Stock market at over two-month low

Kathmandu, November 11

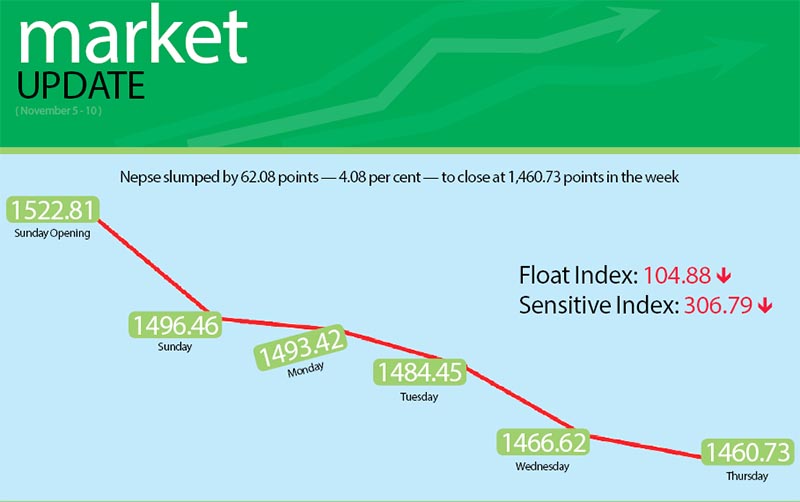

The secondary market dropped significantly for the second consecutive trading week between November 5 and 9. The Nepal Stock Exchange (Nepse) index slumped by 4.08 per cent or 62.08 points in the review period. The secondary market had dropped by 1.99 per cent in the previous week.

The sharp drop witnessed by sub-indices related to the financial sector like commercial banks, development banks, finance and insurance weighed on the stock market. In fact, all the subgroups landed in the red.

Similarly, the sensitive index fell by 12.85 points or 4.02 per cent to 306.79 points and the float index dropped by 4.64 points or 4.24 per cent to 104.88 points in the week.

The benchmark index had opened at 1,522.81 points on Sunday and had retreated below the psychological level of 1,500 points to close at 1,496.46 points. The market remained southbound throughout the week, falling to 1,493.42 points on Monday, dropping to 1,484.45 points on Tuesday, down to 1,466.62 points on Wednesday and finally resting at 1,460.73 points on the last day of the week — Thursday. The last time Nepse had closed below 1,500 points was on September 3

Capital market analysts and investors have pointed out that excess supply of shares in the market has played a significant role in dragging down the index.

Ishwari Rimal, chief executive officer at Nepal Stock House, said the secondary market is being pressured by excess supply against limited demand. “The current trend can be attributed to the huge flow of rights and bonus shares of companies while the demand side is sluggish, which has resulted in a negative impact on the market,” he said.

Another reason, according to Rimal is the forthcoming elections. “With the elections fast approaching, investors are retracting from the market, I think they are in a wait and see mode at present,” he stated. He also said that the market could go further down in the coming weeks.

Similarly, Nawaraj Subedi, chairman of Nepal Stock Market Investors Association, said the first quarter results of banks and financial institutions has also hit the mindset of the investors and the market is continuously falling.

“The capital base of financial institutions has increased. Investors were left unimpressed by the first quarter reports of the banks, which has been reflected in the capital market,” he explained.

Subedi also said uncertainty related to implementation of the fully automated trading system by Nepse also affected the market movement.

The sub-index of commercial banks dropped by 4.23 per cent or 55.05 points to 1,246.26 points in the week. Share price of Nabil Bank fell by seven per cent to Rs 1,130 per unit and Everest Bank by 7.14 per cent to Rs 1,105 per unit.

Similarly, sub-index of development banks retreated 4.53 per cent to 1,742.64 points in the week. Share price of development banks like Kankai slumped by 7.84 per cent to Rs 188 per unit in the review period.

Insurance sector dropped by 4.98 per cent to 7,974.51 points in the week. Share price of Rastriya Beema Company landed at Rs 16,620 per unit, falling by 6.37 per cent in the review period.

During the week, the hotel sector slumped by 5.88 per cent or 135.89 points to 2,175.02 points. Likewise, the manufacturing sector fell to 2,399.33 points, down 48.10 points or 1.97 per cent. The sub-index of microfinance lost 79.76 points or 4.39 per cent to 1,738.50 points.

The hydropower sector fell to 1,781.05 points, with a loss of 45.91 points or 2.51 per cent in the week. Similarly, sub-index of finance sector rested at 754.79 points, down 2.61 per cent or 20.20 points.

Others and trading sectors also fell in the week. Others fell by 2.33 per cent or 19.38 points to 809.79 points in the review period and the trading sector slipped to 222.13 points, falling by 4.48 points or 1.98 per cent in the review period.

Altogether, 6.59 million shares of 179 companies worth Rs 2.53 billion were traded through 29,013 transactions during the week. The traded amount was 12.47 per cent higher than the total weekly turnover of the previous week.

Standard Chartered Bank secured the top position in terms of total turnover with Rs 115.5 million. It was followed by Nepal Life Insurance Company with Rs 93.73 million, Nepal Investment Bank with Rs 88.81 million, Everest Bank with Rs 79.11 million and Nepal Telecom with Rs 77.89 million.

Prabhu Bank topped the chart in terms of trading volume, with 177,000 of its shares changing hands and Nepal Grameen Bikas Bank was the forerunner in terms of number of transactions — 2,795.

New listings

Company

Type

Unit

Century Commercial Bank

Rights

17,024,381

Everest Bank

Rights

15,088,087

Hamro Bikash Bank

Rights

80,770.76

Mission Development Bank

Bonus

428,835

Reliable Microfinance

Rights

282,500