth Scheme-II)