Profit of PEs expected to erode by 51.15 per cent this fiscal

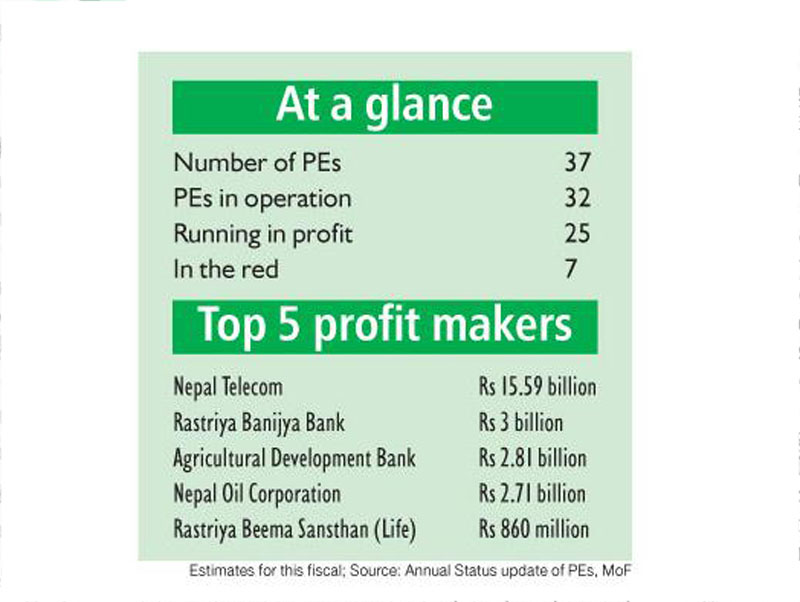

The total profit of all public enterprises (PEs) is expected to decline by more than half in the current fiscal as compared to net profit of Rs 33.92 billion in the previous fiscal year.

The Annual Status Update of the PEs that was tabled by Finance Minister Bishnu Prasad Paudel in the Parliament today showed that profit of PEs in this fiscal will hover around Rs 16.57 billion — a plunge of Rs 17.35 billion or 51.15 per cent as compared to the previous fiscal.

Altogether 25 PEs out of 32 PEs in operation are expected to book profit in the current fiscal. Only 21 PEs had generated profit in last fiscal. Even as the number of PEs expected to generate profit has increased, the profit amount is likely to decline as the profit of Nepal Oil Corporation (NOC) and Rastriya Banijya Bank (RBB) slumped heavily in this fiscal. In addition, the loss incurred by Nepal Electricity Authority (NEA) is expected to surge from Rs 4.96 billion of last fiscal to Rs 12.09 billion in this fiscal.

PEs, namely, Nepal Telecom, RBB, Agricultural Development Bank Ltd (ADBL), Nepal Oil Corporation and Rastriya Beema Sansthan (Life) are expected to be listed as top five profit makers in this fiscal.

Nepal Telecom, largest telecommunication service provider of the country, is expected to book profit worth Rs 15.59 billion in this fiscal as compared to Rs 14.56 billion of the previous fiscal. Similarly, profit of RBB, ADBL, NOC, Rastriya Beema Sansthan (Life) is expected to hover around Rs three billion, Rs 2.81 billion, Rs 2.71 billion and Rs 860 million, respectively.

All the 10 PEs listed under financial sector category are expected to book total profit worth Rs 9.03 billion or 54 per cent of the total estimated profit for this fiscal. PEs under this category had generated profit to the tune of Rs 8.55 billion in the last fiscal.

Apart from RBB and ADBL, which are listed among the top-five profit earners, NIDC Development Bank is expected to earn profit worth Rs 618.4 million. Likewise, profit of Deposit and Credit Guarantee Corporation is expected to hover around Rs 568.9 million, Hydropower Investment and Development Company Ltd at Rs 233.9 million, Nepal Stock Exchange Ltd at Rs 236.6 million, Citizen Investment Trust at Rs 212.5 million, and Nepal Housing Development Finance Company Ltd at Rs 29.8 million.

Similarly, profit of Rastriya Beema Sansthan (Life) and Rastriya Beema Sansthan (Non-life) is estimated at Rs 860.1 million and Rs 563.4 million, respectively.

Meanwhile, almost all PEs listed under trading category, except National Trading Ltd, are expected to generate profit in fiscal 2015-16. Agriculture Inputs Company Ltd, National Seed Company Ltd, Nepal Food Corporation Ltd, NOC, National Trading Ltd and The Timber Corporation of Nepal Ltd are listed under this category.

Majority of PEs ranked under social sector category, namely, Sanskritik Sansthan (Cultural Corporation), Janak Shiksha Samagri Kendra Ltd and Nepal Television may face loss in this fiscal.

Of the total 37 PEs, five have been shut down — Janakpur Cigarette Factory, Nepal Drugs Ltd, National Construction Company Nepal Ltd, Nepal Engineering Consultancy Service Centre Ltd and Nepal Orind Magnesite Ltd. The government has laid off employees of all the closed PEs except for Nepal Drugs Ltd, where 230 staffers are employed.

Among the PEs categorised under public utility sector — Nepal Water Supply Corporation, NEA, Nepal Telecom (NT) — only NT is expected to generate profit. Nepal Water Supply Corporation and NEA may face losses worth Rs 14.8 million and Rs 12.09 billion, respectively.

Performance of PEs listed under industrial sector category is expected to improve. Four PEs in operation (out of seven) under this category are expected to generate total profit worth Rs 478.5 million against the loss of Rs 608.9 million of last fiscal.

Similarly, profit of PEs listed under service category — Industrial Districts Management Ltd, Nepal Transit Warehousing Co Ltd, Nepal Airlines Corporation, National Productivity and Economic Development Centre and Civil Aviation Authority of Nepal — is estimated to slump to Rs 460.8 million as compared to Rs 1.43 billion of the last fiscal.