Unstable policies fuel pessimism in local bourse

Kathmandu, October 19

Due to the unstable government policies related to the secondary market, pessimism has been growing in the local bourse with each passing day and share investors are losing confidence.

Share investors have further alleged that the market regulatory body has not played a positive role to promote the secondary market and that it is merely acting like a puppet of the government.

Radha Pokharel, chairperson of Nepal Pujibazar Laganikarta Sangh, said the Securities Board of Nepal (SEBON) has not played the role it should have to promote the secondary market. “I wouldn’t want to blame any particular individual, but SEBON as an institution has not done anything substantial to promote the market as anticipated by the investors. The regulatory body needs to create an investment-friendly environment.”

She alleged that the government was only engaging in talks and not actually introducing required policies for the secondary market. “We have asked the government to finalise the calculation method of capital gains tax and reduce the interest on margin loans since long but our demands have fallen on deaf ears. In recent times, the market has not been able to attract new investors.”

“If this situation continues, investors will surely withdraw their investment from the share market and shift it to other sectors,” Pokharel mentioned.

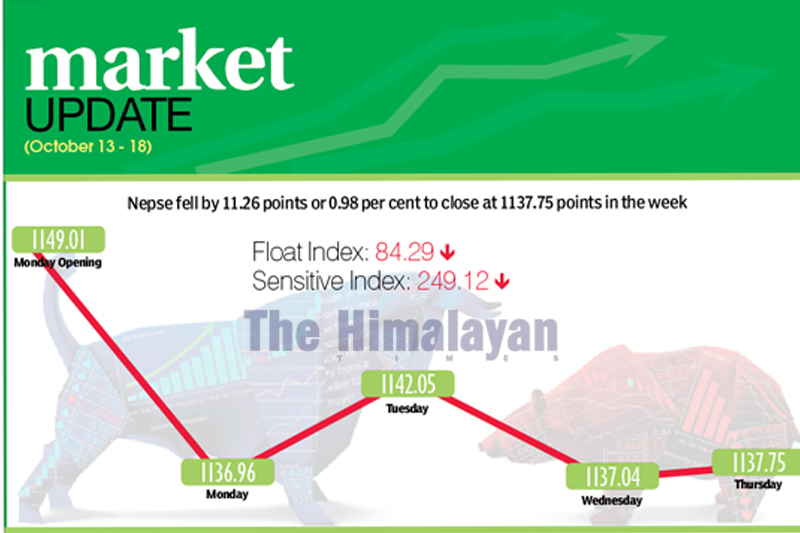

Due to this situation, the Nepal Stock Exchange (Nepse) was in a downward trend between October 13 and 17. The index fell by 0.98 per cent or 11.26 points to 1,137.75 points. Similarly, the sensitive index also went down by 1.11 per cent or 2.81 points to 249.12 points and float index dipped by 0.87 per cent or 0.75 point to 84.29 points.

However, the weekly turnover rose massively by 1,185.36 per cent as compared to the previous week to Rs 820.7 million. In the previous week, the market had witnessed transactions worth only Rs 63.85 million. But what has to be noted was that in the previous week the market was open for only one day due to the Dashain festival. Meanwhile, the trading volume also increased to 3.33 million stocks changing hands this week from 232,620 in the previous week.

Unlike the general practice, the secondary market had opened only on Monday at 1,129.81 points and decreased by 7.16 points by the end of the trading day. The government had declared a public holiday on Sunday due to Chinese President Xi Jinping’s state visit to the country. The market went up by 5.08 points on Tuesday, however, the next dayit dropped by 5.01 points. On Thursday though it again inched up by 0.71 point to close the week at 1,137.75 points.

In the review week, only the mutual fund and hydropower subgroups landed in the green zone.

The mutual fund sub-index climbed up by 1.28 per cent or 0.12 point to 9.51 points and hydropower expanded by 0.004 per cent or 0.04 point to 945.84 points.

Meanwhile, the hotels subgroup was the biggest loser of the week, slumping by 2.79 per cent or 51.43 points to 1,791.34 points due to the share price of Soaltee Hotel going down by five rupees to Rs 207.

The banking subgroup lost 1.24 per cent or 13.15 points to 1,044.79 points. Likewise, others sub-index fell by 1.18 per cent or 7.69 points to 640.59 points and microfinance subgroup declined by 0.96 per cent or 14.26 points to 1,459.53 points.

Moreover, manufacturing sub-index dipped by 0.94 per cent or 23.15 points to 2,417.62 points. The trading subgroup decreased by 0.77 per cent or 2.28 points to 290.23 points and finance sub-index descended by 0.61 per cent or 3.55 points to 570.17 points.

The non-life insurance sub-index also fell by 0.47 per cent or 20.09 points to 4,243.40. The development banks subgroup dropped by 0.37 per cent or 5.92 points to 1,556.79 points and life insurance inched down by 0.07 per cent or 3.68 points to 5,005.06 points.

In the review week, Prabhu Bank topped the list in all three categories — trading volume, number of transactions, and highest weekly turnover — with 440,000 of its shares changing hands through 872 transactions that amounted to Rs 117.71 million.

Meanwhile, Siddhartha Bank with Rs 73.45 million, Asia Life Insurance Co with Rs 36.96 million, Agricultural Development Bank with Rs 31.17 million and Mega Bank Nepal with Rs 28.09 million were the other firms with high turnovers.

In terms of weekly trading volume, Siddhartha Bank with 220,000 shares, Agricultural Development Bank with 75,000 shares, Sunrise Bank with 65,000 shares and Civil Bank with 64,000 shares rounded up the top-five.

Meanwhile, the other companies to record large number of transactions included Siddhartha Bank with 756, Rashuwagadhi Hydropower with 675, Sanjen Jalavidhyut with 595 and Upper Tamakoshi Hydropower with 349.