Political uncertainty weighs on Nepse index

Kathmandu, April 22

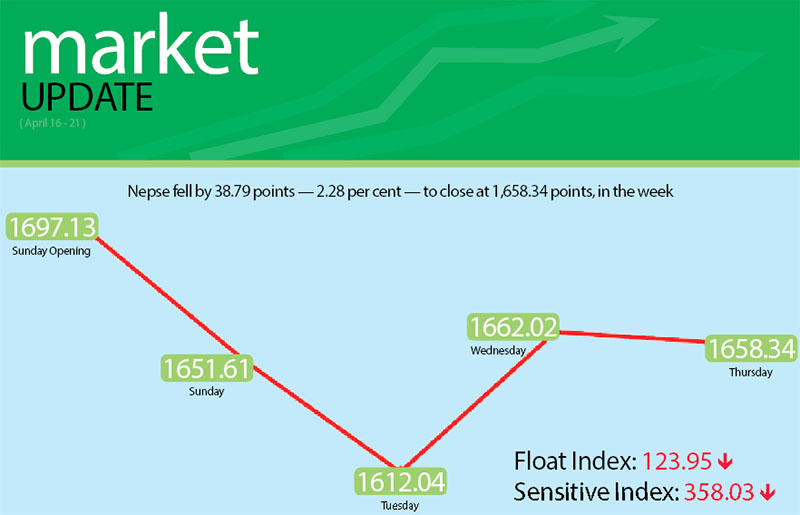

The country’s only secondary market swayed in tune with the political developments in the week of April 16 to 20, with the Nepal Stock Exchange (Nepse) index recording a week-on-week loss of 38.79 points or 2.28 per cent.

“Nepal’s share market tends to be highly sensitive to the political scenario, which is why there was volatility during the week,” explained Bachchu Ram Rimal, general secretary of Nepal Investors Forum. “With positive news related to the local polls recently, the market could move toward positive territory in the coming days.”

Beginning the first trading day of 2074 BS at 1,697.13 points, the benchmark index had plunged by 45.52 points by the time of closing as negative news related to local polls weighed on investor sentiment. While the share market remained closed on Monday due to a public holiday, Nepse continued southbound on Tuesday, recording a drop of 39.57 points. On Wednesday, however, the local bourse reversed course as the political parties expressed commitment to hold the local polls on May 14. Nevertheless, Nepse dipped by 3.68 points on Thursday to rest at 1,658.34 points for the week.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 9.49 points or 2.58 per cent to 358.03 points. Likewise, the float index that measures the performance of shares actually traded also dipped by 3.36 points or 2.64 per cent to 123.95 points.

In total, 7.52 million shares of 154 companies that amounted to Rs 5.18 billion were traded through 33,831 transactions during the week. The traded amount was 37.69 per cent lower than the preceding week when 50,602 transactions of 14.05 million shares of 153 firms worth Rs 8.32 billion had been undertaken.

It has to be noted though that the share market had remained open for normal five days of trading in the past week.

Trading was the sole subgroup to remain stationary at 209.25 points. All the remaining subgroups landed in the red during the review period.

Banking, the share market heavyweight, plunged by 45.35 points or 2.87 per cent to 1,535.87 points.

Hydropower dropped by 43.82 points or 2.15 per cent to 1,990.3 points.

Manufacturing descended by 46.54 points or 2.11 per cent to 2,161.45 points.

Insurance saw the previous week’s rise of 2.19 per cent nearly wiped out as investors rushed to book profit on overheated insurance stocks, thereby causing the subgroup to slump by 180.93 points or 2.04 per cent to 8,688.07 points.

After leading the pack of gainers in the previous week by soaring 7.37 per cent, development banks reversed course to land at 1,939.27 points, down 27.36 points or 1.39 per cent.

Others fell by 8.68 points or 1.26 per cent to 677.06 points, hotels lost 13.58 points or 0.61 per cent to 2,192.62 points and finance shed 0.44 point or 0.06 per cent to 761.21 points.

Meanwhile, Nepal Credit and Commerce Bank retained the top position in all three categories — trading volume, turnover and number of transactions — with 501,000 of its shares worth Rs 217.78 million changing hands in 1,489 transactions.

The other companies to make it to the list of top five in terms of weekly turnover were Rastriya Beema Company with Rs 199.67 million, Prime Life Insurance Co with Rs 184.28 million, Prabhu Bank with Rs 182.91 million and Gurans Life Insurance with Rs 174.43 million.